WLFI Token Sales Under Scrutiny: National-Security and AML Risks

Summary

Executive snapshot

World Liberty Financial (WLFI) — a politically linked token issuer — is now the subject of congressional scrutiny after two U.S. senators asked the Department of Justice and the Department of the Treasury to investigate its token sales. The letter raises questions about whether tokens were sold to buyers connected to sanctioned states and illicit mixers, and whether that conduct skirts sanctions or anti‑money‑laundering (AML) rules. For compliance officers, policy analysts and journalists, the core issue is simple but consequential: how should market intermediaries treat politically tied crypto projects, and what legal exposure might follow?

What the senators asked and why it matters

In a letter reported by Bitcoinist, two senators requested DOJ and Treasury reviews into WLFI’s token sales and distribution methods, explicitly pushing for federal scrutiny of potential national‑security risks and sanctions evasion. The ask is notable because it moves the matter from industry debate into government oversight, increasing the odds of enforcement or regulatory guidance.

This is more than a political scandal: it’s a potential compliance problem with real enforcement tail risk. A DOJ probe or Treasury action (including OFAC designations or civil penalties) could lead to asset freezes, sanctions filings, and criminal or civil exposure for parties that knowingly — or negligently — facilitated restricted transactions.

Allegations: tokens sold to buyers tied to sanctioned actors

Investigative reporting has detailed alarming allegations that WLFI tokens may have been sold to buyers linked to Russia, Iran, North Korea and entities connected to Tornado Cash. Those claims — summarized in this Cryptopolitan piece — underscore the heart of the investigation: whether WLFI token sales facilitated access for actors under sanctions or for known illicit infrastructure.

These allegations, if substantiated, would implicate multiple policy angles: sanctions evasion, AML failures, and possible complicity in moving value to proscribed actors. Even absent criminal intent by the issuer, regulators focus heavily on systems — onboarding, KYC processes, payment rails and whether red flags were ignored.

Why politically tied token issuers are a different risk profile

Political backing changes the calculus. Projects tied to politicians or political movements carry reputational leverage that can attract adversarial actors seeking to launder funds, evade sanctions, or influence politics indirectly.

- Political risk escalates regulatory attention. Governments are more likely to scrutinize tokens that intersect with foreign policy or national-security considerations.

- High‑profile issuers may have weaker transactional opacity controls if early sales prioritize reach over compliance. Seed rounds or private placements can become vectors for sanctioned buyers unless strictly controlled.

- Adversaries have incentives to co‑opt politically visible projects to normalize transactions or obscure provenance.

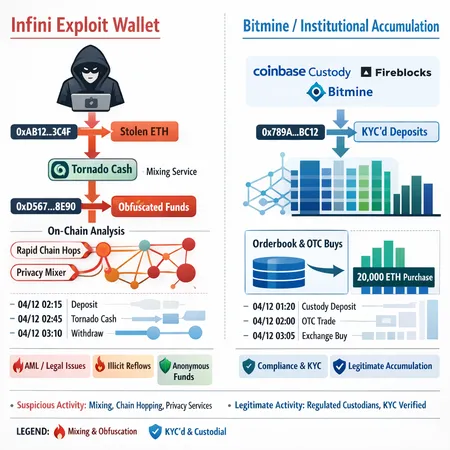

Compliance teams monitoring AML risks will recognise familiar red flags here — unusual geographies, rapid secondary market movement into darknet-linked addresses, or links to known mixing services.

Potential legal exposure: what prosecutors and regulators could examine

If DOJ and Treasury pursue this, the universe of legal levers includes:

- OFAC sanctions enforcement: facilitating transactions with sanctioned persons or jurisdictions can trigger civil penalties or criminal enforcement. Institutions that failed to block or report such transactions could face fines or designation consequences.

- Anti‑money‑laundering statutes: under the Bank Secrecy Act and related frameworks, failures in KYC, suspicious activity reporting (SAR) or implementing risk‑based AML controls can lead to enforcement. Even non‑banks (exchanges, custodians) often fall under AML obligations.

- Criminal facilitation or conspiracy charges: where intent or willful blindness is demonstrable, actors may face criminal charges — especially if funds were known to support illicit programs or to facilitate sanctions evasion.

