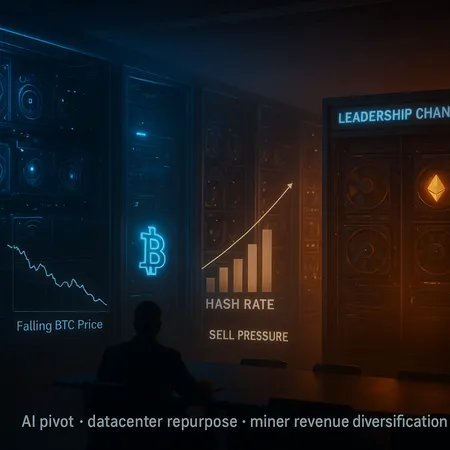

Miners Pivot: Bitfarms’ AI Shift, BTCS’ ETH Play, and What It Means for Hashrate & Sell Pressure

Summary

Executive summary

Crypto mining firms are no longer a single-product industry. Recent moves—most notably Bitfarms’ plan to wind down bitcoin mining operations and redeploy sites for AI workloads—signal a strategic reorientation that institutional miners and infrastructure investors must track closely. At the same time, public players like BTCS are showing how revenue diversification (ETH accumulation and DeFi ops) can lift top-line results, and governance or leadership changes at firms such as BitMine alter investor confidence and execution risk.

This report examines the economics of a datacenter repurpose to AI, practical balance-sheet diversification options, and the likely effects on BTC hashrate and miner sell pressure. It is written for institutional miners, infrastructure investors, and analysts tracking hardware repurposing and revenue-model shifts.

Recent catalyst examples: what the market is seeing

Bitfarms’ announcement to wind down traditional bitcoin mining at some sites and convert capacity to AI workloads is a high-profile signal that the industry’s operating model can change quickly. The company cited economics and demand for AI compute as drivers for the pivot (Bitfarms wind‑down and AI pivot).

Meanwhile, BTCS reported record Q3 revenue driven in part by Ethereum accumulation and DeFi‑related services, illustrating that diversifying away from pure BTC mining can materially affect financials (BTCS posts record Q3 revenue). Finally, corporate governance and leadership shifts at BitMine highlight how management changes can accelerate or impede strategic pivots and influence market confidence (BitMine revamps leadership).

These three threads—AI pivot, protocol accumulation, and governance—frame the choices miners face: double down on ASIC-driven bitcoin mining, repurpose assets to higher‑margin compute, or diversify services and on‑balance-sheet crypto exposure.

Economics of repurposing mining datacenters for AI workloads

Repurposing bitcoin mining facilities for AI inference/training is attractive on paper because AI workloads often pay significantly higher per‑MW rates than stranded hashing capacity. But the conversion is neither cheap nor trivial.

Key cost and capability differences:

- Hardware: ASIC miners are purpose-built for SHA‑256 and cannot be reprogrammed into AI accelerators. A true AI pivot requires adding GPUs, DPUs, or purpose-built AI accelerators, substantially increasing capital expenditure.

- Power & PUE: Mining sites already have high‑voltage power and industrial cooling, which is a plus. However, AI GPUs create different thermal and airflow profiles; facilities often need upgraded power distribution, higher fault tolerance, and denser cooling solutions to achieve acceptable PUE.

- Networking and latency: AI training and inference can require high‑bandwidth, low‑latency interconnects (NVLink, RDMA, 100/400GbE fabrics) that mining sites typically lack. Network upgrades materially raise conversion costs.

- Contracting and demand: Short‑term AI cloud pockets can pay well, but demand is heterogeneous and contractual durations differ from long-term colocation agreements miners enjoy. Sales/marketing capability is therefore an operational uplift requirement.

On the revenue side, hosting AI workloads or providing managed AI compute can offer higher gross margins per MW and better pricing power in tight GPU markets. Yet, the breakeven depends on conversion capex, expected utilization, and the durability of AI demand. For many public miners, the calculus is: can repurposing shorten payback and stabilize cashflows more than continued bitcoin mining during a BTC downturn?

Balance‑sheet and revenue diversification strategies

Miners have three broad approaches to reduce exposure to BTC price cycles and sell pressure:

Protocol accumulation and treasury management: Holding protocol tokens (BTC, ETH) as corporate treasury assets creates optionality. BTCS’ Q3 results underscore that active accumulation of ETH and engagement in DeFi can become a revenue lever and balance‑sheet asset class (BTCS revenue lift via ETH & DeFi). But treasury exposure introduces volatility, regulatory considerations, and liquidity risk.

Service and product diversification: Offering hosting, colocation, rack leasing, or staking and DeFi services turns miners into infrastructure providers. These businesses often have steadier recurring revenue but require new teams, sales channels, and SLAs.

Physical repurpose (AI pivot): Converting datacenters to AI compute or hybrid workloads can unlock higher per‑MW pricing but demands substantial capex and operational changes.

