What Harvard’s $443M Bitcoin Move Means for Endowments and Institutional Portfolios

Summary

A turning point: Harvard’s Q3 2025 Bitcoin stance

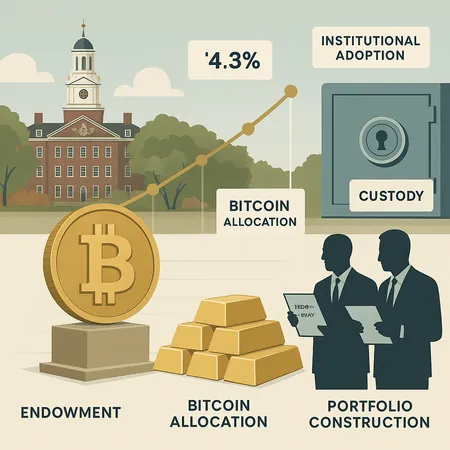

In Q3 2025 Harvard’s endowment materially increased its Bitcoin exposure to roughly $443 million, according to analyses that have tracked the university’s ETF holdings and disclosures. Multiple outlets report the new position outpacing Harvard’s gold allocation by about two-to-one, a symbolic and practical pivot away from a traditional store of value toward a digital one (Cryptonews and Cryptopolitan). This is not just a statement—it is an experiment at scale by one of the world’s most followed endowments.

Harvard’s decision matters because endowments are both large allocators and templates. Their moves reverberate across family offices, university peers, and pension funds that watch governance playbooks closely. For many observers, Bitcoin remains the primary crypto exposure under consideration; this real-world allocation forces a rethink of portfolio playbooks built for inflation hedges like gold.

Scale and pace: how big is $443M in context?

On face value, $443M is small relative to global asset pools. But for an endowment the size of Harvard’s, adding several hundred million in liquid BTC exposure over a short period is meaningful—especially compared to a long-standing gold allocation that universities historically used as an insurance asset. Coverage indicates the new BTC exposure overtakes gold holdings by a roughly 2:1 margin, underscoring a deliberate reweighting rather than a one-off trade (Cryptonews).

Pace matters for markets: rapid accumulation by large institutions can compress available liquidity at tight spreads and temporarily increase realized volatility. Conversely, a slow, staged approach—using dollar-cost averaging or ETF vehicles—helps limit market impact. Harvard’s approach appears measured, leveraging regulated ETF exposures rather than direct private keys, which signals a preference for operational simplicity and third-party custody.

Comparing Bitcoin to gold in an institutional portfolio

Gold has long been the canonical store-of-value in institutional portfolios: deep markets, centuries of price history, and an established regulatory and custodial ecosystem. Bitcoin, by contrast, offers unique characteristics—finite supply, programmability, and traceable on-chain provenance—that have created a distinct investment narrative. Proponents argue BTC can act as an inflation hedge and a non-sovereign asset, while critics point to still-maturing market structure and episodic volatility.

The Harvard case effectively reframes the question: is Bitcoin a substitute, complement, or entirely different risk-factor from gold? Institutions will need to decide not just if BTC belongs in a portfolio, but in which bucket: returns-seeking, diversification, or tail-risk protection. That decision alters allocation sizes, rebalancing rules, and the metrics trustees demand for monitoring performance.

Governance and fiduciary considerations for endowments

Adding Bitcoin to an endowment is a governance exercise as much as an investment decision. Trustees and investment committees must satisfy fiduciary duties—prudence, diversification, and documentation—while responding to stakeholder scrutiny. Key governance elements include:

- Clear investment policy language that defines the rationale (return-seeking vs. hedge), target allocation, and constraints around leverage and derivatives.

- Risk limits and stress tests tailored to BTC’s historical drawdowns and liquidity characteristics.

- Due-diligence evidence on custodians, counterparties, and the ETF structures used to access Bitcoin exposure.

- Transparent reporting protocols for donors, alumni, and regulators, including how the allocation fits the endowment’s long-term payout model.

Experts in the industry, like Bitwise’s CIO, have framed the university trend as part of a wider reassessment—where institutions are choosing BTC over traditional stores like gold for portfolio reasons—underscoring the need for formal governance frameworks to justify that choice to stakeholders (Coingape).

Custody, regulatory, and reporting challenges

Operationally, crypto introduces a set of headaches that do not map cleanly to existing custody and audit practices. Even when exposure is obtained via ETFs, custodial question marks remain: who holds the underlying private keys? What insurance and counterparty protections are in place? Are settlement and redemption mechanics robust during stress?

For institutions considering direct BTC holdings, the checklist grows: insured cold storage, multi-signature governance, transfer controls, periodic proof-of-reserves, and audited security reviews. Even ETF-based exposure requires clarity on the fund’s underlying custody, redemption mechanisms, and who clears trades.

Regulatory and reporting issues also complicate adoption. Accounting treatment of crypto remains an active area—impairment vs. fair-value debates, taxation on realized gains, and the need for granular transaction-level reporting. Endowments must work with auditors comfortable with crypto and be prepared for questions from state regulators or IRS auditors. Platforms and service providers will need to demonstrate strong compliance practices—something that has driven many institutions to choose regulated ETF wrappers or custodians that can meet institutional KYC/AML and insurance standards.

