Inside the Bithumb 620,000 BTC Mistake: How the Exchange Recovered Funds and What It Means for Custody Risk

Summary

What happened: the mistaken distribution in brief

In late 2025 Bithumb — one of South Korea’s largest exchanges — experienced an extraordinary operational error: a promotional distribution meant to credit users instead resulted in the transfer of roughly 620,000 BTC to customer wallets. Early reporting framed the scale starkly: NewsBitcoin captured the initial shock and subsequent scrambling by the exchange to reverse transfers and identify affected accounts (NewsBitcoin report).

At market prices the figure implied billions in BTC changing hands; that magnitude, even as an accident, pushed on-chain and off-chain controls to their limits. The immediate consequences were a surge in withdrawal and trading activity, market noise, and an acute test of Bithumb’s operational and legal readiness.

The sequence: from promotion to recovery

- Promotional instruction issued. According to initial accounts, an automated distribution tied to a promotional program was misconfigured and executed. That single configuration mistake was the proximate cause.

- Rapid on-chain transfers. BTC left exchange-controlled addresses for many user wallets in a short window, creating an irreversible set of transactions on the blockchain.

- Emergency halt and assessment. Bithumb moved quickly to suspend certain services, identify addresses, and trace the flows.

- Recovery maneuvers. The exchange reported that it clawed back 99.7% of the overpaid BTC and that it covered the remainder — specifically BTC that had been sold or otherwise transferred out — using company funds. Cointelegraph documents these follow-up steps and Bithumb’s public claim about reclaiming nearly all the overpayments and making good on sold coins (Cointelegraph follow-up).

Why recovery was possible (and why it wasn’t total)

Two features made recovery feasible: swift operational action and cooperation from counterparties. Where recipient wallets belonged to other centralized platforms or to customers under exchange custody, legal and contractual leverage often enabled rollbacks or negotiated returns. Where BTC had been moved out to private keys controlled by users and sold on spot markets, those coins were immediately fungible and harder to claw back — which is why Bithumb had to cover shortfalls with company capital.

The sequence highlights an uncomfortable truth: blockchain immutability magnifies operational errors. Once tokens leave custody under clear control of private keys, technical recovery is usually impossible; only legal, economic, and cooperative pathways remain.

Market context and investor sentiment during the drawdown

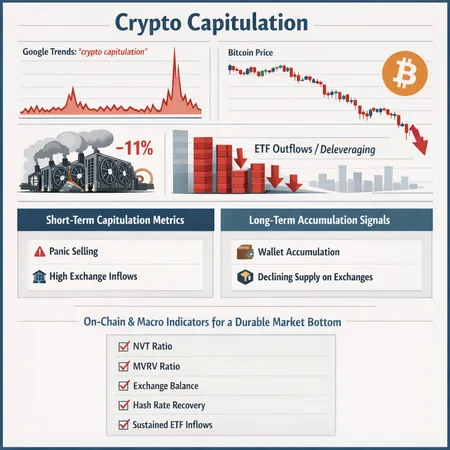

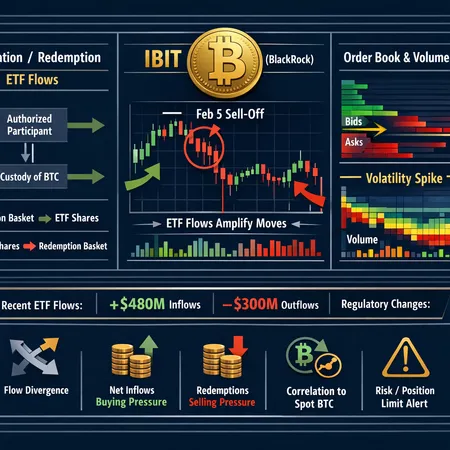

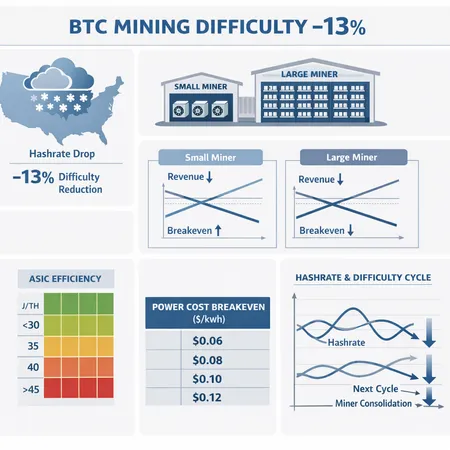

The timing of the mishap mattered. During the same period broader market sentiment was fragile — reports flagged spikes in capitulation as BTC dipped and investors sold into stress (Cryptopolitan analysis). That market backdrop amplified the reputational and liquidity pressure on Bithumb: sudden flows from an exchange can drive price impact and stress liquidity providers.

For compliance officers and allocators, the lesson is clear: operational incidents at large counterparties can intersect with market moves to create non-linear exposure. Custodial counterparty risk is not static; it is state-dependent and amplifies when markets are brittle.

How Bithumb recovered — practical steps taken

Bithumb’s public narrative describes a multi-pronged recovery effort:

- Immediate suspension of select services to prevent further outgoing flows.

- Rapid forensic tracing of on-chain movements to map which addresses received funds and where coins travelled next.

- Coordination with counterparties and other exchanges, enabling voluntary returns where the receiving party recognized the error.

- Corporate funding to cover irretrievable sold BTC, an absorb-and-compensate strategy to make customers whole even when technical reversal was impossible.

- Public communication to calm markets and explain remediation steps.

Cointelegraph’s follow-up coverage details the reclaim rate and Bithumb’s statement about covering sold coins from company coffers. That combination of on-chain tracing + commercial indemnity is how the exchange reached the 99.7% recovery claim in public disclosures.

