Pi Network’s 50% KYC Boost: What It Means for the Token Unlock, Onboarding, and Listings

Summary

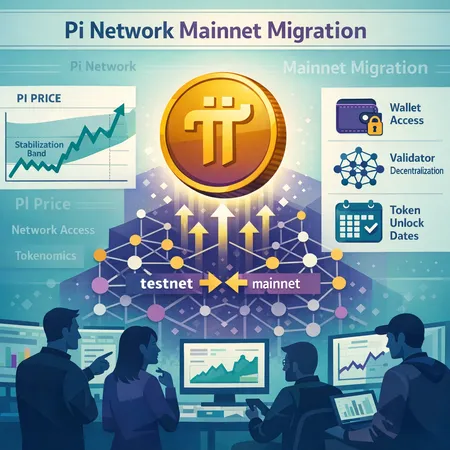

Why this KYC upgrade matters now

Pi Network has pushed a major user-experience and operational upgrade that the team says will speed KYC processing by about 50% ahead of a large token unlock. According to reporting, the KYC acceleration was timed to prepare for the upcoming distribution of roughly 190 million PI tokens, and it accompanies broader performance and UX improvements intended to handle higher load CoinPedia reports. For pioneers, community managers, and exchange operations teams, this is more than a convenience improvement — it's a pivotal change that affects onboarding throughput, distribution integrity, and how PI will behave once secondary market listings occur.

Technically oriented readers should note that the upgrade blends AI-assisted identity verification with back-end performance tuning. More detail on the technical and UX aspects of the upgrade, including how it reduces latency for pioneers, was covered in recent technical briefings and reporting CryptoPotato covers the upgrade here. The result: faster on-chain readiness signals and lower drop-off during moments of peak demand — if everything runs as planned.

Technical changes: AI-enhanced KYC and performance upgrades

The public descriptions point to two coordinated efforts: smarter KYC orchestration and infrastructure optimization. The first uses AI and automation to split and parallelize identity verification tasks; the second focuses on throughput improvements across API, queueing, and database layers.

AI-powered verification pipeline

AI models are being used to accelerate document and face-match checks, triage cases, and reduce manual-review queues. Practically this means optical character recognition (OCR) + computer vision models handle the obvious verifications, while confidence scoring routes marginal cases to human reviewers. In high-volume situations this hybrid design reduces bottlenecks: high-confidence matches clear automatically, borderline cases are queued, and human review capacity is focused where it matters most. That triage can cut per-user latency roughly in half when models are well-tuned and training data reflects real-world variety.

Backend and UX performance improvements

On the infrastructure side, Pi’s upgrade appears to include better request batching, optimized database indexing, and perhaps caching layers that prevent repeated re-processing of the same applicant. The UX side reduces steps and clarifies error states so fewer users abandon the flow mid-KYC. Together, those changes reduce total wall-clock time for a completed KYC and lower the ratio of users who fall out during onboarding.

These are standard techniques in large-scale identity systems, but the timing matters: when a token unlock and listing create a spike in new wallets and KYC attempts, both AI routing and solid backend engineering are necessary to prevent a queue that cascades into reputational and market problems.

Why faster, more reliable KYC matters for a mass token unlock

There are three linked operational imperatives during a mass unlock: onboarding throughput, token distribution integrity, and market-listing readiness.

First, onboarding throughput. If even a modest fraction of Pi pioneers attempt KYC simultaneously — say, during a scheduled unlock or immediately before an exchange listing announcement — a slow verification pipeline becomes a gate that frustrates users and concentrates demand into spikes. Faster KYC lowers abandonment rates, reduces help-desk burden, and preserves the credibility of the distribution timeline.

Second, distribution integrity. A mass unlock amplifies the risk that fraudsters or duplicate accounts slip through if the system focuses only on speed. AI that triages effectively can increase integrity by routing ambiguous or high-risk cases for manual review, rather than accelerating them blindly. The key is maintaining a clear audit trail and conservative risk thresholds on accounts that will receive significant token allocations.

Third, secondary market and listing readiness. Exchanges that list PI will evaluate not just tokenomics but the provenance of supply. Faster, verifiable KYC feeds — and published attestations about the process — help exchanges satisfy their compliance teams and market makers. Conversely, if onboarding looks chaotic, exchanges may delay listings or impose stricter cooldowns that fragment liquidity. For market participants who track Bitcoin and other bellwethers, listing signals from exchanges often precede large flows; poor KYC execution can therefore create volatile price behavior once PI hits order books.

