Why Institutional Demand Just Flipped Daily Mined Bitcoin Supply — What It Means for Liquidity, Custody and Price Discovery

Summary

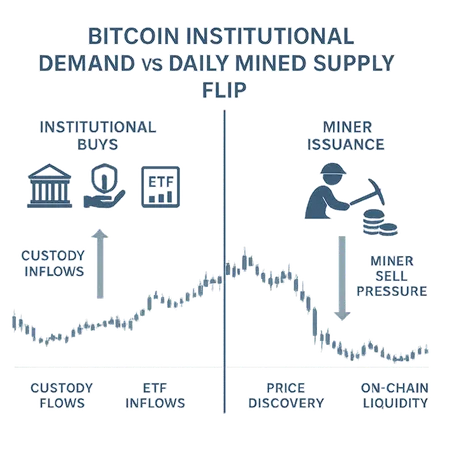

The signal: institutional buys flip daily mined BTC supply

A recent on-chain read—first covered in Cointelegraph—shows that institutional purchases have outpaced daily mined Bitcoin supply for the first time since early November. Put plainly: institutions are buying as many coins each day as miners are creating, and for a short window that makes net new supply effectively neutral or even negative after accounting for other sell-side flows. You can think of this as demand swallowing the tap of freshly mined BTC, a milestone with outsized implications for liquidity and price discovery.

This is not just a headline. When institutional demand consistently exceeds miner issuance, the market’s readily available spot float shrinks. That matters because price discovery in BTC hinges on the balance between buyers who want custody and sellers who liquidate on exchanges. With institutions increasingly taking coins off-market into cold custody, the on-exchange pool that underwrites intraday price moves becomes thinner.

Why this flip is happening: quiet bank and custodian activation

Two structural trends are colliding.

First, large financial intermediaries are moving from denial to discreet execution. Reporting from CryptoSlate shows that a large share of top U.S. banks are quietly activating Bitcoin strategies that they didn’t publicly embrace for years. This institutional backfill can happen through a few channels: direct purchases for balance-sheet or treasury exposure, allocations to crypto funds, or facilitating client buys via custody solutions.

Second, custodians and ETF vehicles are maturing. Institutional buyers prefer segregated custody, regulated custodians and familiar asset wrappers. As these offerings scale, the friction and custody risk that once discouraged big allocators shrink. The result is more predictable, larger block buys that are routed off-exchange and into custody, rather than being left to circulate on spot exchanges.

For many traders, Bitcoin remains the primary market bellwether; but behind the scenes, traditional bank channels and regulated custodians are creating a steady demand corridor that is less visible in public order books.

What the flip means for on-chain liquidity and exchange balances

When institutions pull coins into custody, exchange reserves decline. That is a simple but powerful mechanical effect.

Lower exchange balances make it easier for a given buy to move the price — there’s less depth to absorb large orders. Historically, when exchange reserves fall materially the market becomes more prone to rapid rallies and steeper corrections, because the buyer–seller matching happens across thinner order books. The institutional buy > miner supply dynamic accelerates this thinning since fresh miner issuance is a predictable buffer that normally replenishes spot liquidity.

Watch these metrics daily:

- Exchange reserves (total BTC held on centralized exchanges) — sustained drawdowns correlate with liquidity tightening. A fast, multi-week drop in reserves often precedes sharp price moves.

- Net miner flows — the pace at which miners move coins to exchanges versus into OTC channels. If miners increase sell pressure to cover operational costs while exchange reserves are falling, expect short-term tug-of-war dynamics.

- Custody inflows reported by custodians and ETF NAV creations — large custodial inflows signal coins are being removed from immediate circulating supply.

Custody flows, ETFs and corporate treasuries: new plumbing for demand

Custody flows are the plumbing that converts institutional intent into offline ownership. ETFs (and ETF-like vehicles) and corporate treasury buys create predictable, recurring demand that often avoids exchange order books. The Benzinga report on a Vivek Ramaswamy–backed treasury purchase shows how public corporate buys and insider signals can amplify institutional interest in tradable vehicles, translating into secondary market price effects.

ETF inflows in particular matter for two reasons:

- They create a structural bid: authorized participants (APs) will source spot BTC to create ETF shares, removing coins from the market.

- They concentrate ownership in regulated custodial environments, which reduces short-term liquidity and can insulate long-term holders from rapid selling.

The net effect: increases in ETF and treasury demand can accelerate the mined-supply flip and sustain periods where new issuance is absorbed by long-term holders rather than rotating through exchanges.

Miners: sell pressure, economics and behavioral shifts

Miners remain a core source of daily BTC supply. Their decision to sell — to cover capex, electricity, payroll and debt servicing — is driven by economics. But miners are also strategic: they can choose to hold, sell OTC, or use derivatives to hedge.

