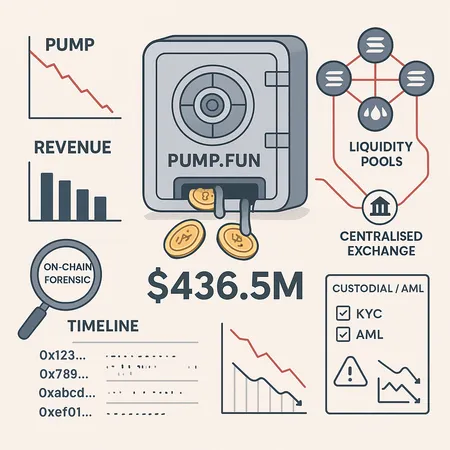

Pump.fun’s $436.5M USDC Withdrawals: An On‑Chain Exposé and Risk Playbook for Solana Memecoins

Summary

Overview: why Pump.fun’s withdrawals matter

In mid‑October, on‑chain analysis revealed that an entity connected to the memecoin ecosystem known as Pump.fun moved a very large amount of USDC — reported at approximately $436.5 million — into new custody. That flow coincided with a sharp drawdown in the PUMP token and rapidly declining revenue for the project. For compliance officers and on‑chain analysts, this is not merely a market story: it is a checklist of operational, regulatory, and systemic exposures that can ripple through the Solana ecosystem and beyond.

This article reconstructs the on‑chain evidence and timeline, quantifies the market impact on PUMP markets, outlines custodial and AML implications of large stablecoin transfers, maps contagion vectors affecting liquidity pools and central counterparties, and proposes practical audit and monitoring controls that exchanges and funds should adopt.

On‑chain evidence and timeline

On‑chain reporters first flagged substantial USDC movements tied to Pump.fun in mid‑October. Detailed transaction tracing shows a series of large transfers out of addresses associated with the project; investigative articles summarize the flow and timing and provide block‑level snapshots for verification. Primary on‑chain reporting documenting the withdrawals is available in contemporary coverage, which identified the approximately $436.5M figure and the sequence of transfers (Blockonomi and Cointelegraph).

Chain of transfers and custody moves

The observable pattern was: concentrated token treasury holdings → on‑chain conversion or routing into USDC‑denominated positions → large outbound transfers to one or more custodial addresses or bridges. The reporting indicates most of the flow settled into custodial endpoints rather than being widely dispersed across many retail addresses. That concentration matters: funds that aggregate into centralized custody create identifiable counterparties who become focal points for compliance and liquidity exposure.

Timing matters too. The largest tranche of the withdrawals aligned with a week where memecoin markets broadly slumped, amplifying sell pressures and downstream liquidity strain (Cointelegraph coverage). Community reporting and backlash followed, documenting reputational impact as observers tried to reconcile large stablecoin exits with on‑platform revenue shortfalls (BeinCrypto analysis).

Market impact: PUMP price collapse and revenue decline

The most immediate market signal was price. PUMP’s order books experienced extreme slippage as the on‑chain withdrawals and attendant selling pressure hit markets, producing a significant price collapse over a matter of days. Token revenue metrics that once supported tokenomics assumptions — liquidity mining payouts, on‑chain fee capture, and treasury yield figures — shrank as on‑chain balances moved to custody and market depth evaporated.

For risk teams this produces a three‑part problem: (1) asset value deterioration for counterparties holding PUMP, (2) lost on‑chain revenue or operational liquidity for the project itself, and (3) a behavioral shift where market participants rapidly de‑risk from memecoins, increasing concentration in perceived safe havens such as USDC and SOL. The combination creates exacerbated slippage in Solana liquidity pools and, potentially, forced deleveraging in centralized books that had exposure to memecoin pairs.

Custodial and AML implications for large stablecoin movements

Large stablecoin flows — especially sudden transfers of hundreds of millions of dollars into custody — raise immediate AML and compliance questions regardless of the underlying narrative. Key issues include provenance, intent, and layering.

- Provenance: Tracing the history of the funds matters. Were proceeds from token sales, bridge inflows, or third‑party aggregations? On‑chain forensics can and should map prior hops to detect mixing, sanctioned addresses, or previously flagged actors.

- Intent and disclosure: Projects moving treasury assets into custodial wallets without public disclosure create market and disclosure risk. Exchanges and custodians will want attestations describing why custody was changed and who controls the destination keys.

- Layering and structuring: Large single transfers are easier to audit than many small “smurfed” transfers, but rapid successive movements across exchanges, chains, or mixers are classic AML red flags.

