Can Charles Hoskinson’s Rallying Cry Stop a Liquidity-Driven ADA Slide?

Summary

Executive snapshot

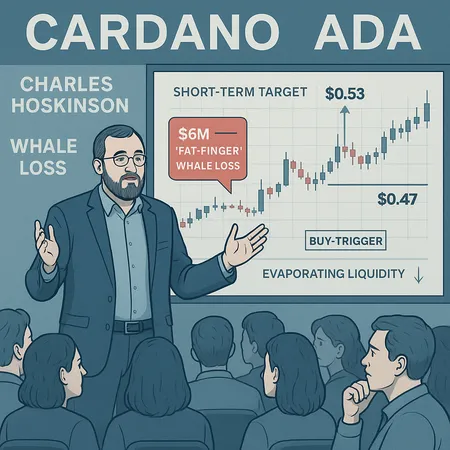

Cardano (ADA) is navigating a classic crypto stress test: public leadership trying to shore up morale even as on-chain and derivative shocks collide with thin liquidity. Charles Hoskinson’s high-profile appeals for calm and optimism have been vocal and blunt, but a recent on-chain mishap — a whale 'fat-finger' that burned roughly $6 million after hitting an illiquid pool — shows how quickly technical realities can overwhelm sentiment. Analysts are eyeing a short-term technical target of $0.53 while warning that behavior around $0.47 support will be decisive for the recovery path.

The messaging: Hoskinson’s defense and the morale play

Over the last few market days Charles Hoskinson has taken to public channels with an unusually forceful tone, urging holders not to panic-sell and framing the situation as a moment to regroup rather than capitulate. Outlets covered his call to ditch doomscrolling and aim for a so-called 'gigachad' rally, which doubled down on optimism and a community-first response to market stress. See coverage of his appeals in this piece from CoinSpeaker and a separate roundup at Bitcoinist documenting his plea to investors to "hold the line." (CoinSpeaker, Bitcoinist).

Leadership messaging like this serves several functions: it rallies retail holders, signals unity to large stakeholders, and attempts to counter negative narratives in social channels. For community managers, the immediate benefit is tactical — reduce panic-driven sell pressure, keep liquidity from worsening due to fear, and provide a coordinated set of talking points. But there are limits to what rhetoric can accomplish. Sentiment is a component of price action; it can slow a cascade but rarely stops it if liquidity and technical triggers are already in play.

The shock: a $6M whale fat-finger and illiquid pools

On-chain events can abruptly change that calculus. CoinDesk reported a recent fat-finger where a Cardano whale accidentally sold into an illiquid USD-A pool, resulting in a roughly $6 million realized loss. Errors like this do two things simultaneously: they remove meaningful liquidity from a price band and create immediate slippage that algorithms and other traders can exploit. The result is an outsized move that is mechanical, not rhetorical — sentiment matters less when an order book physically lacks depth at prevailing prices (CoinDesk report).

That event is emblematic of a broader problem: even if holders largely agree to "hold," market microstructure — concentrated limit orders, low stablecoin depth in automated market makers, and derivative funding dynamics — can still produce sharp drawdowns. For ADA, a combination of thinner liquidity pools and active derivative hedging means that a single large trade or a cascade of liquidations can dominate short-term price action.

Technical picture: buy trigger, $0.53 target and the $0.47 fulcrum

Technicians are not ignoring sentiment, but they trade levels. Several analysts have identified a buy trigger and short-term objective near $0.53, with immediate structural support around $0.47. A recent piece examining Cardano’s buy trigger argues that this bounce matters more now because it could reestablish momentum after washouts and re-price expectations for risk-on flows (AmbCrypto analysis). Meanwhile, a price-projection write-up outlines a scenario in which ADA targets $0.53 in a recovery leg while testing $0.47 as support if selling pressure persists (Blockchain.News prediction).

From a mechanics standpoint, the $0.53 level represents a short-term resistance band where failure to hold above it invites re-tests lower. The $0.47 level is the psychological and technical fulcrum: break below it with volume and on-chain outflows, and stop-loss cascades plus derivative squeezes become more likely. Conversely, a clean reclaim of $0.53 on meaningful volume would signal that buy-side liquidity has reformed and that sentiment-led rallies can attract fresh derivative longs.