- Securities and consumer protection law: depending on the token’s structure and how it was marketed, securities regulators or consumer protection agencies might also investigate token sale disclosures and investor protections.

Legal exposure is not limited to the issuer. Intermediaries — exchanges, custodians, on‑ramps and KYC vendors — that processed sales or secondary trading without adequate controls could attract regulatory scrutiny.

Practical steps exchanges and custodians should take now

Operational readiness matters. Below are pragmatic, prioritized controls that institutions should implement immediately or reinforce:

- Enhanced due diligence (EDD) for politically tied issuers: require governance disclosures, beneficial‑owner identification, and full KYC for token sale participants. Treat political‑backed projects as elevated risk.

- Sanctions and watchlist screening at the wallet and transaction level: integrate OFAC, EU and other global lists with on‑chain heuristics and static wallet blacklists. Screen not just purchasers but counterparties on successive hops.

- Behavioral and entity analytics: deploy chain analysis tools to detect links to mixers (e.g., Tornado Cash) or sanctioned clusters. Transaction pattern recognition reduces false negatives.

- Transaction blocking and freezing protocols: create playbooks for handling flagged tokens — from temporary freezes to delistings — and ensure legal teams can act quickly on regulator signals.

- Comprehensive SAR processes and escalation: ensure suspicious activity gets escalated internally and reported to relevant authorities with supporting chain evidence.

- Counterparty contracts and indemnities: require token issuers to warrant compliance steps in agreements with exchanges and custodians, and where possible secure indemnities against downstream sanctions claims.

Exchanges should also evaluate whether to pause new listings or token trading for politically tied projects until EDD is complete. Custodians must reassess custody eligibility and wallet segregation policies.

Vetting political‑backed issuers: a checklist for compliance teams

A basic roadmap for vetting:

- Ownership and funding due diligence: identity and backgrounds of founders, funders and major token holders.

- Geographic risk mapping: assess links to sanctioned jurisdictions or adversarial states.

- Token distribution transparency: examine private sale terms, vesting schedules and buyer lists when available.

- On‑chain provenance analysis: trace early token flows, looking for connections to mixers or sanctioned addresses.

- Governance and legal opinion: require independent legal analysis of token classification, applicable securities and sanctions risks.

- Public disclosures and media monitoring: red‑flag projects with credible reporting of links to sanctioned actors.

Applying this checklist reduces operational surprise and strengthens the defensibility of listing and custody decisions.

Broader policy implications and industry responses

This episode highlights a broader need for clearer rules and cooperation between regulators and the crypto industry. Policymakers will likely press for: better transparency in token sales, stricter KYC for industry vendors, and clearer liability rules for intermediaries. Industry groups should push for standardized EDD templates and more robust transaction screening interoperability.

Cross‑border coordination is crucial: sanctions and AML frameworks differ, and misalignment can create safe havens for bad actors. Exchanges operating globally should harmonize policies with the strictest applicable regimes to avoid regulatory arbitrage.

Journalists and policy analysts tracking this topic should follow both the congressional inquiries and any DOJ/Treasury actions closely; media reporting will pressure market participants to tighten controls and could influence enforcement priorities.

Conclusion — key takeaways for compliance officers

WLFI’s situation demonstrates how politically tied token sales can trigger national‑security, AML and sanctions concerns that extend beyond reputational damage. Regulatory attention — exemplified by the senators’ request for DOJ and Treasury probes — raises the stakes for issuers and intermediaries alike. Compliance teams and custodians must treat political risk as a distinct axis of counterparty assessment: implement enhanced due diligence, improve on‑chain analytics, and establish rapid escalation paths for suspected sanctions exposure.

For ongoing situational awareness, track both official filings and investigative reporting (see the reporting on the congressional letter and the allegations of sanctioned buyers linked to Tornado Cash in these pieces: Bitcoinist report on the senators' letter and Cryptopolitan′s coverage of alleged buyer links).

Stay vigilant: political narratives can create pathways that adversaries exploit, and the regulatory response is likely to be swift. Tools and playbooks exist, but they must be applied proactively. Bitlet.app and other industry platforms will be watching how enforcement and guidance evolve — and compliance teams should do the same.

Further reading

For context on on‑chain risk signals and industry best practice, see regulatory guidance from OFAC and FinCEN, and consider integrating specialist blockchain analytics into your controls to reduce detection gaps.