When institutional demand soaks up miner issuance, miners face a simple choice: sell into thinner markets (potentially moving fair value) or route more coins into OTC desks and custody partners. The latter reduces visible exchange supply but doesn’t eliminate selling — it just hides it from on-exchange depth metrics. Traders should therefore monitor both:

- Miner exchange flows (on-chain movements from known miner addresses to exchanges)

- Miner balance on-chain — are miners accumulating or drawing down reserves?

If miners increasingly sell OTC into custody-recipient flows (e.g., to APs or custodians), that still transfers coins to long-term holders and keeps public order books relatively light.

Short-term price discovery: why expiries and liquidity overlays matter

Price discovery becomes more fragile when the on-exchange float is low. Derivatives expiries and stock/options contract expiries can temporarily distort liquidity and amplify moves. Decrypt noted that options and stock/options expiries can coincide with concentrated flows on a Friday — those windows sometimes cause short-term squeezes because hedging flows and delta adjustments interact with thin spot liquidity.

Key interactions to watch:

- Options expiries: large expiries can force dealers to hedge, creating directional buys or sells in the spot market.

- Futures basis & funding rates: persistently negative basis or high funding reflects shorts/leverage imbalance which can unwind violently when spot liquidity is thin.

- Open interest around key strikes: concentrated OI near current price is a potential source of gamma squeezes.

When institutional inflows remove float at the same time dealers are hedging option exposures, price moves can accelerate beyond what fundamentals alone would suggest.

Practical signs institutional allocators and advanced traders should watch

This is the actionable checklist I would use if managing allocation or trading tactical directional exposure:

- Exchange Reserves Trend

- Watch for sustained weekly declines in BTC held on major exchanges. A rapid, multi-week drop signals tighter on-chain liquidity.

- Custody and ETF Creations

- Monitor daily reports from major custodians and ETF NAV creations/redemptions. Large net creations indicate institutional coins are being removed from circulation.

- Miner Outflows and Balances

- Track known miner-address flows to exchanges and OTC venues. A spike in miner-to-exchange flows increases short-term sell pressure; steady miner-to-custody flows indicate more coins moving into long-term hands.

- Derivatives Signals

- Funding rates, futures basis and open interest concentration at strikes. Sudden dealer hedging needs around options expiries can compound liquidity shocks.

- Block & OTC Trade Reports

- Keep an eye on reported block trades and OTC desks’ color. Large OTC purchases often presage longer-term custodial holdings.

- On-chain Concentration Metrics

- Growth in coins held by long-term wallets and institutional addresses reduces effective circulating supply.

A practical rule: if ETF inflows plus identified custody purchases exceed miner daily issuance on a sustained basis, be prepared for lower-than-normal intraday liquidity and bigger price moves on news or derivatives events.

Risk considerations and nuance

This flip is important but not determinative. A few caveats:

- Time window matters: a one- or two-day flip is different from a sustained, multi-week regime change. Confirm persistence before shifting large, long-term allocations.

- Hidden selling: miners and OTC sellers can transfer coins into custodial or OTC hands without hitting exchanges, so on-chain exchange balances are an imperfect proxy.

- Liquidity can return fast: sharp price moves often invite market makers and derivatives desks to provide depth; temporary squeezes can reverse quickly.

Institutional demand reduces readily available float, but it also raises the cost of aggressive leverage and can increase correlation across risk assets when macro events force simultaneous portfolio rebalancing.

Tactical takeaways

For allocators: consider how a structurally thinner on-exchange market changes execution and risk. Use limit-orders, staggered buys and prefer working with custodial APs to avoid slippage. If you’re building a multi-week or multi-month allocation, prioritize custody and execution partners that can transparently report inflows.

For traders: expect higher short-term volatility around expiries and key liquidity windows. Tighten risk controls and size positions relative to the observed exchange depth. Watch funding rates and dealer flows — they’ll often be the first sign of a reflexive move.

For researchers and analysts: combine traditional on-chain metrics with institutional color — custodian reports, AP creation data, and bank custody program disclosures — to get a fuller picture. Services such as exchange reserve trackers and miner flow dashboards are critical, but pair them with off-chain reporting and regulatory filings.

Bitlet.app users and other market participants should factor custody flows into execution planning — both as an alpha signal and a practical constraint on liquidity.

Conclusion

The recent crossover where institutional buys briefly exceeded daily mined BTC supply is a meaningful supply-demand signal. When sustained, it tightens on-chain liquidity, moves coins off-exchange into custody, and makes price discovery more sensitive to derivative hedging and expiries. That combination increases the potential for sharper, shorter-lived moves — both up and down — and changes how allocators and traders should think about execution and risk.

Watch exchange reserves, custody inflows, miner flows, and derivatives expiries closely. If ETF creations and corporate treasury purchases keep pace with or exceed miner issuance, expect an environment where relatively modest flows can produce outsized price moves. The market is shifting from a public, exchange-centric supply pool toward a custody-driven regime; that’s a structural change worth monitoring every day.