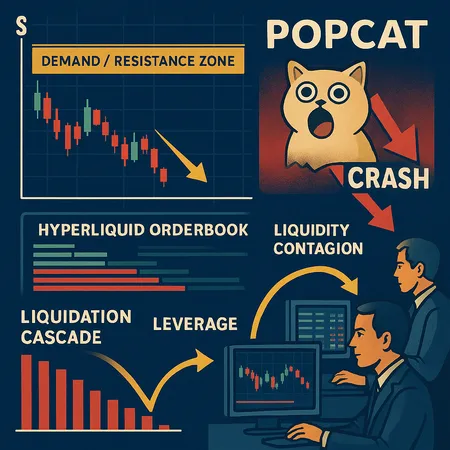

Solana’s Critical Juncture: What a POPCAT Meltdown and Hyperliquid Activity Mean for SOL

Summary

Executive snapshot

Solana is at a technical crossroads: price action around the $140–$155 band is attracting attention because it is the last meaningful structural demand cluster before lower support ranges. At the same time, the POPCAT memecoin collapse and odd trading behavior on Hyperliquid have shown how a single levered memecoin can cascade into SOL spot and derivatives stress. This piece breaks down the technical map, the anatomy of the POPCAT event (including evidence consistent with manipulative flow), how liquidations transmit into SOL markets, and concrete tactics for traders and builders.

Technical picture: key demand and resistance zones for SOL

SOL’s range structure matters now more than ever. On-chain liquidity and visible orderbook depth point to two nearby zones to watch: a demand band roughly between $140–$155 and a resistance area between $185–$205 (note: ranges are illustrative; always cross-check live price data before trading). The $140–$155 area has acted historically as a confluence of buy-side liquidity—bin-size concentrations, larger limit orders on major DEX aggregators, and spot holders who accumulated during prior dips.

A clean retest and hold of $140–$155 would suggest that market makers and long-term allocators remain willing to absorb memecoin-driven volatility, reducing tail risk for SOL. Conversely, a break below that band would likely accelerate directional pressure, opening up lower structural supports (e.g., $110–$125) and increasing the likelihood of derivative-driven deleveraging.

What a retest to $140–$155 implies

- If the zone holds: short-term sellers get squeezed; implied volatility should compress; funding rates on perpetuals may normalize as shorts cover. Liquidity providers may widen spreads but continue to quote size, stabilizing the crypto market microstructure around SOL.

- If the zone fails: expect a quick repricing of margin requirements, forced deleveragings, and an uptick in cross-asset liquidation cascades. That scenario would make options and futures markets more expensive to use for hedging and push more capital into temporary stablecoin positions.

Anatomy of the POPCAT crash

POPCAT’s collapse was textbook for modern memecoin volatility: extremely concentrated holdings, low real liquidity, and outsized leverage. Three dynamics interacted to produce the crash:

- Concentration and shallow liquidity: large holder wallets—often a handful—held a meaningful share of circulating supply. When these wallets sold or moved funds off-exchange, price slippage was severe.

- Leverage amplification: traders using HYPE-denominated perpetuals and margin on Hyperliquid used high leverage on a token with shallow on-chain depth. Small price moves triggered outsized liquidations.

- Feedback loops: liquidations pushed price lower, which fed more liquidations—this classic positive feedback loop is amplified on chains like Solana where settlement is fast.

Evidence pointing to suspicious orderflow on Hyperliquid

On-chain and exchange-level indicators from the POPCAT incident reveal patterns that are consistent with abusive or at least highly coordinated behavior, though public data rarely proves intent and should be interpreted cautiously. Observed signals included:

- Large, rapid self-routing of orders between tightly clustered wallets and HYPE orderbooks, producing non-economic fills and odd depth curves.

- Repeated aggressive post-only or maker-cancel behavior that removed visible liquidity immediately before sweeping taker trades—an execution pattern that can create localized fragility.

