Institutional Bitcoin Accumulation vs ETF Outflows: Metaplanet, MicroStrategy, and Tax-Season Dynamics

Summary

Executive overview

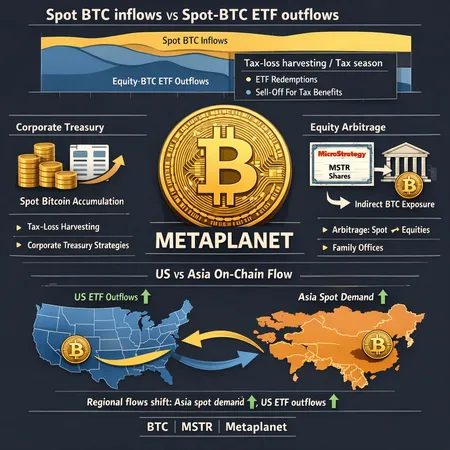

Institutional Bitcoin accumulation is no longer a single narrative. On one hand, we see explicit, balance-sheet-focused plans such as Metaplanet’s pledge to buy 210,000 BTC by 2027. On the other, institutions and even some pension funds are using equity exposure — notably MicroStrategy (MSTR) shares — as an indirect route to Bitcoin exposure. Layered on top of these strategies are seasonal and tax-driven flows: tax-loss harvesting has triggered large spot Bitcoin ETF outflows, reshaping liquidity and regional price differentials.

This piece explains the mechanics, quantifies the potential market impact, and offers tactical takeaways for institutional allocators and family offices weighing direct custody, equity proxies, or ETF exposure.

Why Metaplanet’s 210k BTC plan matters

Metaplanet’s shareholder-approved plan to accumulate 210,000 BTC by 2027 is notable for scale and intent. That quantity represents roughly ~1% of circulating Bitcoin supply — a non-trivial claim on available coins — and signals a corporate-treasury-style accumulation strategy at institutional scale (Blockonomi coverage).

Market mechanics and absorption

- Demand concentration: A committed buyer targeting 210k BTC over a multi-year horizon can smooth execution to reduce market impact, but even patient buys need deep OTC liquidity and venue access.

- On-chain footprint vs OTC: Large allocations are typically executed off-chain via OTC desks and block trades to avoid moving spot price materially on public order books. That reduces visible on-chain flow while increasing OTC counterpart risk and counterparty exposure.

- Supply compression: Large corporate accumulation programs reduce the free-floating supply available to retail and traders, potentially increasing realized volatility when flows reverse or accelerate.

For allocators, the takeaway is simple: when large corporate plans are public, horizon-aware execution and custody planning become more important. Aggregated corporate buys act like a long-term demand anchor — good for the price narrative — but create execution and basis risks during drawdowns.

The equity proxy: MicroStrategy and pension fund behavior

MicroStrategy has become a de facto public vehicle for Bitcoin exposure by allocating corporate treasury to BTC purchases and by trading as a leveraged proxy for the asset. Recent reporting shows a Florida pension fund increasing its Bitcoin exposure not by buying BTC directly but by accumulating MicroStrategy stock (Crypto.news report).

Why use MSTR instead of BTC?

- Operational simplicity: Buying equities sidesteps custody, private-key management, and some compliance headaches. For many trustees and pension fiduciaries, an equity allocation is administratively cleaner.

- Liquidity and accessibility: MSTR trades on public exchanges with deep intraday liquidity, margin, and derivatives available for hedging.

- Regulatory clarity (relative): For some U.S. public funds, equity exposure fits existing governance frameworks better than direct crypto holdings.

The hidden costs and basis risk

Using MSTR introduces material basis risk. MicroStrategy’s share price reflects not only BTC price moves but also corporate decisions, leverage, investor sentiment, and equity-market multiple changes. If MicroStrategy halts purchases, issues equity, or changes policy, the correlation to BTC can diverge rapidly. Institutions buying MSTR should model the correlation and consider hedges (e.g., trading BTC futures or options) to isolate pure BTC exposure.

Spot Bitcoin ETF flows and tax-loss harvesting mechanics

Seasonal tax behavior can create outsized short-term flows in ETF wrappers. Recent analyst-driven coverage shows approximately $825 million in outflows from spot Bitcoin ETFs in a single week attributable to tax-loss harvesting (Cryptonews analysis).

What is tax-loss harvesting and why does it affect ETFs?

Tax-loss harvesting is the practice of selling assets that have declined to realize capital losses, which can be used to offset gains for tax efficiency. When investors (retail or institutional) sell spot Bitcoin ETFs en masse to realize losses, the ETF issuer must redeem or sell underlying BTC to meet redemptions, pressuring the ETF’s price and underlying market.

Key mechanics:

- ETF redemptions vs creation: Authorized Participants (APs) facilitate creation/redemption. Large redemptions force APs to deliver or liquidate BTC, which can transiently increase selling pressure on spot markets or OTC channels.

- NAV slippage and premium/discount: During heavy outflows, ETFs can trade at a discount to NAV, creating arbitrage opportunities for sophisticated participants who can swap ETF shares for BTC (or vice versa) via AP channels.

