Lessons from the $LIBRA Meme Coin Crash and How to Invest Smarter with Bitlet.app

The recent crash of the $LIBRA meme coin has once again reminded investors of the volatile nature of hype-driven crypto assets. Many traders were drawn to $LIBRA due to its rapid price increase fueled by social media buzz and speculative frenzy. However, the abrupt crash left many investors with significant losses, emphasizing the importance of prudent investing.

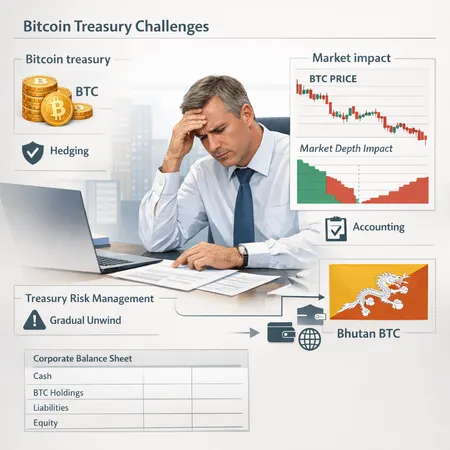

Key Lessons from the $LIBRA Crash:

Beware of Hype-Driven Assets: Meme coins often experience rapid price surges based on social media trends rather than fundamental value. This makes them highly risky.

Do Your Research: Understand the project's fundamentals, community support, team credibility, and long-term potential before investing.

Diversify Your Portfolio: Don't put all your funds into high-risk investments. Diversification can shield you from market shocks.

Invest What You Can Afford to Lose: Especially with speculative assets, only use money that won't jeopardize your financial stability.

Consider Smarter Purchase Options: Instead of lump-sum investments, look for solutions that allow you to spread your purchase over time.

This is where Bitlet.app steps in to offer a smarter way to invest in cryptocurrencies. Bitlet.app's unique Crypto Installment service enables users to buy cryptocurrencies now and pay for them monthly. This approach reduces the immediate financial burden and allows you to manage risk more effectively.

By leveraging Bitlet.app, investors can:

- Enter the crypto market with smaller monthly payments instead of full payments upfront.

- Avoid the pitfalls of investing large sums into volatile assets all at once.

- Benefit from greater budget flexibility, aligning crypto purchases with your financial planning.

The $LIBRA crash is a cautionary tale, but with tools like Bitlet.app, you can approach crypto investments with a smarter, more measured strategy. Explore Bitlet.app today to harness the power of crypto installment plans and invest in your digital future wisely.