Analyzing the Cryptogate Scandal: Lessons from the $LIBRA Meme Coin Crash in 2025

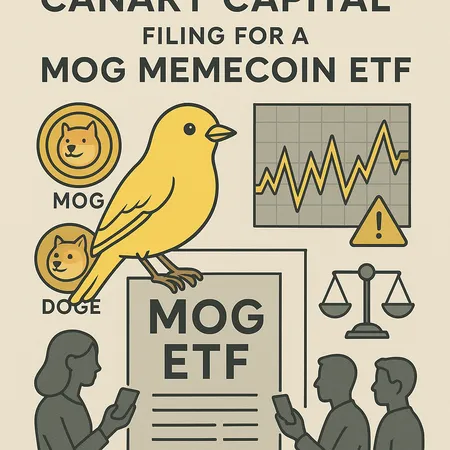

In 2025, the cryptocurrency world witnessed a shocking event known as the Cryptogate scandal, centered around the sudden crash of the $LIBRA meme coin. This event underscored the volatile nature of meme coins and the dangers of investing without comprehensive research and risk management.

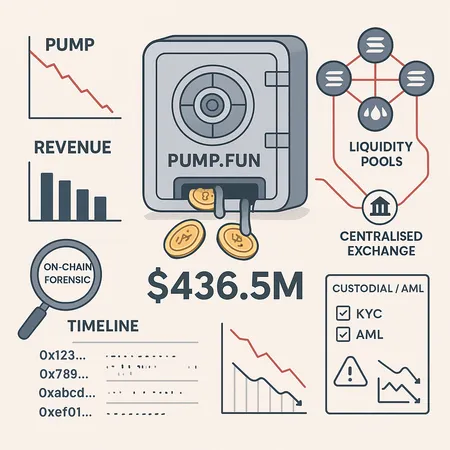

The $LIBRA coin, initially gaining massive hype and rapid valuation increases, crashed overnight due to undisclosed issues and allegations tied to Cryptogate. Many investors suffered significant losses, illuminating the broader risks prevalent in speculative crypto assets.

From this scandal, several vital lessons emerge for crypto investors:

Research Thoroughly: Prioritize projects with transparency, solid fundamentals, and credible teams.

Avoid FOMO-driven Decisions: Resist the temptation to invest impulsively based on hype or social media trends.

Diversify Holdings: Don't put all your funds into one high-risk asset.

Use Innovative Platforms: Platforms like Bitlet.app offer safer ways to invest in cryptocurrencies by providing Crypto Installment services. This means you can buy cryptos like $LIBRA (or others) now and pay monthly, reducing immediate financial pressure and allowing for better risk management.

Stay Updated on Regulatory Developments: Ensure your investments align with legal standards to avoid sudden disruptions.

The Cryptogate scandal serves as a cautionary tale that even popular meme coins can carry hidden risks. Leveraging platforms that support flexible payment and thoughtful investment strategies, such as Bitlet.app, equips investors with tools to navigate the volatile crypto landscape more securely.

Invest wisely, stay informed, and consider crypto installment plans to spread your investment cost over time, reducing exposure to unpredictable market swings.