Redefining Scarcity in 2026: Bitcoin, Gold, and the Financialization of Access

Summary

Introduction: scarcity is no longer just a unit count

For decades investors described scarcity as a simple arithmetic problem: how many units exist, and how many can there ever be? That made sense for gold and for a long time for Bitcoin: finite supply, predictable issuance, and therefore a scarcity premium. But by 2026 this view is incomplete. A parallel concept — access or liquidity scarcity — has emerged. It privileges the ease with which investors can convert an asset into cash at scale and without severe market impact. That distinction matters for asset allocators who must decide not only how many tokens or ounces to hold, but how they will actually use them when markets stress.

This article reframes scarcity across three axes: fixed issuance, effective/financialized supply, and access-driven liquidity. I focus on how ETFs, derivatives, and institutional custody reshape price discovery for Bitcoin relative to gold and silver, and provide practical allocation frameworks for long-term investors and wealth managers.

Traditional scarcity vs. access/liquidity scarcity

The traditional scarcity argument is straightforward: an asset with a capped supply and declining issuance schedule becomes harder to produce or obtain over time, so — all else equal — its price should reflect that increasing rarity. Bitcoin’s 21 million cap is the archetypal example; gold’s millennia of extraction and constrained above-ground stock place it in the same conversation.

The access/liquidity scarcity view flips the question: scarcity is not only how many units exist, but how many units are economically available when needed. In 2026 that includes what sits in exchange order books, what is locked in cold storage under long-term custody mandates, what is encumbered as collateral in derivatives trades, and what sits behind fund wrappers such as spot ETFs. Crypto comments and on-chain data have long shown that tokens with low on-chain turnover can behave very differently from tokens with active, liquid markets.

Crypto-economy coverage of 2026 highlights this shift by comparing how investors are rethinking scarcity between Bitcoin, gold, and silver; it’s not just ounces or units any more, it’s usable ounces or units in markets where institutions operate and regulatory wrappers exist (see this analysis on scarcity comparisons).

How financialization changes effective supply

There are three financial plumbing mechanisms reshaping effective supply for BTC and the way price discovery occurs.

Spot ETFs: access at scale and capital flows

Spot ETFs radically broaden investor access and change where buying pressure lands. A spot BTC ETF routes retail and institutional dollars into a fund that typically acquires and custodys real BTC. That process can remove coins from free float (if held long term in a custodian) while concentrating buying in the ETF’s creation/redemption cycles and authorized participants.

The 2026 experience shows this dynamic is material and fast-moving. Early-week flows can be large and directional: a Cointelegraph analysis of recent flows showed spot Bitcoin ETFs lost $681 million in their first week of 2026 during a risk-off episode, illustrating how ETF flows can rapidly amplify or withdraw liquidity and affect price discovery. That example underscores that ETFs don't simply replicate the spot market; they mediate access to it and sometimes become the market.

For allocators, the practical takeaway is that ETF inflows can temporarily depress exchange liquidity (less free BTC on market) while creating a concentrated, off-exchange pool of demand that can re-enter markets via redemptions.

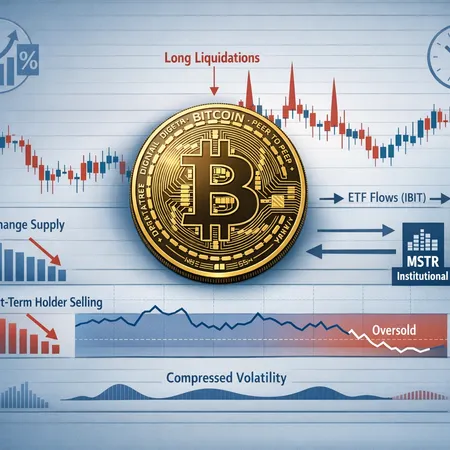

Derivatives: synthetic supply, leverage, and market depth

Futures, perpetual swaps, and options layer synthetic supply on top of physical markets. Derivatives allow participants to gain or hedge exposure without moving spot inventory, and they introduce leverage that expands notional exposure relative to underlying asset holdings. That can make effective market depth feel deeper in calm markets but much shallower in stress, because margin calls and forced liquidations compress liquidity quickly.

Institutional desks frequently use OTC derivatives to provide bespoke exposures, which can keep large positions off public order books. That reduces visible liquidity while increasing systemic connection through counterparty networks. The result: price discovery becomes a function of cross-market liquidity (spot vs. futures vs. OTC) rather than a pure spot-supply story.

Institutional custody and locked supply

Custody is one of the most underappreciated drivers of access scarcity. Institutional-grade custody and regulatory constraints encourage long-duration holdings in cold storage, insurance-backed vaults, or within fund vehicles that discourage frequent outflows. Large allocations by sovereign wealth funds, family offices, or managers can therefore create a pool of BTC that is effectively off-limits for trading — even if technically counted in circulating supply.

A second crypto-economy piece examining Bitcoin’s evolving economic roles discusses how institutional flows and custody shape Bitcoin’s function across store-of-value, collateral, and transactional roles. That duality — instrument and asset — is key for understanding 2026 scarcity: institutions bring credibility and flows, but they also remove usable supply from daily market turnover.

Gold and central-bank demand: a different scarcity profile

Gold remains a touchstone for scarcity conversations, but its mechanics differ. Central banks and official sector buyers accumulate gold for reserve diversification and geopolitical insurance. These buyers are typically patient; they remove metal from circulating pools for long durations and often record it as reserves rather than tradable inventory.

