Inside the $333M Bitcoin ATM Scam Wave: A Practical Guide for Security, Compliance, and Consumers

Summary

Why this matters: a short framing

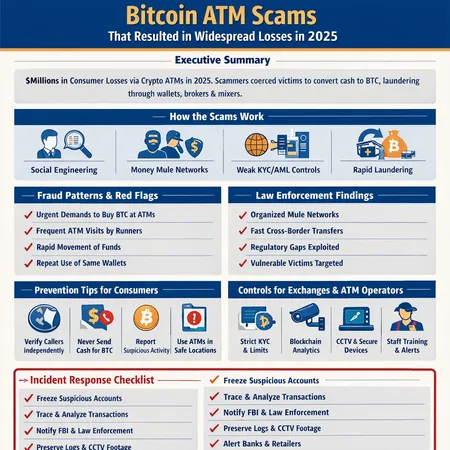

In 2025 the FBI recorded an alarming trend: criminals repeatedly leveraged cryptocurrency ATMs to convert scammed funds into BTC and ship value out of victims’ control. Industry reports summarized the agency’s estimate that about $333 million was stolen from Americans in ATM-related schemes that year (see reporting by the Daily Hodl and crypto.news). For many security teams, Bitcoin remains the primary on‑ramp and off‑ramp, and this episode exposed how weak processes and social engineering can defeat technical controls.

This guide is practical and targeted. If you run an ATM fleet, oversee AML for an exchange, or are a consumer at risk, you’ll find concrete detection rules, remediation steps, and escalation paths you can adopt today.

How Bitcoin ATM scams worked in 2025: common patterns

Attackers combined two capabilities: social-engineering scripts and rapid conversion through ATMs. The typical lifecycle included:

1) The lure and the script

Scammers used impersonation (grandparent/friend-in-distress), fake IRS/utility threats, or bogus tech support to create urgency. The victim was told to withdraw cash and convert to BTC immediately "to avoid arrest" or to pay a supposed debt.

2) Directed cash-to-BTC at ATMs

Victims were instructed to feed cash into a nearby crypto ATM and send BTC to an address the scammer provided. Because ATM transactions are rapid and irreversible on-chain, the scammer completed the theft before the victim realized.

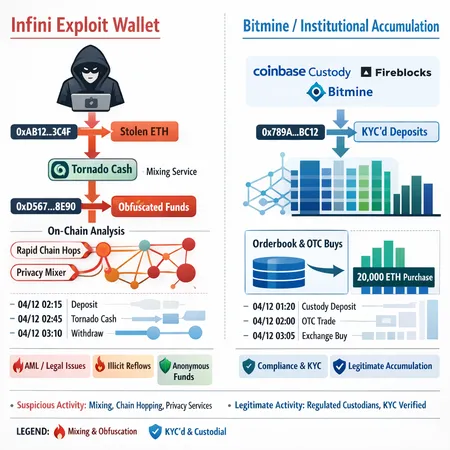

3) Money mules and address layering

Scammers often moved funds through intermediate addresses or third‑party wallets and sometimes recruited money mules to cash out across multiple ATMs, obscuring on‑chain provenance.

4) Exploiting operator/process gaps

Operators with lax KYC thresholds, poor transaction limits, lack of real-time monitoring, absent or unclear on-screen warnings, and weak camera/record‑retention policies made these attacks more profitable and harder to trace.

These behavioral and operational patterns are consistent with the FBI’s summary of the 2025 incidents, described in reporting that aggregates the agency’s findings (Daily Hodl coverage; crypto.news coverage).

What the FBI flagged (high‑level takeaways)

The FBI’s reporting and industry summaries highlighted several enforcement- and prevention-relevant observations:

- The core enabler was social engineering rather than ATM software exploits. Rapid decision pressure made victims skip verification.

- Criminals moved money quickly after ATM conversion, complicating recovery.

- Victims often failed to preserve receipts, timestamps, cameras footage, or the scammer’s wallet address — all crucial for investigations.

- Fragmented operator policies and inconsistent KYC thresholds allowed higher-value criminal conversions in some jurisdictions.

Taken together, these findings underscore that reducing losses requires both consumer education and systematic changes by ATM operators and exchanges.

Immediate consumer protections: what retail users must do now

If you use cash or crypto ATMs, follow these concrete rules:

- Stop, breathe, and verify. If someone pressures you to convert cash to BTC immediately, treat that as a red flag. Call the person who allegedly needs the money — using a number you already have, not the one they text.

- Never comply with unsolicited demands for crypto to resolve legal or account issues. Government bodies and legitimate companies do not demand immediate crypto payments.

- Keep receipts and screenshots. Capture the ATM receipt, the recipient wallet address, and timestamps. This helps law enforcement and exchanges trace flows.

- Record the transaction QR/TxID immediately. If you can copy the destination address or transaction ID instantly, investigators have a better chance.

- Contact local law enforcement and submit a report to the FBI’s IC3 and the ATM operator quickly. Time is critical before funds are mixed on-chain.

- Prefer regulated on‑ and off‑ramps for large transfers. If you must use ATMs, limit amounts until operator processes improve.

These are practical habits that reduce the likelihood of becoming a convenient victim for a scripted scam.

