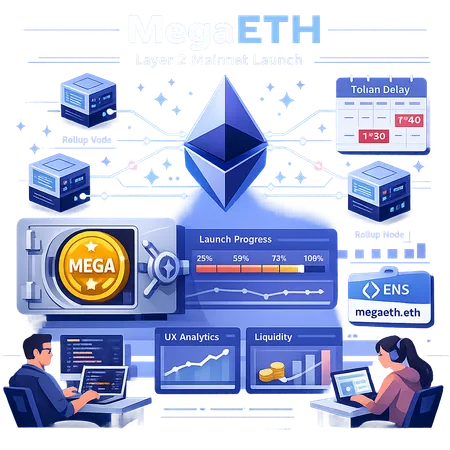

MegaETH Mainnet: What the launch delivers, why MEGA is delayed, and what it means for Layer 2 adoption

Summary

What MegaETH’s mainnet launch actually delivers

MegaETH has gone live with a mainnet that, by the team’s own framing, prioritizes product readiness over token distribution. The announcement describes a working Layer 2 environment with developer RPCs, a sequencer accepting transactions, and bridging infrastructure for moving assets between Ethereum and the new network — the kinds of primitives builders need to start integrating and stress-testing real apps. The project intentionally delayed the MEGA token distribution until clearly defined milestones are reached, a decision explicitly explained in the launch coverage (see the official write-up on the MegaETH mainnet launch).

In practical terms this means: the network is usable for experimentation and early integrations; smart contracts can be deployed; and users can transact with lower fees than L1 (depending on the L2’s design choices). What it does not give you yet is a native token-driven liquidity layer or token incentives to bootstrap validators and liquidity providers immediately. That gap is central to how adoption will actually play out over the coming months.

Why the team is delaying the MEGA token — reasoning and signals

The public rationale for deferring MEGA distribution centers on milestone-based governance: the team wants core features, audits and stability checks completed before marketing a token that could drive speculative inflows. This approach mirrors a product-first philosophy — ship a usable network, then layer on financial incentives once the tech proves itself in production (the announcement explains the timing and rationale in more detail).

There are several signals behind this move:

- Security-first posture: delaying token issuance reduces immediate economic attack vectors linked to token incentives (e.g., flash-loans or governance-capture risks tied to an early distribution).

- Regulatory and reputational conservatism: token launches attract regulatory scrutiny and trader attention; more runway to show compliance and security can reduce downstream friction.

- Product maturity: tokens often draw speculative liquidity that obscures whether users actually like the product. A tokenless launch emphasizes organic, usage-driven validation.

All of that sounds sensible — but it’s a trade-off, not a free lunch. Immediate token distribution is one of the fastest ways to bootstrap TVL, create liquidity pools, and incentivize ecosystem partners. Postponing that lever slows some growth vectors even as it de-risks others.

Technical trade-offs: rollup types, security assumptions and where MegaETH might fit

A core technical question for any Layer 2 is what kind of rollup (or alternative) is being used, because that choice determines latency, finality, and trust assumptions. Even if a project doesn’t broadcast its design decisions loudly, understanding the trade-offs lets builders make reasoned decisions.

Optimistic rollups: rely on fraud proofs and a challenge window. They can be easier to implement for EVM-equivalence and often have lower prover costs up front, but withdrawals can take longer because of challenge periods and the security model depends on economically rational challengers.

zk-rollups (zkEVMs): offer near-instant finality from a user perspective once proofs are verified on L1; they provide strong cryptographic guarantees but historically have been more complex to build (prover costs, compatibility trade-offs) and sometimes sacrifice perfect EVM compatibility.

Data availability choices: some rollups post calldata on Ethereum L1 (maximizing L1 security but increasing cost), while others explore alternative DA layers or modular designs that compress or anchor data differently. Each DA approach changes the long-term security and cost profile.

Sequencer and censorship risk: most rollups use a centralized sequencer initially for throughput and UX; the degree of decentralization and dispute mechanisms determines censorship resistance and the real-world trust model.

For adopters evaluating MegaETH, the important technical questions are: which rollup flavor does the chain use, how are proofs/challenges handled, where is data posted, and what guarantees does the team offer about sequencer availability and exit finality. These aspects directly influence developer integration complexity and the risk model for funds held on the network.

Another useful contrast is why some projects choose to stay on L1. ENS, for example, recently announced plans to deploy ENSv2 exclusively on Ethereum L1 and halted an L2 namechain route — a reminder that for projects with high security or composability requirements, L1 remains the default safe choice. The ENS case highlights how some protocols prefer L1’s settled security assumptions over L2s’ evolving trade-offs (see the ENS deployment explanation).

