Institutional Investors

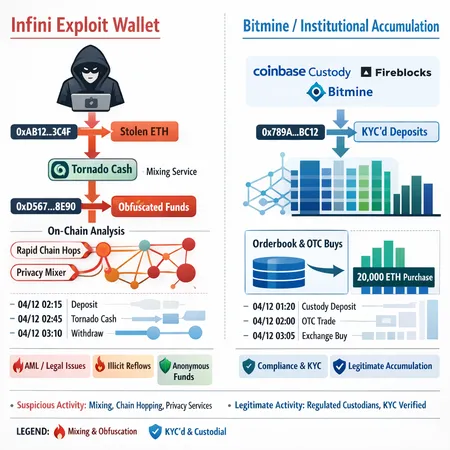

A forensic comparison of an exploit-linked wallet that reactivated to buy ETH (and routed funds through Tornado Cash) against institutional accumulation such as Bitmine’s 20k ETH purchase. This piece provides a practical on-chain provenance and AML framework for reporters and compliance teams to separate illicit reflows from legitimate buying.

Spot Bitcoin ETFs have gained significant traction in the U.S., marked by a $552.78 million net inflow that highlights growing institutional confidence. Discover what this trend means for investors and how platforms like Bitlet.app make crypto investing more accessible with innovative solutions like Crypto Installments.

Stablecoins are gaining traction among institutional investors due to their stability and reliability. Platforms like BVNK and Bitlet.app are making crypto investments more accessible and secure, offering innovative services such as Bitlet.app's Crypto Installment plan.

Citi's announcement of launching a crypto custody service in 2026 marks a significant step for institutional investors seeking secure and regulated solutions for digital asset management. This move reflects growing acceptance of crypto in mainstream finance, offering enhanced trust and accessibility.

Ethereum's recent price surge is increasingly driven by rising ETF inflows and growing institutional interest. Discover how these factors are shaping the market and how platforms like Bitlet.app can help you participate in this momentum with flexible crypto installment options.

Standard Chartered has introduced direct spot trading for Bitcoin and Ether, enhancing market liquidity and providing institutional investors with more accessible crypto trading options. This move signifies growing mainstream acceptance and offers new opportunities for strategic investment.

Standard Chartered has introduced direct Bitcoin and Ether spot trading, marking a significant step for institutional investors seeking streamlined access to digital assets. This development potentially enhances liquidity and trust in crypto markets, supporting mainstream adoption.

Bitcoin's unprecedented rise in 2025 is largely driven by increased institutional investments and favorable policy shifts. Platforms like Bitlet.app enable new investors to capitalize on this momentum with flexible payment options.

Crypto ETFs are gaining traction, and Solana's Staking ETF is a prime example attracting institutional interest. Discover how these innovative financial products bridge traditional finance and crypto investing, and how platforms like Bitlet.app facilitate accessible crypto investments with flexible payment options.

Crypto ETFs are gaining momentum, especially with innovative staking products such as Solana's ETF that lure institutional investors. Platforms like Bitlet.app provide avenues for investors to engage with crypto assets conveniently, offering unique services like Crypto Installments.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility