Reading the Signals: What the Ethereum Foundation’s Five‑Year Austerity and Vitalik’s 16,384 ETH Move Mean for Developers and Investors

Summary

Executive overview

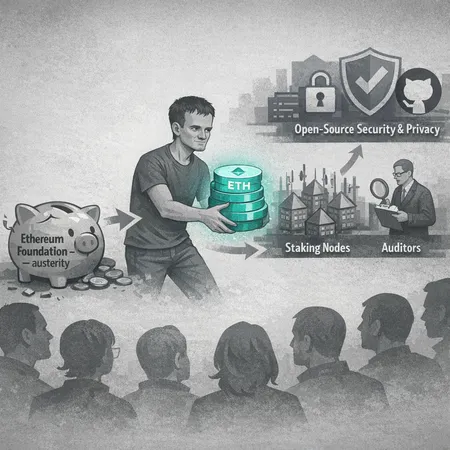

The Ethereum Foundation (EF) has announced a five‑year program of “mild austerity” for its spending priorities, and Vitalik Buterin has moved 16,384 ETH out of his long‑term holdings to fund open‑source security and privacy work. Coverage from The Block and Coinpedia reported the ETH allocation detail, while Coindesk quantified the transfer at roughly $17.3 million. Crypto press and community threads interpret these moves as a pivot from centralized grant largesse toward more targeted, high‑impact financing for public goods. This article breaks down the motivations, the practical effects on public‑good infrastructure and the pragmatic steps developers, contributors and investors should take now.

What happened — the facts and the framing

In January 2026 the EF publicly signalled it would operate with a tighter budget envelope for core grantmaking and operations over the next five years. Independent reporting framed the decision as a deliberate reorientation toward prudence in light of macro uncertainty and internal prioritization reviews. At roughly the same time, Vitalik announced a personal allocation of 16,384 ETH to fund open‑source security and privacy projects, a move covered by The Block and Coinpedia and quantified by Coindesk as ~USD 17.3M. Cryptopolitan summarized the EF’s austerity context: the Foundation wants to stretch impact across a changing ecosystem while avoiding unsustainable long‑term commitments.

The key reading: the EF is tightening institutional spending while a major individual backer is deploying capital directly to public‑goods work, especially security and privacy tooling. That combination says something important about what the community values and what it expects to pay for.

Why Vitalik moved personal funds into security and privacy projects

Vitalik’s transfer is best read as targeted philanthropy rather than an attempt to replace the EF. Several motivations are evident:

- Risk concentration and triage. With institutional budgets shrinking, high‑priority public goods (consensus client audits, validator tooling, cryptography libraries and privacy primitives) face funding gaps. A focused endowment can underwrite audits and bounties that have outsized safety returns.

- Speed and flexibility. Personal allocations avoid institutional procurement cycles and can fund small teams, independent researchers, and proof‑of‑concept privacy work quickly.

- Signalling. A high‑profile allocation directs attention to security and privacy as non‑negotiable public goods — not optional features.

Reporting on the transfer also emphasizes the optics of austerity: while the EF rebalances, individuals with capital are choosing to back the plumbing that undergirds the chain. Coverage in The Block and Coinpedia highlights that Vitalik’s move maps directly to the EF’s new priorities, and Coindesk frames it as part of a broader reaction to the foundation’s pivot.

What this means for public‑good infrastructure funding

The EF’s austerity plus Vitalik’s targeted grants changes the funding landscape in practical ways:

- Less predictable institutional funding. Teams that relied on multi‑year EF grants should expect more conservative renewals and stricter milestone enforcement. That increases execution risk for long‑horizon research and tooling.

- More competitive, mission‑driven micro‑funding. Small, high‑impact projects (audits, fuzzing, privacy libraries) become attractive candidates for personal philanthropy and venture grants because they produce measurable safety improvements quickly.

- Fragmentation risk. If funding shifts from a central foundation to many smaller donors, coordination overhead rises and duplication is possible. The community must avoid fragmented incentives across clients, libraries and tooling.

Practically: expect grant cycles to focus on critical infrastructure — consensus clients, validator node health, bridging‑safety primitives and privacy libraries — rather than softer community activities. That’s not inherently bad, but it shifts the burden to contributors and fundraisers to be more explicit about impact metrics and risk reduction.

Staking, auditing priorities and the technical fallout

Austerity does not directly change ETH staking economics — the protocol‑level issuance rules and validator rewards remain the same — but it can affect the quality and resilience of staking infrastructure.

- Client diversity and maintenance. EF grants have historically supported client teams and interop testing. Reduced funding can slow client upgrades, hurt testnets and make coordinated upgrades (like hard forks) harder to execute smoothly.

