Metaplanet’s Bitcoin Playbook: What Its 2025–27 Treasury Build Means for Corporate Crypto Adoption

Summary

Metaplanet’s 2025 push in context

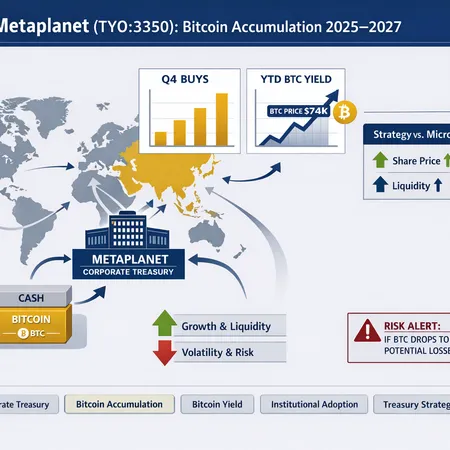

Metaplanet (TYO:3350) closed 2025 with a noticeable acceleration in bitcoin accumulation: a Q4 buy of 4,279 BTC that brought total treasury holdings to 35,102 BTC, according to market reporting. That incremental purchase was framed not as a one-off, but as part of a public ambition to capture roughly 1% of Bitcoin’s total supply by 2027, a target that signals multi-year commitment and capital allocation to BTC on the balance sheet (Invezz).

For many corporate treasuries this level of visibility matters: the decision to buy and disclose creates a signaling loop. Institutional peers watch, OTC desks recalibrate appetite, and equity markets reprice exposure. For readers focused on treasury strategy, the Metaplanet case is now a useful playbook and a cautionary tale at once. For many traders, Bitcoin remains the primary market bellwether — and corporate demand like Metaplanet’s alters that bellwether’s noise floor.

Q4 buys, BTC yield and the balance-sheet arithmetic

Coindesk quantified Metaplanet’s latest accumulation and total holdings after the Q4 buy: 35,102 BTC in treasury (Coindesk). The purchase of 4,279 BTC represents roughly a 13.9% increase over its pre-Q4 level (prior holdings ≈ 30,823 BTC); put another way, that single quarter accounted for a double-digit uplift in the company’s BTC inventory.

Metaplanet also highlighted strong BTC performance on yield-generating activities in 2025, reporting record BTC yield contributions to corporate returns — a point covered in market reporting about the company’s 2025 results (BeInCrypto). While yield sources (lending, structured products, or other income-producing programs) vary in risk and accounting treatment, the combination of accumulation + yield changes the calculus for treasury teams: holdings not only provide price exposure but can also be a source of recurring returns if risk-managed correctly.

Quantifying the balance-sheet exposure is straightforward once you know holdings. At key illustrative price points the market value of Metaplanet’s 35,102 BTC is:

- At $74,000 per BTC: ~USD 2.60 billion (35,102 × 74,000 ≈ 2,597,548,000)

- At $100,000 per BTC: ~USD 3.51 billion

- At $150,000 per BTC: ~USD 5.27 billion

These headline figures matter for corporate reporting, investor discussions, and for comparisons with other listed corporate treasuries. Metaplanet’s asset exposure must be reconciled with its liabilities, cash runway, and the stock market’s appetite for crypto-tilted balance sheets.

Comparing Metaplanet with Strategy (MicroStrategy) and other listed treasuries

Strategy (MicroStrategy) long ago established the template for a public company allocating material parts of its treasury to BTC: outspoken management, regular purchases, and high correlation between BTC price moves and the equity valuation. Metaplanet’s approach shares the signal mechanics — transparent buys and target-setting — but differs in scale and regional influence. MicroStrategy’s balance-sheet allocation is historically larger in dollar terms and has produced a pronounced equity-level sensitivity to BTC volatility; Metaplanet is building toward a significant but still smaller stock of BTC relative to the 1%-of-supply target it has announced.

The Block’s Q4 coverage provides a useful corporate-level read of Metaplanet’s strategy and execution choices, showing a more diversified set of levers (yield, active accumulation, and investor communications) than a single-minded buy-and-hold narrative (The Block). This nuance matters: a treasury that combines yield generation and drip accumulation can present different downside behavior compared with a pure-accumulation strategy.

From an investor viewpoint, the practical difference is equity beta: if a firm actively generates BTC yield and amortizes purchases over time, the trailing volatility of profits may be lower than a firm that simply holds large, unhedged bitcoin positions. But once BTC becomes a material line item, the share price will still reflect BTC’s market moves — history with MicroStrategy is instructive here.

If BTC falls toward $74k: exposure, impairments and market effects

Market commentary has flagged the $74k level as a stress threshold for certain balance-sheet dependent strategies; analysts have modelled what this kind of drawdown would do to treasury-heavy firms (Coinpedia). For Metaplanet the numbers are direct: a slide to $74k values its 35,102 BTC at roughly $2.6 billion. Whether that move triggers equity distress depends on how that BTC line is financed and accounted for.