User experience and security tradeoffs

Speed and security are often pitched as opposites, but the right design blends them. That requires clear policies and a realistic understanding of tradeoffs.

One common tradeoff: false positives versus false negatives. A KYC flow focused on maximal speed may increase false negatives (fraud slipping through), while a conservative flow increases false positives (innocent users flagged and delayed). For community retention and brand trust, excessive false positives are damaging — pioneers who get wrongly blocked share their experience widely on social channels, and that churn is expensive.

Another tradeoff is privacy and data handling. AI-driven KYC requires training data and model updates; how that data is stored, who has access, and whether processing occurs on-device or in the cloud are all security decisions with regulatory implications. Exchange partners will ask for documented data protection practices before agreeing to list or custody PI.

Finally, decentralization perception versus operational centralization. Some community members will be uncomfortable with centralized KYC orchestration; balancing transparency about process and the necessity of compliance for listings is a communication challenge that community managers must handle proactively.

Recommendations for pioneers, community managers, and exchange operations

Below are practical, prioritized steps each stakeholder group should take in the weeks before and during a token unlock and potential listings.

For Pi pioneers and large holders

- Start KYC early. Even with a 50% speed gain, batch effects and manual reviews can create unpredictable delays — begin verification well in advance of any unlock windows.

- Verify identity data quality. Ensure your document photos are sharp, metadata fields correct, and device permissions (camera, location) are allowed where required.

- Maintain channels for appeals. Keep screenshots of KYC submissions and support correspondence in case you need to escalate.

For community managers and project teams

- Stagger unlocks where possible. Phased distributions reduce peak load and give the KYC pipeline time to breathe; a controlled drip reduces risk for both network and exchange partners.

- Publish a KYC SLA and a transparency note. Exchanges and professional traders appreciate a short, factual explanation of KYC scope, expected processing times, and escalation paths.

- Prepare proactive communications. When pioneers hit delays, the first 24–48 hours of messaging define the narrative; be candid about tradeoffs and what’s being done to address edge cases.

For exchange ops and listing teams

- Ask for attestation and logs. Prior to listing, require documentation on KYC process, error rates, manual-review criteria, and any third-party vendors involved; a simple attestation can speed compliance sign-offs.

- Stress-test deposit and withdrawal rails. Coordinate with custodians and the Pi team to simulate spikes. Confirm how locked/unlocked flows will be handled in the first 7–14 days after listing.

- Design initial listing rules conservatively. Consider phased order types (limit-only for first 24–48 hours, then full market access) to prevent wildly distorted price discovery.

- Communicate post-listing monitoring plans. Market surveillance and AML tooling should be ready to flag anomalous flows if large amounts of PI move unexpectedly.

Platforms that provide payment and trading rails, including products like Bitlet.app, will also need to confirm their onboarding capacity and custody integrations ahead of any listing activity.

Practical checklist for the critical 30 days

- Pioneers: Complete KYC and retain receipts; confirm wallet linkage and disclosure settings.

- Community managers: Publish a timeline, SLA, and FAQs; prepare AMAs to address high-volume confusion.

- Exchanges: Validate KYC attestations, run a deposit stress-test, and plan staggered listing unlocks.

- Everyone: Monitor social channels and set escalation points to surface systemic issues fast.

Conclusion

Pi Network’s ~50% KYC speed improvements are a meaningful operational upgrade that, if implemented with balanced controls, will reduce onboarding friction and help support a smoother token unlock and market debut for PI. But speed alone is not enough: exchanges and community teams must work together to preserve distribution integrity, communicate transparently, and manage market access in phases. The next few weeks will test whether the AI-assisted verification and backend upgrades hold under real stress — and how well stakeholders coordinate when token flows begin.

Sources

- Report on sped-up KYC and the 190M token unlock: Pi Network speeds up KYC by 50% ahead of 190M token unlock (CoinPedia)

- Coverage of the Pi upgrade with details on faster experience for pioneers: Major Pi Network upgrade for 50% faster experience for pioneers — details (CryptoPotato)