A combined strategy is common: retain a core profitable mining fleet, accumulate protocol exposure selectively, and deploy repurposed capacity where ROI and contractual terms stack up. This blended approach can blunt miner sell pressure by generating alternative cashflows and providing choice—sell mined BTC, hold it, or swap into other assets when market conditions favor one action over another.

Bitlet.app and other operators in the infra stack are watching these dynamics closely because the market for colocation and compute is tightening; firms that can reliably switch workloads have a competitive advantage.

Implications for hashrate, miner sell pressure, and network security

Short‑term sell pressure

In a falling BTC price environment, stress on cashflow forces some miners to liquidate BTC to meet debt and operating expenses, increasing sell pressure. Firms that can diversify revenue—through ETH accumulation, DeFi operations, or AI hosting—can reduce immediate liquidation needs. BTCS’ example shows revenue streams outside pure BTC mining can materially offset the pressure to sell mined coins.

However, the act of repurposing assets can itself increase short‑term sell pressure. Operators who choose to exit BTC mining to finance conversion capex may sell miners or BTC to raise cash. Similarly, firms that scrap older ASICs will often liquidate hardware or mined BTC proceeds, temporarily adding supply to the market.

Medium to long‑term hashrate dynamics

The network hashrate evolves based on ASIC efficiency, electricity economics, and miner participation. Key scenarios:

- Selective exits and repurposing: If a meaningful minority of marginal miners repurpose or exit, the hashrate could decline modestly, reducing network difficulty and improving margins for the remaining operators. That would stabilize security after an adjustment period.

- Rapid mass exit: A large-scale migration away from mining would lower hashrate substantially, possibly raising concerns about short-term security and centralization as fewer large operators dominate hashing power.

- Equipment turnover and consolidation: Repurpose strategies accelerate the retirement of older ASICs and favor well‑capitalized, low‑cost operators. Hashrate may become more concentrated among fewer, more efficient players—but total security (in joules/sec or economic terms) may remain sufficient if remaining players maintain capacity.

Network security is ultimately a function of economic incentives. As long as BTC miner economics remain positive for some cohort of operators (due to low power costs, hedged electricity, or diversified revenues), the network retains sufficient hash power. Diversification into ETH or providing AI compute reduces reliance on BTC mining economics, which in turn lowers systemic risk of coordinated forced selling—but it also creates new single‑point risks if firms misexecute pivots.

Investment and operational considerations for institutional miners and infra investors

For institutional miners and infrastructure investors evaluating pivots or backing firms that pivot, consider:

- Capex vs. operational complexity: Calculate a two‑ to three‑year payback for conversion capex including networking, cooling, and GPU procurement. AI demand can be lumpy.

- Contract structure: Prioritize longer‑term AI or colocation contracts where possible to protect utilization assumptions and cashflow.

- Balance‑sheet policy: Define clear treasury rules for accumulation vs. liquidation of BTC/ETH to reduce ad hoc sell pressure. BTCS’ results illustrate the upside of active asset management but also the need for robust risk controls.

- Governance and execution risk: Leadership stability matters. The BitMine leadership revamp is a reminder that pivots require managerial depth and investor communication to succeed (BitMine leadership changes).

- Regulatory and tax implications: Holding or operating on‑balance-sheet crypto and providing DeFi services brings regulatory scrutiny and tax complexity that differ from traditional mining.

From an allocation standpoint, investors should stress‑test scenarios where BTC stays rangebound, declines further, or rebounds strongly. The marginal value of an AI pivot increases if BTC stays depressed for long periods; conversely, a strong BTC rally can make pure mining attractive again.

Practical checklist for miners considering a pivot

- Audit existing infrastructure: PUE, power distribution, cooling, floor loading, and network fabric.

- Model full conversion costs: GPUs/accelerators, networking, installation, and revenue ramp assumptions.

- Secure demand: Lock in anchor customers or longer‑term contracts before heavy conversion capex.

- Maintain optionality: Consider hybrid models (split racks for mining and AI) where possible to switch back if economics change.

- Formalize treasury policy: Predefine thresholds for when to sell mined BTC versus hold or swap into ETH/other instruments.

Conclusion — what to watch next

The miner landscape is entering a period of experimentation. Bitfarms’ AI pivot is a high‑visibility test case on whether datacenter repurpose can out‑compete traditional bitcoin mining under weak BTC pricing. BTCS demonstrates that protocol accumulation and DeFi operations can materially boost revenue, while leadership changes at BitMine underscore the execution risk inherent in any strategic shift.

For network observers and investors, the critical variables will be how many marginal miners exit or repurpose, the speed of ASIC retirement, and whether diversified revenue models become a durable hedge against sell pressure. The net effect on hash rate and network security will depend less on headlines than on measured economics—power costs, contract tenors, and conversion ROI. Stay pragmatic: run scenario models, insist on contracted demand before heavy capex, and treat treasury policy as a core part of operational risk management.