Why Privacy Coins Outperformed in the Slump — Defensive Rotation or Structural Rerate?

Summary

Executive overview

When the macro backdrop turned cautious and risk assets sold off, privacy coins — led by XMR, DASH, DUSK and ZEC — delivered an unusual relative strength versus the larger market. That outperformance looks like a mix of defensive rotation, regulatory flow dynamics, and idiosyncratic narratives rather than a single structural re‑rating across the category. For portfolio managers and altcoin traders, the critical job is to separate durable demand signals from episodic momentum and to size positions where upside is meaningful but tail risk is limited.

On‑chain and macro drivers of demand for privacy

Two categories of drivers explain why capital flowed into privacy coins during the slump: macro/regulatory and protocol‑level on‑chain signals.

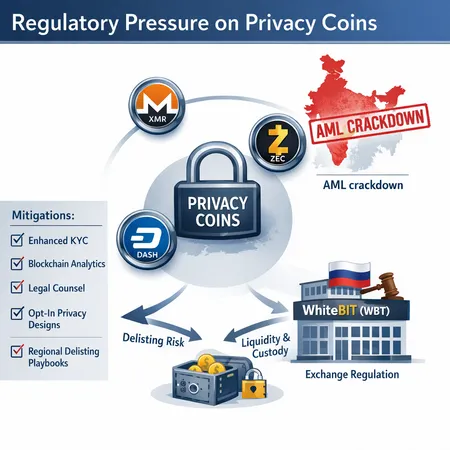

Macro and regulatory: As macro uncertainty and talks of stricter on‑chain surveillance or AML enforcement rose, a subset of traders rotated into privacy assets as a defensive hedge against surveillance, censorship risk, and exchange counterparty exposure. In risk‑off markets investors often shift from highly correlated beta plays toward assets they perceive as less transparent or differently correlated to on‑chain monitoring.

On‑chain behavior: Even though privacy coins by definition resist easy on‑chain tracing, observable metrics still matter — increases in peer activity, rising fee capture on networks, and concentrated flows through OTC desks or privacy‑supporting DEX rails create a narrative that demand is increasing. Media coverage that highlights that relative strength reinforces FOMO and liquidity chasing; for a recent write‑up on how privacy coins defied the broader slump, see the reporting by Decrypt which documents the category’s surprising resilience reporting on privacy coins.

For many traders, Bitcoin remains the primary market bellwether, but in this cycle the privacy cohort decoupled enough to look like a short‑term defensive pocket rather than just another altcoin beta play.

The Dusk Network surge: momentum, narratives, and overbought risk

DUSK became the poster child for the rally, putting a spotlight on how small‑cap privacy projects can amplify returns during a liquidity rotation. Analysts highlighted the magnitude of the move — a 500%+ spike in price that drew technical buyers and retail momentum flows — but also warned about classic overbought dynamics and crash risk. FXEmpire’s analysis of the Dusk run captures both the upside narrative and the downside deja vu of rapid pumps followed by sharp reversals FXEmpire on Dusk surge and crash risks.

What to watch on DUSK specifically:

- Liquidity traps: sudden depth evaporation on bids during stop‑runs.

- Concentration: large holdings in a few wallets can mean single‑entity sell pressure can unwind the rally fast.

- Narrative decay: once media attention and momentum traders rotate out, fundamentals (usage, real privacy utility, developer activity) must support higher valuations — and for many newer privacy projects that support is still thin.

The DUSK episode therefore exemplifies a broader point: outsized returns in the privacy space often start as momentum/defensive flows and later require substantiation through sustained on‑chain activity or governance progress to be durable.

Zcash governance: why governance friction can both help and hinder rotation

ZEC sits in an interesting position. It is technically mature and has one of the better known brands in privacy, but its governance and funding debates create both a reason for inflows and a reason for caution. Governance friction — disputes over developer funding, the pace of adoption for shielded addresses, and how to decentralize upgrades — can push capital into ZEC as a store of privacy‑value while simultaneously encouraging traders to favor other privacy exposures if they perceive governance risk as an execution drag.