- Seasonal timing: Tax-loss harvesting windows (late Q4 and tax season) concentrate these flows into narrow timeframes, amplifying short-term volatility.

Immediate market impacts

- Price pressure and illiquidity: $800M+ outflows in a compressed period can depress prices, widen spreads, and push volume to OTC desks.

- Arbitrage opportunities: Sophisticated players with AP access can capture discounts, but this requires infrastructure and regulatory relationships.

Regional flows: Asia vs U.S. dynamics

Regional demand patterns matter. Historically, Asia-driven retail and OTC demand has exerted premium pressure at times, while institutional U.S. flows show up via ETFs, treasuries, and equity proxies.

- Asia: OTC markets, derivatives venues, and regional exchanges can create local demand pockets. When Asian buyers dominate a session, onshore premiums or funding-rate divergences can appear. These flows may not be immediately visible on-chain.

- U.S.: ETF mechanics, corporate treasury buys, and public-equity strategies (like MSTR) are dominant. Tax-loss harvesting in the U.S. drives seasonality in ETF flows that ripple into global liquidity.

The practical consequence: institutional allocators should monitor not just global spot volume but regional liquidity indicators (local exchange premiums, funding rates, OTC desk inventories) and ETF flows to time large executions.

Arbitrage between spot accumulation and equities

There are two related arbitrage constructs institutions can use:

ETF/NAV arbitrage: When ETFs trade at discounts (often during heavy outflows), Authorized Participants can step in to buy ETF shares and exchange them for underlying BTC (or the reverse), profiting from the spread after execution costs. This requires AP status, settlement rails, and BTC custody.

Equity vs spot arbitrage (MSTR vs BTC): Because MSTR is a liquid equity with strong BTC correlation, traders can establish pairs trades (long BTC, short MSTR or vice versa) to capture divergence. This is not risk-free — corporate actions, share issuance, or leverage decisions can widen the basis.

Tactically, arbitrageurs must account for:

- Execution costs and slippage in OTC trades.

- Financing costs for equity vs crypto positions.

- Regulatory and settlement asymmetries between equities and crypto.

Corporate treasury strategies and execution considerations

If you are advising or managing a corporate treasury allocation to BTC, consider these practical rules:

- Stagger execution: Use VWAP/TWAP strategies across OTC and regulated venues to limit market impact.

- Define custody and insurance: Choose custodians with institutional-grade custody, insurance backstops, and clear legal frameworks.

- Hedge operational risk: Short-term hedges using futures or options can shield paper volatility while accumulation continues.

- Transparency and governance: Publicly disclosing a framework (purchase cadence, limit, and purpose) reduces market mispricing and aligns investor expectations.

Metaplanet’s program is illustrative: a clearly articulated long-dated target reduces short-term signaling risk but still requires sophisticated execution partners.

Tactical takeaways for allocators and family offices

- Decide on the exposure vector: Direct BTC ownership gives the purest exposure but demands custody and operational overhead. Equity proxies (MSTR) simplify operations but introduce basis risk. ETFs provide regulatory simplicity but are subject to seasonal flows and NAV dynamics.

- Plan for tax season: Anticipate increased ETF redemptions and tax-loss-driven pressure near year-end and in tax windows; avoid executing large buys/sells only during those periods unless you have AP-level capabilities.

- Use OTC and staged buying: Large allocations should be executed via OTC desks and block liquidity; stagger buys to reduce slippage and information leakage.

- Model correlation and basis risk: If using MSTR or other proxies, stress-test scenarios where correlation breaks (e.g., corporate dilution, halted purchases). Plan hedges accordingly.

- Maintain operational optionality: Hold relationships with custodians, APs, prime brokers, and OTC desks. Solutions like regulated custody, insured storage, and institutional counterparties matter.

For institutional allocators seeking execution and installment solutions, platforms across the ecosystem — including providers like Bitlet.app — are increasingly offering tailored rails for staged accumulation and custody.

Conclusion

Institutional Bitcoin accumulation is multifaceted: large corporate programs (Metaplanet) compress long-term supply, equity proxies (MicroStrategy) offer an operationally simpler but imperfect exposure, and tax-driven ETF outflows create seasonal liquidity dislocations. Successful institutional strategies recognize the trade-offs among custody, tax, execution cost, and basis risk.

By combining disciplined execution, diversified exposure paths, and active monitoring of ETF flows and regional liquidity, allocators can capture Bitcoin’s upside while managing the unique market microstructure and seasonal risks that now shape pricing dynamics.

Sources

- Blockonomi — Metaplanet unveils plan to accumulate 210k Bitcoin by 2027: https://blockonomi.com/metaplanet-unveils-plan-to-accumulate-210k-bitcoin-by-2027/

- Crypto.news — Florida's pension fund quietly boosts Bitcoin bet via MicroStrategy stock: https://crypto.news/floridas-pension-fund-quietly-boosts-bitcoin-bet-via-microstrategy-stock/

- Cryptonews — Tax-loss harvesting drives $825M outflow from Bitcoin ETFs this week, analyst: https://cryptonews.com/news/tax-loss-harvesting-drives-825m-outflow-from-bitcoin-etfs-this-week-analyst/