Legal and regulatory fallout risk

This incident sits at the intersection of operational failure and legal exposure. Potential fallout vectors include:

- Consumer protection and restitution claims. Affected customers can pursue civil remedies where losses remain.

- Regulatory fines or license sanctions. Regulators in South Korea and elsewhere may investigate whether the exchange violated custody, AML/KYC, or operational resilience rules.

- Criminal liability or enforcement. Depending on statutory frameworks and whether negligence or systemic control failures are found, executives could face criminal inquiries.

- Contractual and counterparty disputes. Third-party counterparties that assisted in returning funds may negotiate fees or set off other claims.

For global institutions, the key takeaway is that counterparty risk includes legal jurisdiction and the strength of local regulatory regimes. An exchange’s ability to credibly self-fund a shortfall — as Bithumb reportedly did — matters. But so does the transparency of that funding: were corporate reserves used, insurance tapped, or credit facilities drawn down? These answers affect recovery probabilities in future incidents.

What this should change about institutional counterparty diligence

Large allocators, custodians, and compliance officers should update their playbooks. Recommended adjustments include:

- Move beyond balance-sheet checks. Ask detailed questions about operational controls: transaction approval workflows, last-mile signing controls, and promotional sandboxing.

- Demand clear incident response SLAs. What will the exchange do within minutes, hours, and days? How is communication routed?

- Verify legal enforceability. In which courts can restitution be pursued? Are there cross-border enforcement agreements?

- Model state-dependent exposure. Stress-test counterparties under market stress and high-volume flow scenarios.

- Check insurance and capital adequacy. Is the exchange able and willing to self-fund losses, or does it rely on limited insurance policies with narrow coverage?

Institutional diligence should now treat “operational resiliency” as equally important as cybersecurity hygiene or capital adequacy. Exchanges handling BTC and similar assets must show defensible, auditable custody systems.

Recommended best practices for custody and promotional controls

Below are practical controls that would have mitigated or prevented the Bithumb incident and that institutions should demand from counterparties.

Organizational and governance

- Segregation of duties (SoD). No single operator should be able to change production promotion code or execute large transfers without multiple independent approvals.

- Change management with explicit rollback plans. Promotions and scripts must run in staging first and require sign-off from operations, compliance, and legal.

Technical custody controls

- Multi-signature and distributed signing. Keep high-value holdings under multi-sig schemes or custody models requiring threshold signing across geographically and jurisdictionally diverse parties.

- Hardware Security Modules (HSMs) and strict key lifecycle management. Keys should be generated, stored, and rotated under hardened procedures.

- Hot/cold wallet segmentation and circuit breakers. Limits on maximum outbound flow per hour/day and automated braking mechanisms for anomalous spikes.

Transaction & promotion controls

- Rate and volume limits for automated payouts. Prevent scripts from issuing large atomic transfers without human review.

- Dry-run and canary deployments. Conduct small-scale, observable tests of promotional workflows in production before full rollout.

- Reconciliation automation. Continuous, automated ledger reconciliation to detect discrepancies between internal balances and on-chain state.

Incident response and remediation

- Pre-negotiated cooperation agreements. MOUs with major exchanges and compliance teams can speed voluntary returns.

- Auditable forensic capabilities. Record signing ceremonies, operator activity, and full audit trails to support legal claims.

- Liquidity contingency plans. Maintain committed lines or insurance to cover shortfalls when coins become irretrievable.

Transparency and ongoing assurance

- Third-party audits and proof-of-reserves. Regular, verifiable audits of custody practices and reserves build trust.

- Public, timely communication protocols. Clarity reduces market panic and aligns customer expectations.

Platforms such as Bitlet.app and others emphasize some of these controls in their product design; asking for evidence of implementation — not just policy statements — should be standard due diligence.

Practical checklist for counterparties and compliance teams

Before onboarding or renewing exposure to an exchange, request and document:

- Evidence of multi-sig or equivalent custody controls.

- Recent third-party operational and financial audits.

- Incident response playbooks and sample forensic reports.

- Limits, approval workflows, and canary deployment logs for promotions.

- Insurance policy terms and capital adequacy statements.

- Legal jurisdiction mapping and simple contact paths in case of emergency.

This checklist helps convert abstract “custody risk” concerns into actionable procurement and monitoring items.

Closing thoughts: why this matters now

The Bithumb incident is a vivid reminder that centralized exchanges remain single points of operational failure in a world where blockchain transactions are immutable. The exchange’s ability to reclaim 99.7% of the overpaid BTC and to use company resources to cover sold coins reduced immediate customer harm — but it should not lull market participants into complacency. Recovery required speed, cooperation, and capital; it did not eliminate the systemic risk revealed by the mistake.

For compliance officers, institutional allocators, and risk-conscious retail readers, the message is straightforward: custody risk is baked into counterparty relationships and becomes existential when markets are stressed. Insist on demonstrable controls, rehearsed incident response, and transparent governance. And remember that when an operational error meets market volatility, the costs can look very different than they do on a sunny audit day.

Sources

- NewsBitcoin — South Korea's Bithumb exchange accidentally sends 44 billion in Bitcoin to users: https://news.bitcoin.com/south-koreas-bithumb-exchange-accidentally-sends-44-billion-in-bitcoin-to-users/

- Cointelegraph — Bithumb claws back 99.7% of overpaid Bitcoin, covers remaining shortfall: https://cointelegraph.com/news/bithumb-claws-back-99-7-of-overpaid-bitcoin-covers-remaining-shortfall?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Cryptopolitan — Crypto capitulation spikes as Bitcoin dips: https://www.cryptopolitan.com/crypto-capitulation-spikes-as-bitcoin-dips/