Put simply: governance debates can be a catalyst for rotation into privacy assets (investors preferring decentralized, privacy‑aligned projects) but can also be a reason to rotate away if on‑chain coordination or funding appears unstable. That dynamic helps explain why some portfolios reallocated toward XMR or smaller privacy projects rather than concentrating exclusively in ZEC.

Is this defensive rotation or a structural re‑rating?

Three tests help decide whether this is a temporary rotation or a longer re‑rating:

- Sustained on‑chain activity: Do unique addresses, transaction counts, and fee capture remain elevated after the initial rally? Privacy coins don’t expose all metrics, but proxies like daemon activity, node counts, and reported OTC volumes can be informative.

- Institutional acceptance: Are custodians, regulated desks, and OTC liquidity providers expanding support? Limited custody options cap structural re‑rating potential.

- Regulatory clarity: Are authorities signaling tolerance or tightening enforcement? A string of restrictions or delistings would likely truncate a lasting re‑rating.

At present the balance suggests a dominant defensive rotation with selective structural upgrades. Projects that secure institutional plumbing (liquid, compliant custody, real privacy utility and clear governance) have the best shot at a re‑rating; others will likely see episodic pumps and collapses.

Tactical implications for portfolio managers and traders

Below are practical guidelines tailored for allocators and active traders assessing privacy exposure. These are analytical recommendations, not investment advice.

Position sizing and risk allocation

- Treat privacy coins as a tactical sleeve: start with small allocations (commonly 0.5–5% of crypto risk capital depending on mandates and risk appetite). Scale up only when on‑chain/activity metrics and custody pathways improve.

- Use stop rules and time‑based exits for momentum plays like DUSK — rapid pumps often demand rapid de‑risking.

Custody and access

- Custody is a live constraint. Many custodians still limit or refuse privacy coin custody; self‑custody (hardware wallets, full nodes) is common for XMR and DASH but carries operational risk and compliance obligations.

- For funds that require institutional custody, proactively map which custodians support each ticker (XMR, DASH, DUSK, ZEC) and build vetted OTC counterparties. Platforms like Bitlet.app and other liquidity monitoring tools can help track flows and execution quality in niche markets.

Regulatory and compliance planning

- Model adverse regulatory scenarios: forced delistings, travel‑rule friction, and AML directives. For each scenario define clear playbooks — whether that means hedging, accelerating liquidation, or moving into custody‑friendly overlays.

- Maintain audit trails for KYC/AML where possible when transacting through custodians and OTC desks; this reduces the chance of stuck assets or enforced freezes.

Trade structures and implementation

- For speculative entry into overbought names (e.g., a DUSK‑style pump), consider smaller initial buys with staggered add points and protective options if liquid options markets exist.

- Use liquidity‑aware sizing: scale into coins based on realized depth rather than just dollar conviction.

Execution checklist before adding privacy exposure

- Confirm custody path and withdrawal simulations.

- Validate counterparty KYC/AML policies for incoming/outgoing flows.

- Stress test position under delisting, concentration sell, and exchange freeze scenarios.

- Document exit triggers and time horizons for tactical allocations.

Conclusion

The recent outperformance of privacy coins looks primarily like a defensive rotation fueled by macro uncertainty, regulatory narratives, and episodic momentum — with notable exceptions where governance clarity and real usage support a longer re‑rating. DUSK’s move is a cautionary example of how fast gains can amplify both interest and risk, while Zcash’s governance debates show how on‑chain politics can cut both ways for allocators. For portfolio managers and traders the right posture is disciplined exposure: small tactical allocations, custody and compliance-first execution, and active monitoring of the three structural tests (on‑chain durability, custody expansion, and regulatory clarity).

Sources

- Decrypt — Privacy coins defy crypto market slump: https://decrypt.co/354993/privacy-coins-monero-dash-and-dusk-defy-crypto-market-slump

- FXEmpire — Dusk price forecast and crash risk analysis: https://www.fxempire.com/forecasts/article/dusk-price-forecast-zec-rivals-545-pump-carries-major-crash-risks-1573510