Sentiment vs. liquidity: which wins when markets move fast?

This is the crux for Cardano holders and community managers. Sentiment shapes behavior, but liquidity and technical mechanics execute moves.

Sentiment can delay or reduce the severity of selling. Coordinated community action — asking long-term holders to stand down, amplifying optimistic roadmaps, reminding markets of upgrades and milestones — increases the chance that a dip will find local support. Hoskinson’s public stance is precisely the kind of leadership messaging that can soften panic among retail holders.

Liquidity, however, is blunt. If an illiquid pool or thin order book sits where dozens of stop losses line up, a single large trade or liquidation wave will produce outsized price movement. The recent $6M whale slip is a reminder that execution risk and pool depth are deterministic variables: they don’t respond to rallying speeches.

Derivatives amplify both. Perpetual funding rates, concentrated open interest, and automated deleveraging can turn sentiment-driven squeezes into mechanical liquidations. Community optimism might encourage re-entry, but if funding and OI remain skewed, volatility will be exaggerated.

In short: messaging can change the odds and timing of capitulation, but it cannot replace the need for real liquidity. When liquidity is patchy, technical realities dominate price action even if social sentiment is bullish.

What community managers and holders should watch now

Levels and volume: watch $0.53 and $0.47 closely. Confirm moves with on-chain and exchange volume — low-volume crosses of these levels are unreliable.

Pool depth and slippage: monitor liquidity in ADA/USDC and ADA/USD pools on major AMMs and DEXs. A thin pool magnifies a single whale trade into a cascade. The fat-finger incident is a case study in why depth matters.

Derivative metrics: keep an eye on open interest, funding rates, and liquidation clusters on major futures venues. Large, one-sided OI increases the chance of forced deleveraging.

Social sentiment indicators: track turnover in active wallet counts, large transfers to exchanges, and sentiment on major channels. Leadership messaging helps here — but data will tell whether sentiment is translating into buy-side behavior.

Risk rules: for funds and serious holders, consider position-sizing and staggered re-entry to avoid being slippage victims. Use limit orders where possible to control execution risk.

Communication playbook for leaders: practical moves beyond cheerleading

Be transparent about risks, not just optimistic. A message that acknowledges a recent whale error and explains how the protocol or community is responding feels more credible than pure positivity.

Help rebuild liquidity: coordinate with market makers, encourage centralized and DEX liquidity provisioning, and highlight recently deep pools. Information reduces uncertainty.

Share actionable guidance: publish the technical levels the community should watch (e.g., $0.53 and $0.47), plus the metrics — pool depth, exchange inflows — that will determine whether those levels hold.

Use credibility wisely. When a founder speaks, flows often follow. But misreading market mechanics (promising a rally that is impossible without liquidity) risks reputational damage and worsened sentiment if words fail.

Bottom line: messaging matters — until mechanics don’t

Charles Hoskinson’s public defense of Cardano and his calls for optimism are valuable. They can slow panic, coordinate holders, and buy time for liquidity to rebuild. But the $6M whale fat-finger incident is a sober reminder that microstructure and derivatives are often the proximate causes of sudden drawdowns. Short-term traders and community managers should treat messaging as one lever among several: helpful, but not sufficient.

Technical traders will watch the $0.53 target and test $0.47 support as decision points. If buy-side liquidity reappears and derivatives positioning normalizes, sentiment-led recoveries can gain traction; if not, the market will respond to the immutable math of order books and AMM pools.

For holders and community stewards looking to act now: monitor liquidity, confirm moves with volume, and keep communications honest and data-driven. Platforms like Bitlet.app that integrate various tools for on-chain monitoring and P2P flows can help users manage execution and settlement risk during volatile stretches — but ultimately, liquidity and technical triggers will dictate ADA’s immediate path.

Further reading

For background on the public messaging, see coverage of Hoskinson’s comments at CoinSpeaker and Bitcoinist. For the whale incident and its implications, CoinDesk’s report on the fat-finger loss is instructive: CoinDesk. Technical analysis and buy-trigger discussion can be explored at AmbCrypto and Blockchain.News.

For many traders, Cardano remains a core narrative play — but in the short term, liquidity and market mechanics will often have the last word.