Custodians and regulated counterparties must therefore treat memecoin‑related stablecoin inflows as enhanced‑risk transactions. That includes requesting originator KYC, performing source‑of‑fund investigations, and applying stricter transaction monitoring thresholds for tokens like PUMP where price volatility and liquidity gaps are significant.

Contagion vectors across Solana liquidity pools and centralized counterparties

Memecoin shocks do not stay confined to token markets. There are multiple contagion paths to watch:

- Liquidity pools on DeFi AMMs: Large withdrawals and token price collapses cause impermanent loss and slippage, which can cascade as LPs withdraw funds, thinning liquidity and widening spreads across correlated pools. Thin markets amplify price moves for other assets paired with memecoins.

- Centralized exchange exposure: CEXs that list memecoins or accept deposits tied to memecoin projects can see sudden funding inflows and withdrawals, margin calls, or defaulted loans if they provided credit lines against volatile tokens.

- Bridge and cross‑chain hops: If stablecoins or PUMP‑proceeds are bridged off Solana, contagion can jump chains, creating reconciliation headaches and latency in AML responses.

- Market‑maker balance sheet strain: Proprietary desks providing two‑sided quotes for memecoin pairs can be materially impaired by rapid adverse selection, prompting pullbacks and widening spreads across the platform.

A realistic stress scenario: a treasury converts PUMP to USDC, sends to a centralized custodian, markets sell PUMP aggressively, liquidity providers pull their LP positions, and the custodian receives withdrawal requests tied to the same wallet cluster. The result is simultaneous operational pressure — not just price risk but settlement and counterparty risk.

Practical audit and monitoring steps for exchanges and funds

Below are concrete measures compliance officers and risk teams should adopt to mitigate memecoin counterparties and liquidity events.

1) Enhanced on‑chain forensic tooling

Deploy continuous address clustering, real‑time alerts for large stablecoin transfers (thresholds tuned per market), and automatic tagging of memecoin treasury addresses. Integrate third‑party analytics to enrich wallet risk scores and surface bridge activity or sanctioned address interactions early.

2) Transactional limits and custody gating

Apply graduated limits for incoming memecoin‑derived stablecoin flows. Large transfers above defined thresholds should require enhanced onboarding steps: counterparty attestations, proof of treasury governance approval, and manual AML review. Custodians should enforce withdrawal holds pending verification of source of funds for unusually large USDC inflows.

3) Margin, collateral, and concentration controls

Treat memecoins as a high‑haircut asset class. Increase margin requirements, restrict token acceptance as collateral for lending, and monitor concentrated exposures across books. Scenario test the impact of a 50–90% memecoin price shock on financed positions and collateral ratios.

4) Proof‑of‑reserves and reconciliation cadence

For funds and exchanges, reconcile proof‑of‑reserves to on‑chain balances more frequently for memecoin pools. Randomized third‑party attestations and cross‑matching of custody addresses against known treasury addresses reduce settlement surprises.

5) Whitelisting, KYC escalation, and counterparty attestations

Require whitelisting for counterparties that receive large stablecoin settlements and mandate KYC escalation for treasury managers of memecoin projects. Contracts or agreements should include clauses about treasury movement notifications and dispute resolution.

6) Stress testing and playbooks

Run periodic stress tests that simulate memecoin runs: rapid token de‑pegging, large stablecoin transfers, bridge latency, and downstream withdrawal waves. Document a response playbook that aligns legal, AML, operations, and trading desks for faster coordinated action.

Conclusion: practical vigilance, not panic

The Pump.fun episode is a reminder that memecoin markets can concentrate risk quickly and loudly. The $436.5M figure reported in on‑chain coverage is a useful data point; for risk teams the more important lesson is structural: memecoin treasuries, concentrated stablecoin flows, and thin liquidity combine to create outsized operational and contagion risk on chains like Solana. Well‑designed monitoring, tighter onboarding, and routine stress testing will not stop every episode, but they materially reduce the chances that a single counterparty can destabilize a fund, an exchange order book, or an AMM pool.

Platforms and services that touch these markets — from DEXs and custodians to installment or P2P providers such as Bitlet.app — should incorporate the layered controls above into their risk frameworks to stay ahead of the next memecoin shock.

Sources

- Blockonomi — Pump.fun withdraws $436.5M USDC: https://blockonomi.com/pump-fun-pump-price-platform-withdraws-436-5m-usdc-as-token-falls-24-weekly/

- Cointelegraph — PumpFun transfers $436M as memecoin market slumps: https://cointelegraph.com/news/pumpfun-transfers-436m-as-memecoin-market-slumps?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- BeinCrypto — Pump.fun USDC withdrawals and community backlash: https://beincrypto.com/pumpfun-usdc-withdrawals-mayhem-backlash/