That creates a scarcity of a different kind: deep, enduring, and slow-moving. Where ETF-driven BTC flows can be rapid, central-bank gold demand is sticky — it reduces available supply incrementally and predictably. The contrast matters for allocators who need to decide whether they want fast-reacting hedges (where ETF liquidity is useful) or a slow-moving ballast (where gold’s central-bank demand is attractive).

Silver complicates the trio: industrial demand means its scarcity is both measured in above-ground stock and in near-term consumption, so it can fluctuate sharply with economic cycles. Investors who care about true scarcity often treat silver separately from the monetary-asset discussion.

Price discovery and liquidity scarcity in practice

When access and liquidity shape scarcity, price discovery stops being the sole province of spot exchanges. Instead, it migrates across venues: ETF creations/redemptions, derivatives funding rates, OTC block trades, and even inter-custodian flows can lead price.

Two practical observations:

- Visible on-exchange order books can understate true market fragility. A market with many coins locked in custody and active derivatives positions can look liquid until a shock forces those custodians or counterparties to act.

- ETF and institutional flows concentrate demand, which can stiffen prices on the way up and accelerate declines on redemptions. The Cointelegraph flow example is a reminder: institutional wrappers make price behavior more sensitive to macro risk-off events.

For wealth managers, this means measuring scarcity should include both stock-based metrics (supply caps, gold above-ground inventory) and flow-based metrics (ETF AUM changes, derivatives open interest, on-chain movement into long-term custody).

Practical allocation frameworks for exposure to scarcity

Below are three stylized allocation frameworks you can adapt to a client’s risk budget and liquidity needs. Each assumes the investor thinks scarcity matters but has different priorities on liquidity, volatility tolerance, and time horizon.

1) Conservative Reserve (capital preservation + long-duration ballast)

- Cash and short-duration sovereign paper: 60%

- Gold (allocated between physical and allocated ETF exposure): 25%

- Bitcoin (spot ETF or small direct custody): 10%

- Opportunistic / alternative (silver, hedge funds): 5%

Rationale: prioritize predictable liquidity and the slow, steady scarcity of gold. Small BTC exposure acts as a convexity/tail hedge but is kept mostly in regulated, custody-backed structures.

2) Balanced Scarcity (diversified store-of-value plus growth)

- Cash: 20%

- Gold: 25%

- Bitcoin (mix of spot ETF and direct custody): 30%

- Credit/Alternatives (including short-duration real assets): 15%

- Silver/Other: 10%

Rationale: a meaningful allocation to BTC acknowledges its unique scarcity and return potential but balances it with gold’s reserve qualities. Use direct custody for long-term holdings and ETFs for tactical exposure.

3) Growth/Tail Hedging (active digital-asset tilt)

- Cash: 10%

- Gold: 10%

- Bitcoin (direct custody and selective derivatives for leverage): 50%

- Alternatives / Venture / DeFi exposures: 20%

Rationale: high conviction in Bitcoin’s asymmetric upside as a scarce digital asset. Employ derivatives carefully for exposure but maintain robust counterparty risk controls and collateral plans.

Implementation details and guardrails

- Choose wrapper consciously: spot ETFs simplify compliance and custody but may concentrate redemptions into single channels. Direct custody gives control but adds operational complexity.

- Monitor ETF AUM and creation/redemption spreads weekly; large swings are early indicators of access-driven scarcity shifts. Cointelegraph’s coverage of early-2026 ETF flows is an example of how quickly this metric can change market dynamics.

- Watch derivatives open interest and funding rates as sentiment indicators and measures of synthetic supply. Sudden compressions can precede sharp spot moves.

- Maintain a liquidity bucket: even if you buy scarce assets, keep cash or highly liquid instruments to meet margin calls, redemptions, or opportunistic buys.

- Consider counterparty and custody diversification. Institutional custody reduces some risks but introduces others (counterparty credit, legal structures). Platforms like Bitlet.app exist in the ecosystem to provide various custody and access solutions — know their terms before committing capital.

A checklist for portfolio managers

- Define the scarcity you care about: fixed supply, access, or both.

- Map where your exposures sit: spot holdings, ETF wrappers, derivatives, OTC, and custody arrangements.

- Stress-test liquidity: model a 20–30% price move and simulate redemption and margin impacts.

- Rebalance rules: set thresholds tied to ETF flows and derivatives positioning as well as price bands.

- Governance: document custody providers, insurance terms, and legal recourse in cross-border situations.

Conclusion: scarcity is now a multi-dimensional signal

By 2026 the scarcity story has matured from a unit-count debate into a nuanced interplay of supply, access, and market plumbing. Bitcoin’s fixed cap still matters — it anchors expectations and explains part of the asset’s allure — but ETFs, derivatives, and institutional custody now determine how that scarcity translates into prices and investor outcomes. Gold’s scarcity remains important but moves on a different time scale, often driven by central-bank behavior rather than daily flows.

For long-form investors and wealth managers the practical lesson is clear: allocate not just to scarce instruments, but across modes of scarcity — liquid access (ETFs, exchange liquidity), locked supply (custody, reserves), and synthetic exposure (derivatives). Measuring both stocks and flows will give you a better read on true scarcity in modern markets.