- Clusters of large cancels and re-posts aligned with wallet clusters that later captured liquidation arbitrage gains.

Those observations are indicative of manipulation-like behavior (wash trades, spoofing patterns, or predatory liquidity withdrawal), but attribution requires exchange-level logs and KYC tracing. Still, from a risk-management viewpoint, the existence of such on-chain fingerprints should be treated as a serious signal: memecoin orderbooks on Hyperliquid can be arbitrage playgrounds for well-capitalized actors and a trap for levered retail traders.

How levered memecoin liquidations contagion into SOL spot and derivatives

The mechanics are straightforward but fast:

- Liquidations fire on levered memecoin positions (e.g., POPCAT perpetuals on HYPE). These liquidations auto-execute as taker trades into the memecoin orderbook, causing deep slippage.

- Revenue from liquidation auto-sweeps into stablecoins or larger assets; some liquidators convert proceeds into SOL for settlement or collateral top-ups, creating rapid spot buying/selling pressure on SOL.

- Margin calls propagate: traders who used cross-margin or had SOL collateral see margin ratios deteriorate, forcing SOL spot or futures sells to meet maintenance requirements.

- Basis and funding shifts: as shorts or longs rebalance, futures markets reprice, causing funding rate spikes that in turn force further position changes—an accelerant for volatility.

Because Solana is frequently used as a collateral and base pair for memecoin trading, the chain’s native token (SOL) becomes the natural plumbing for absorbing capital flows during stress. That plumbing can clog: if large liquidations hit SOL orderbooks faster than makers can reprovide depth, spreads blow out and price gaps occur.

Tactical guidance for traders and risk managers

These are practical, non-ideological steps for managing exposure to SOL and memecoin-led contagion.

For active traders and risk managers

- Reassess leverage: cap maximum leverage on memecoin positions and avoid excessive cross-margining with SOL collateral. Prefer isolated margin for high-volatility tokens.

- Hedge actively: if you have directional SOL exposure, consider short futures or buy protective puts rather than relying on stop-loss orders that can gap. Use size bands tied to liquidity metrics (orderbook depth, on-chain DEX reserves).

- Monitor real-time flow metrics: watch wallet clusters, abnormal cancel-to-trade ratios, and sudden DEX liquidity withdrawals—these are earlier warnings than price alone.

- Stress-test scenarios: run automatic drills for a POPCAT-like drop with simultaneous SOL drawdown. Quantify worst-case P&L and ensure capital buffers are sufficient.

- Funding awareness: track perpetual funding and basis curves; sudden funding spikes often precede rapid deleveraging phases.

For builders and liquidity providers on Solana

- Implement isolated margin and position caps for volatile memecoins to limit cross-asset contagion. This prevents a POPCAT crash from automatically deleveraging SOL-backed positions.

- Harden oracles and smoothing: use TWAP windows and multiple feed sources to avoid amplifier effects from instantaneous price swings on a single DEX.

- Incentivize real liquidity: short-term liquidity mining that attracts deep, committed LPs reduces slippage during stress. Design rewards to favor longer time-weighted commitments.

- Monitor and throttle API behavior: rate-limit aggressive order churn and introduce maker protection periods after bulk cancels to discourage predatory behavior.

Bitlet.app and other ecosystem tools that provide portfolio analytics can help traders visualize these cross-market exposures in real time—use them to map memecoin-to-SOL contagion paths.

Conclusion: posture for uncertainty

The combination of a technical retest to the $140–$155 band and the memecoin-driven stress test from POPCAT highlights how fragile market structure can be when leverage, concentration, and thin liquidity collide. Traders should assume that memecoin events will continue to produce outsized local volatility; risk managers should adapt by lowering systemic leverage, hardening product-level protections, and monitoring orderflow indicators that precede price moves.

In short: treat SOL’s current levels as a high-attention zone, respect the speed of Solana-native liquidations, and use conservative hedging and margin isolation to reduce contagion risk.