Operational and technical controls for ATM operators

Operators should assume adversaries will use social engineering. Harden the chain of controls around the ATM experience.

Hardware and on‑screen controls

- Enforce visible, plain‑language warnings about scams on boot and before every transaction. Simple, repeated prompts make a measurable difference in interrupting scripted abuse.

- Limit transaction amounts per session and per day by default; require escalation (ID/liveness) above modest thresholds.

- Enable tamper detection and ensure cameras have secure storage and at least 90 days retention (or as required by local regulators).

Software and UX design

- Add friction checkpoints: introduce a mandatory 60–120 second delay for new or high‑value recipients and require re-confirmation of the recipient address.

- Show a clear, non-technical confirmation screen that tells users: “Crypto transactions are irreversible. Do not send funds to anyone who pressures you.”

Monitoring and chain controls

- Integrate real‑time chain analytics and watchlists (e.g., Chainalysis/others) to flag deposits to addresses previously associated with scams or rapid mixing.

- Implement velocity and clustering rules: multiple outgoing deposits to different addresses from the same ATM within a short window should trigger manual hold or operator review.

- Maintain a shared hotlist with local exchanges and law enforcement to block or flag known scam destination addresses.

Staffing and policies

- Train cashiers and field staff to recognize scams and to lock down specific ATMs on request. Provide an operator hotline that victims can call immediately.

- Publish clear incident reporting flows and preserve evidence for investigations.

Collectively, these measures make it harder for scammers to convert social-engineered gains into finalized BTC transfers.

Measures for exchanges and custodians (security & compliance)

Exchanges are often the destination where stolen BTC gets converted back to fiat. They must act quickly to reduce success.

- Implement rapid-blocking workflows: when a scam is reported with a destination address, exchanges should have an emergency review team that can trace inbound funds and freeze conversions where possible.

- Use on‑chain clustering and risk scoring to flag deposits originating from ATM-based scams. Automated rules should quarantine suspicious deposits pending human review.

- Enforce enhanced KYC and withdrawal checks on accounts receiving funds from flagged addresses; require source-of-funds explanations and proof.

- File SARs promptly when funds are linked to scams, and maintain close lines with law enforcement to speed subpoenas and asset preservation.

- Maintain a public-facing consumer education page and work with ATM operators to reduce fraud success rates across the ecosystem.

These operational controls reinforce AML programs and reduce the incentives for criminals to use ATMs as a cashout channel.

Compliance, AML, and incident response playbook

Security and compliance teams should codify a playbook covering the entire incident lifecycle:

- Detection: automated rules detect suspicious ATM-originated inflows, velocity spikes, and known-scam addresses.

- Triage: an analyst validates chain evidence and checks whether funds were held on exchange or already forwarded.

- Containment: freeze convertible assets on the platform and notify counterparts (ATM operator, correspondent banks, law enforcement).

- Reporting: file SARs/STRs as required and submit details to national cybercrime units (the FBI IC3 in the U.S.).

- Evidence preservation: retain chain data, account logs, KYC records, ATM camera footage, and communication transcripts.

Having this process documented reduces delay — and delay is what allowed the $333M wave to escalate.

Quick checklists: short actions you can take this week

For ATM operators (operational):

- Lower anonymous transaction caps and require ID above a small threshold.

- Push on‑screen warnings and add a mandatory delay for high-value sends.

- Ensure camera operation and 90‑day footage retention.

For exchanges/compliance teams:

- Add ATM-origin rules into AML engine and create quarantine workflows.

- Subscribe to a blockchain intelligence provider and ingest scam address feeds.

- Test SAR and law-enforcement escalation paths.

For consumers:

- Verify any urgent request offline. Keep transaction receipts and screenshot the address/QR.

- Share this guidance with relatives and friends who may be targeted.

Longer-term: ecosystem-level changes

The $333M incident is a reminder that technology alone won’t stop social-engineering. We need combined solutions:

- Industry collaboration: exchanges, ATM operators, and law enforcement should share IOCs and hotlists continuously.

- Regulatory clarity: consistent KYC thresholds for ATMs and minimum camera/recording standards would reduce safe havens.

- Better UX and consumer nudges: research shows well-designed warnings and friction reduce scam compliance rates.

Bitlet.app and other service providers in the space should be part of these cross‑sector dialogues to improve consumer protection and AML outcomes across the crypto market.

Final thought

Scammers exploited familiar psychological levers — fear and urgency — and combined them with infrastructure gaps in ATM and exchange processes. The FBI’s $333M figure is a blunt metric, but the lessons are granular: tighten operational controls, make scams harder to complete, and give victims tools and clear reporting channels. Implementing the practical steps in this guide reduces both the supply of convertible funds and the chance that an urgent social‑engineering script succeeds.

Sources

- Daily Hodl — Scammers used Bitcoin ATMs to steal $333,000,000 (FBI report summary): https://dailyhodl.com/2026/01/05/scammers-use-bitcoin-atms-to-steal-333000000-as-fbi-warns-crypto-scams-not-slowing-down-report/

- crypto.news — Bitcoin ATM scams steal $333M from Americans in 2025, FBI says: https://crypto.news/bitcoin-atm-scams-steal-333m-from-americans-in-2025-fbi-says/