Gold, Cash, and Bridges: How Reserve Models for Stablecoins Are Evolving

Summary

Executive overview

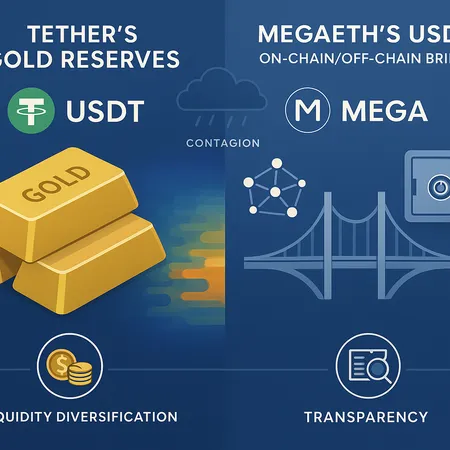

Stablecoins remain the plumbing of crypto markets. Recent moves — notably Tether's increased gold purchases and MegaETH's launch of USDm (USDM) with a pre‑deposit bridge — underscore an important trend: issuers are rethinking what counts as a reserve. For risk analysts and stablecoin watchers, this isn't merely academic. The composition and governance of reserves shape liquidity during runs, the clarity of redemption mechanics, and the channeling of systemic risk into traditional markets.

Why reserve diversification is happening

Historically, most fiat‑pegged stablecoins anchored their peg to cash and cash equivalents: short‑term Treasury bills, commercial paper, or bank deposits. That model prioritizes price stability and easy convertibility. But several pressures are driving diversification:

- Regulatory and reputational pressures: issuers face calls for stronger collateral frameworks and for assets that are perceived as more resilient in macro stress.

- Yield and balance‑sheet management: holding only cash can be low yield; alternative assets may offer different risk/return profiles.

- Market confidence and narrative: investors sometimes view tangible assets — notably gold — as a hedge against fiat debasement or banking stress.

These drivers have prompted some players to add non‑cash assets to their reserve mix. That move reduces some concentration risks, but it introduces others: valuation complexity, liquidity risk, and audit challenges.

Tether's pivot: adding gold to the reserve mix

Tether (USDT) has long faced scrutiny over what sits behind its circulating supply. Recent reporting shows Tether has become a meaningful purchaser of physical gold, an explicit diversification away from pure cash holdings. The decision to hold gold reflects a strategic tradeoff: gold can act as a store of value when fiat markets wobble, but it is less liquid on short notice than cash and requires custody, valuation, and potentially larger haircuts in distressed markets.

Holding gold changes the failure modes for a stablecoin issuer. A bank run-style redemption event on USDT would now compel Tether to decide between selling physical bullion (which can move markets and incur time/loss) or relying on other liquid assets. For counterparties, the key questions are custody transparency, the frequency and granularity of attestations or audits, and how the issuer values gold for on‑chain mint/redemption calculations.

For readers who track these dynamics, see the recent reporting on Tether's gold acquisition strategy for specifics and timeline: Tether's expanding gold stockpile.

MegaETH and USDm: a pre‑deposit, on‑chain/off‑chain bridge model

MegaETH announced a native stablecoin called USDm (ticker USDM / USDm) that uses a pre‑deposit bridge to onboard liquidity. The architecture differs from a typical mint‑on‑redemption flow: users deposit value upstream (often off‑chain or in a wrapped on‑chain form) and the protocol issues USDm on‑chain against those pre‑deposits. This model can speed minting and improve on‑chain liquidity, but it ties token supply more tightly to the operational health of the bridge and the counterparty settlement process.

MegaETH's launch details highlight a couple of mechanics worth noting:

- Pre‑deposit implies funds are held (or locked) before stablecoins circulate, which can reduce some immediate redemption pressure but concentrates operational and custody risk at the bridge.

- The bridge can be a point of frictions — settlement delays, KYC/AML checks, jurisdictional freezes — that break the simple promise of 1:1 redeemability in practice.

You can read MegaETH's announcement and technical framing here: MegaETH launches USDm with pre‑deposit bridge.

Reserve transparency: attestation, valuation, and disclosure

Diversified reserves increase the need for transparent, frequent, and granular reporting. What matters to risk analysts:

- Asset-level disclosure: Does the issuer provide line‑item reporting (cash, commercial paper, treasuries, gold, other commodities)?

- Valuation policy: How frequently are non‑cash assets marked to market? Are haircuts and liquidity buffers explicitly modeled?

- Custody proof and audit cadence: Are custodians independent, and are attestations conducted by reputable third parties with adequate scope?