A practical note: technology providers such as Bitlet.app have been mentioned in institutional conversations as part of broader custody and trading ecosystems, but institutions will weigh third-party operational risk carefully and expect contractual protections.

Will others copy Harvard? Herding, prudence, and timing

The psychology of institutional adoption tends toward copycat behavior but with important caveats. Harvard’s visible move lowers the perceived novelty risk and provides a precedent; however, not every endowment has the same liquidity profile, governance bandwidth, or risk tolerance.

Concrete drivers for copycat flows include peer benchmarking, trustee pressure, and the work product Harvard’s investment office publishes for justification. On the other hand, institutions with conservative mandates or with large near-term liabilities (e.g., pensions) may hesitate.

Industry commentators see a plausible acceleration of allocations from large, flexible pools: family offices, tech-oriented endowments, and some pension funds that value diversification may increase Bitcoin exposure. Bitwise’s commentary and broader narratives—such as Michael Saylor’s macro argument that US adoption forces adversaries to buy BTC at higher prices—feed a storyline of strategic accumulation that could spur further institutional purchases (Coingape; Benzinga).

But herd moves can be double-edged: broad adoption reduces informational asymmetry and may deepen markets, yet simultaneous de-risking could amplify sell-side pressure if institutions rebalance during stress.

What more institutional demand means for BTC liquidity and volatility

Institutional allocations of meaningfully large size change market microstructure. On the liquidity side, ETFs and dark-pool mechanisms improve capacity for large trades, while OTC desks and prime brokers expand block execution. Over time, sustained demand from endowments and pensions would likely deepen order books and tighten spreads, especially in developed markets and ETF-listed venues.

However, the transition is non-linear. If a cluster of institutions decides to liquidate at once—driven by correlated reporting periods or liquidity needs—BTC’s historical drawdowns could reassert themselves. In other words, institutional buying can both dampen volatility in normal times and amplify it during system-wide stress.

The net effect depends on governance discipline (rebalancing rules and liquidity buffers), access to derivatives for hedging, and the maturity of market plumbing. If the industry builds robust custody, derivatives, and clearing solutions, BTC’s volatility profile as experienced by institutions could diminish over time.

Practical roadmap: building Bitcoin into institutional portfolios

For CIOs, trustees, and family office managers contemplating a Bitcoin allocation, a practical framework could include:

- Define the role: Is BTC a diversifier, return-seeker, or alternative store-of-value? The answer sets risk tolerances.

- Limit size: Start small (e.g., 0.5–3% of total assets) and expand only with demonstrated operational readiness.

- Operational proof: Require institutional-grade custody (insured, audited, multi-sig or qualified custodian), clear contractual remedies, and independent audits.

- Liquidity modeling: Stress-test cashflow demands against worst-case BTC drawdowns and bid-ask spreads for large trades.

- Reporting and governance: Update investment policy statements, document decision rationale, and set transparent reporting to stakeholders.

- Use staged deployment: prefer ETF wrappers or OTC execution for initial allocations to reduce operational complexity, moving to direct custody only once in-house capabilities and legal frameworks are mature.

These steps mirror how many institutions have approached new asset classes: cautious, governance-first, and evidence-driven.

Conclusion: precedent, not inevitability

Harvard’s $443M Bitcoin position is a strong signal that major endowments are willing to experiment with BTC as part of long-term portfolio construction. It creates a governance template and a market precedent, but it does not guarantee mass adoption. Institutional uptake will hinge on solving custody, reporting, and regulatory puzzles and on each institution’s mandate and liability profile.

If a wave of similar allocations materializes, markets will adapt—deeper liquidity, institutional-grade products, and potentially a moderating effect on volatility as trading infrastructure matures. Yet the risk remains that correlated institutional behavior could cause sharper moves during periods of stress. For CIOs, trustees, and family offices, the right response is pragmatic: rigorous governance, disciplined sizing, careful operational execution, and clear communication to stakeholders.

Institutional adoption of Bitcoin is accelerating, and Harvard’s move raises the bar for due diligence and policy design. The next 12–24 months will be telling: expect more debate in boardrooms, more sophisticated custody solutions, and continued scrutiny from auditors and regulators as the ecosystem industrializes.

Sources

- Harvard bets big on Bitcoin with $443M stake, outpacing gold 2-to-1 — Cryptonews: https://cryptonews.com/news/harvard-bets-big-on-bitcoin-with-443m-stake-outpacing-gold-2-to-1/

- Harvard ramps up Bitcoin holding to $443M — Cryptopolitan: https://www.cryptopolitan.com/harvard-ramps-up-bitcoin-holding-443-million/

- Bitwise CIO commentary on universities stacking BTC over gold — Coingape: https://coingape.com/harvard-university-stacking-more-bitcoin-over-gold-bitwise-cio-matt-hougan-reveals/

- Michael Saylor’s argument on US Bitcoin adoption and strategic accumulation — Benzinga: https://www.benzinga.com/crypto/cryptocurrency/25/12/49251667/michael-saylors-theory-on-us-bitcoin-adoption-forcing-adversaries-to-buy-btc-at-higher-pric?utm_source=benzinga_taxonomy&utm_medium=rss_feed_free&utm_content=taxonomy_rss&utm_campaign=channel&utm_source=snapi