Fed Policy

A strategic explainer for macro-focused investors on why capital rotated into gold and silver recently, and which macro and on-chain catalysts could reverse the narrative in favor of BTC.

A market-focused evaluation of whether BTC is slipping into a temporary bear phase driven by liquidity drains, spot ETF flows, and shifting Fed expectations. Practical scenarios and on-chain metrics for portfolio managers weighing allocation and hedge timing into 2026.

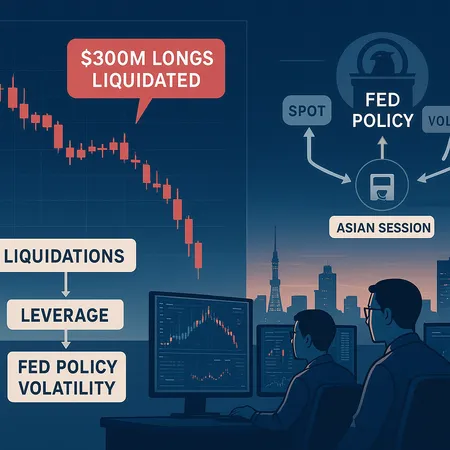

On Nov 14 Bitcoin plunged under $100,000 as roughly $300M of long positions were liquidated amid hawkish Fed comments — a classic cascade where derivatives, thin Asian liquidity, and macro re-pricing amplified each other. This deep-dive explains the mechanics, market-side effects, expected technical levels, and an operational risk-management playbook for traders and funds.