Gold holdings are particularly sensitive to disclosure gaps. Unlike cash held at regulated banks, bullion custody and verifiable chain‑of‑title require trusted custodians and timely attestations. Pre‑deposit bridges similarly demand visibility into on‑chain reserves versus off‑chain holdings; if redemption depends on slow off‑chain settlement, token holders effectively hold a contingent claim.

Market liquidity and haircuts: real costs of non‑cash reserves

From a market‑microstructure viewpoint, substituting a portion of cash for gold or other assets tightens the issuer's immediate liquidity. In calm markets, liquidation of gold is feasible. In stressed markets, selling large blocks may widen spreads and move prices, forcing deeper haircuts. Practical implications:

- Liquidity buffers: issuers should maintain liquid buffers (cash, short Treasuries) to handle high redemption windows while reserving less liquid assets for solvency support.

- Discount modeling: risk teams must model realistic fire‑sale discounts for non‑cash assets and incorporate them into stress tests.

- Market impact: large scale buying or selling of gold by a major issuer can feed back into commodity markets, creating cross‑market contagion.

This is where reserve diversification can paradoxically create systemic linkages between crypto and legacy markets: a stablecoin issuer selling gold to meet redemptions injects volatility into commodity markets, which in turn may affect asset valuations used elsewhere on‑chain.

Bridge models and contagion channels during stress

The USDm pre‑deposit bridge and similar hybrid models introduce distinct contagion channels:

- Operational freeze: if the bridge operator halts redemptions (due to sanctions, legal orders, or liquidity shocks), on‑chain USDm holders can be left with tokens that are hard to redeem off‑chain, decoupling on‑chain liquidity from off‑chain asset availability.

- Counterparty default: custodians or settlement agents that hold pre‑deposited funds become single points of failure. Their insolvency can render a portion of on‑chain supply effectively unbacked.

- Liquidity mismatch: bridges may hold less liquid assets or pooled collateral; rapid redemptions can cascade into forced asset sales across markets.

Compare two thought experiments: a run on USDT partially backed by gold versus a bridge freeze on USDm. The former primarily strains commodity liquidation channels and Tether's custody network. The latter can produce immediate on‑chain price divergence — USDm trading below peg — while legal and operational processes determine ultimate recovery. Both scenarios create price dislocations, but the timing and transmission routes differ.

Stress‑testing and metrics risk teams should track

Risk teams evaluating reserve models should incorporate both quantitative and qualitative checks:

- Liquidity coverage ratio: how many days of historical peak redemptions can be covered by cash and short‑term liquid assets without touching illiquid reserves?

- Fire‑sale haircut scenarios: estimate realized values of gold and other non‑cash assets under tiered market stress (mild, moderate, extreme).

- Bridge availability and settlement latency: measure historical bridge downtimes and average settlement times for mint/redemption flows.

- Legal/jurisdictional exposure: map custodians, settlement agents, and issuers to jurisdictions and regulatory regimes.

- Audit fidelity: assess auditor independence, scope (attestation vs. full audit), and frequency.

Good stress tests blend market simulations with operational failure modes. For instance, model a simultaneous commodity price decline and bridge settlement suspension: how would that affect pegged liquidity and confidence?

Practical takeaways for stablecoin watchers

- Diversification is not a panacea. Adding gold can reduce some concentration risks but increases liquidity and valuation complexity.

- Bridge‑centric designs accelerate on‑chain utility but centralize operational risk. Pre‑deposit models offer faster issuance but mean custodians and bridges are critical nodes.

- Transparency matters more than the exact mix of assets. Frequent, asset‑level attestations and clear redemption mechanics materially reduce run probability.

- Model contagion holistically. Stablecoin stress can propagate to commodity markets, banking relationships, and on‑chain liquidity pools alike — a cross‑market view is essential.

For those comparing approaches, follow both market disclosure (attestations, legal structure) and technical mechanics (bridge logic, on‑chain collateralization) when forming a risk view.

Closing thoughts

The stablecoin landscape is maturing. Tether's shift toward gold and the emergence of native tokens like USDm from MegaETH illustrate divergent strategies to shore up confidence and utility. Each path trades off liquidity, transparency, and operational complexity in different ways. Risk analysts should stop thinking of reserves as a single line item and instead interrogate custody, valuation policies, bridge mechanics, and legal relationships.

As on‑chain ecosystems grow, platforms like Bitlet.app and others will increasingly rely on these plumbing choices — for both settlement efficiency and systemic resilience. A thoughtful, scenario‑driven approach to reserve analysis will be crucial if stablecoins are to remain the reliable rails the market expects.