Key channels of vulnerability:

- Accounting and impairments: under many accounting regimes, if BTC is treated as intangible or inventory, sharp price declines can force impairment charges that hit earnings — reducing book equity even if the company holds long-term conviction.

- Funding and leverage: if BTC was purchased with debt or if leverage backs margin positions, a price drop could necessitate deleveraging at disadvantageous prices.

- Equity market repricing: public equities that signal large BTC exposure often de-rate when BTC falls; that may create a feedback loop where the company’s equity capital becomes more expensive just when it might want to raise funds.

Practical stress numbers: the move from $150k to $74k would be a roughly 50%+ drawdown — turning multi-billion-dollar positions into materially smaller valuations. The exact impact on Metaplanet’s balance sheet depends on its cash reserves, leverage and how management chooses to present BTC accounting; see Coinpedia’s discussion of strategy-style risk for context (Coinpedia).

Liquidity effects and institutional signalling heading into 2026

Corporate accumulation on the scale Metaplanet has signalled is not neutral for market liquidity. Adding 4,279 BTC in a quarter was meaningful to OTC desks and spot liquidity pools, and a stated plan to scale toward 1% of supply by 2027 implies sustained demand. That reduces active sell-side inventory and can raise the premium for immediate execution, particularly on larger blocks.

Two structural market effects to watch:

- Reduced available long-term inventory: institutional accumulation removes coins from active circulation (OTC and exchange deposits). Over time, that scarcity can amplify price moves from new demand or from negative shocks.

- Coordination of signaling: public companies buying BTC provide a validation loop for other corporates and pensions. In Asia — where corporate treasuries have historically been conservative on crypto — Metaplanet’s public stance makes it easier for peers to justify exploratory allocations or pilot programs.

The end result is not just price mechanics but narrative mechanics: corporate treasury interest in Bitcoin becomes self-reinforcing as more balance sheets disclose positions. That institutional verification is arguably as important as the absolute size of the holdings.

Practical steps and risk controls for CFOs considering similar strategies

For CFOs and treasury teams evaluating a Metaplanet-style approach, the following checklist condenses practical risk management and execution items:

- Define mandate and guardrails: set an explicit target range (percent of cash or assets) for BTC exposure, and a time horizon that matches corporate liquidity needs.

- Dollar-cost-average with ceilings: stagger purchases to avoid large market impact; set single-trade size limits tied to average daily volumes and OTC desk capacity.

- Use hedging selectively: collar strategies, long-dated puts, or variance swaps can cap downside while preserving upside; balance hedging costs against opportunity cost.

- Clarify accounting treatment in advance: work with auditors and regulators to determine impairment rules, tax consequences, and disclosure timing — Asian and global rules may differ.

- Monitor yield counterparty risk: if pursuing BTC yield (lending, staking, or structured income), assess credit and operational risks of counterparties and the liquidity profile of yield instruments.

- Stress test and scenario plan: model a range of BTC prices (e.g., $74k scenario), funding shocks, and forced-sale scenarios; prepare communications playbooks for investors.

These steps reflect practical treasury discipline. Bitlet.app’s products and educational resources can be useful background for CFOs exploring crypto allocation and execution pathways.

Conclusion — what Metaplanet’s moves mean for adoption

Metaplanet’s Q4 purchases and 2025 yield results are a clear signal: corporate bitcoin accumulation in Asia is transitioning from niche pilot projects to full-scale balance-sheet strategy. The company’s ambition to approach 1% of supply by 2027 underlines that this is intended as a multi-year initiative, not a marketing stunt. For institutional investors and CFOs, the takeaway is twofold: there is increased market impact from repeated, visible corporate demand; and implementation — from accounting to hedging — is where returns are preserved or lost.

As we head into 2026, expect more corporate disclosures, more structured offerings targeted at treasuries, and a deeper conversation about how to responsibly combine bitcoin accumulation, yield, and traditional risk controls. The template pioneered by Strategy (MicroStrategy) has matured into a toolkit: Metaplanet’s version emphasises regional reach, yield generation, and a public roadmap. That mixture will help decide whether this wave of institutional adoption is a structural supply-side shift or a cyclical appetite spike.

Sources

- Invezz — Metaplanet adds 4,279 BTC in Q4 as it targets 1% of total Bitcoin supply by 2027

- Coindesk — Metaplanet buys 4,279 Bitcoin, lifts total holdings to 35,102 BTC

- The Block — Metaplanet Bitcoin Q4 2025 analysis

- BeInCrypto — Metaplanet BTC yield record 2025

- Coinpedia — Will Saylor’s strategy go bankrupt if BTC drops to $74,000? (risk discussion)