- Validator tooling and node operators. Independent validator services, telemetry, monitoring and slashing‑mitigation tooling often benefit from grant support. Less EF funding means third‑party staking services or marketplaces (including platforms like Bitlet.app that offer staking or earn services) may need to shoulder more responsibility for tooling and audits.

- Audit prioritization. The logical consequence of budget triage is that audits will be prioritized by systemic risk. Projects with smaller TVL or fringe utility may struggle to get audited unless they can demonstrate systemic exposure (bridges, L2 sequencers, MEV‑sensitive components).

For investors and institutional stakers: the risk profile of some third‑party staking products changes when the institutions that historically funded the safety layer reduce spending. That demands greater due diligence and insurance/guardrails from providers.

Governance and funding risks investors should watch

Reduced EF budgets create several governance and financial‑risk signals investors need to monitor:

- Concentration risk. When the EF pulls back, high‑impact decisions and funds may shift to a smaller set of wealthy individuals or private entities. That raises centralization risks for public‑good funding.

- Operational fragility. Delays in client updates or lower audit capacity increase the odds of exploitable bugs, which in turn increases tail risk for ETH holders.

- Reputational and coordination risk. Grant uncertainty can push projects to seek private capital, changing incentives and potentially undermining public‑good neutrality.

Investors should track grant announcements, client team funding statuses, and major audit schedules. Where possible, treat funding runway and security audit history as material due diligence on protocol‑adjacent projects.

How the community should adapt: concrete, prioritized steps

Prioritize critical infra with transparent triage. The community should agree on a short list of critical public goods (e.g., consensus client maintenance, validator tooling, cross‑chain bridge audits, cryptographic libs) and commit scarce funds to them first. Create public criteria for triage so applicants can design proposals that meet clear standards.

Diversify revenue and funding channels. Relying on a single foundation is brittle. Push for recurring‑revenue models: protocol treasuries with clear spending rules, subscription‑style grants, and corporate sponsorship for core dev sprints. Quadratic funding and Gitcoin rounds remain useful mechanisms for broad community buy‑in.

Scale audit marketplaces and bounty programs. Convert ad hoc audits into an organized marketplace with rolling bug‑bounty capital. Vitalik’s allocation demonstrates the value of concentrated, high‑impact bounties. Projects should publish realistic threat models and reserve capital for emergency audits.

Institutionalize transparency and reporting. When funding is scarcer, transparency becomes the strongest credibility signal. Grantees should publish roadmaps, burn‑rate reports and deliverable milestones.

Build cross‑fund coordination vehicles. Multi‑donor, multi‑sig endowments or stewardship DAOs can pool individual philanthropy and corporate grants, reducing fragmentation and improving grant coordination.

Invest in onboarding and compelling comms. With narrower institutional funding, attracting independent contributors matters more. Fund maintainers to do developer experience, docs and mentorship so infrastructure stays healthy even with fewer paid teams.

Practical checklist for developers, contributors and investors

- Developers: make grant proposals outcomes‑driven, succinct and show how deliverables reduce systemic risk. Include testing budgets and open audit readiness artifacts.

- Contributors: prefer projects with published roadmaps and verifiable results. Participate in community triage discussions to align priorities.

- Investors: add funding‑runway and audit history to your risk matrix. For protocol investments, model slower upgrade timelines and higher probability of emergent bugs.

Also: support platforms and networks that enable recurring community funding. Smaller recurring donations aggregated across many users can be more sustainable than intermittent large gifts.

Final thoughts: austerity as discipline, not abandonment

The EF’s five‑year mild austerity is a governance choice, not an existential retreat. In a decentralized ecosystem, institutional prudence can be healthy: it forces sharper prioritization and can stimulate diverse funding innovations. Vitalik’s transfer of 16,384 ETH is an important signal — a recognition that when institutions tighten belts, individuals and coalitions still need to bankroll the plumbing that makes the system safe.

That said, the transition period will be bumpy. The community must convert goodwill and ad hoc philanthropy into durable, transparent funding channels for critical public goods. For ecosystem actors — from client maintainers to validator operators and investors — the immediate task is simple: be explicit about value, measure impact, and collaborate on pooled solutions that reduce fragmentation.

If you’re making a grant ask or evaluating a staking provider, treat audit readiness, client funding status and funding runway as first‑order concerns. The market will adjust; the goal is to make that adjustment deliberate and resilient.

Sources

- Vitalik commits roughly 16,384 ETH to open‑source security and privacy projects (The Block)

- Why Vitalik Buterin just pulled 16,384 ETH from his holdings (Coinpedia)

- Vitalik Buterin withdraws USD17 million in ETH as Ethereum Foundation enters mild austerity (Coindesk)

- Ethereum Foundation enters period of austerity (Cryptopolitan)

For broader context on funding models and community coordination see examples from DeFi coordination efforts and historical market reactions where Bitcoin narratives influenced treasury decisions.