Short-term UX and liquidity implications for users and builders

With no MEGA token yet in circulation, the immediate user experience will be product-driven rather than token-driven. That has concrete effects:

- Liquidity and trading: Without a native token to seed pools, DEX liquidity and token-based yield opportunities are limited. Builders should expect thinner on-chain liquidity for native assets, and third-party market makers may be slower to commit capital.

- Onboarding friction: Bridges are the critical path. The safety, UX and throughput of MegaETH’s bridge will determine whether users move funds in meaningful volume. Poor UX or long finality windows will stifle adoption even if fees are attractive.

- Composability: Many DeFi flows assume token-incentivized pools. Absent MEGA, some integrations (e.g., liquidity mining, staking-based modules) can be postponed or must be rethought using external tokens (bridged ETH, stablecoins).

- Developer tooling and wallets: Even without a token, solid RPC endpoints, block explorers, and wallet integrations enable developers to test and roll out features. Builders should integrate early to discover edge cases and bottlenecks.

In short: UX can be excellent (low fees, fast throughput) even without a token, but liquidity-driven network effects will take longer to materialize.

Tokenless rollout: how it helps — and how it can hurt network effects

Benefits

- Focused product feedback: Developers and early users evaluate the chain based on UX and technical merit, not speculative yields.

- Reduced immediate attack surface: No token means fewer direct financial incentives for manipulative attacks tied to a newly minted asset.

- Time for audits and governance design: The team can refine tokenomics, anti-sybil distribution strategies, and governance mechanisms without the pressure of a live market.

Drawbacks

- Slower TVL growth: Tokens catalyze liquidity. Without MEGA distribution, yield farms and incentivized pools that attract capital are scarce.

- Harder to recruit builders: Many teams chase token grants and liquidity-mining budgets; those accelerants are missing.

- Marketing momentum: Tokens create headlines and liquidity events that drive short-term user acquisition. A tokenless launch is quieter by design.

For network effects, the absence of a token turns the growth model inward — rely on developer adoption, robust UX, and partnerships rather than token-market dynamics. That can produce a healthier foundation, but it typically requires more time and deliberate ecosystem programs to reach critical mass.

Competitive positioning: existing L2s vs L1-first projects

Where MegaETH can compete

- If MegaETH delivers a very low-cost, developer-friendly environment with robust bridging and predictable finality, it can attract builders seeking cheaper transaction rails for NFTs, gaming, or high-frequency dApps.

- A product-first, audited roll-out will appeal to protocols concerned about security reputational risk; some teams prefer a stable L2 partner to a noisy token-led ecosystem.

Where challengers remain stronger

- Established L2s like Arbitrum, Optimism, and mature zk-rollups already have liquidity, bridge integrations, and large developer communities. They’ve also monetized network effects via tokens or incentive programs.

- Projects that decided to remain on L1 (ENS is a direct example) avoid L2-specific trade-offs entirely and benefit from maximum composability with the rest of the Ethereum ecosystem.

MegaETH’s strategic window: carve out a niche where product reliability and predictable developer experience matter more than immediate token incentives — but do it quickly. A long hiatus without clear progress could let incumbents lock in more market share.

Practical guidance for builders, investors and product managers

Builders: Start integration and smoke tests now. Evaluate RPC latency, bridge UX, reorg behavior, and exit finality. Use a feature flag approach: keep your app L1-first with optional L2 routing so you can switch based on user demand and liquidity.

Investors: Treat MEGA as a conditional future asset. The token delay is a risk mitigant, but it also stretches the time before liquidity and yields appear. Monitor on-chain metrics: active addresses, transaction volume, bridge throughput, and smart contract deployments.

Product managers: Think about user journeys without token incentives. How will you motivate users to migrate? Can you offer fiat onramps, UX improvements, or off-chain incentives (e.g., loyalty credits) until native incentives appear? Consider partnering early with bridge providers and wallet teams.

Also keep an eye on interoperability — projects that choose L1 exclusively (like ENS) can signal when strict security and composability requirements will keep demand on L1 rather than an L2.

Finally, integrate ecosystem tooling like analytics and monitoring early. Platforms such as Bitlet.app that provide payments and onboarding rails can help reduce friction for user-facing features without relying on token mechanics.

Conclusion — is MegaETH worth integrating or monitoring now?

Yes — but with tempered expectations. MegaETH’s mainnet gives builders a real environment to evaluate UX, latency, and tooling. The token delay reduces speculative noise and can be a positive sign of a security-minded team. However, it also postpones a major lever for liquidity and ecosystem growth.

For developers and product teams, the immediate win is technical validation: test contracts, validate bridge safety, and assess user flows. For investors and product managers, MEGA’s absence means you should prioritize usage metrics over token hype and be prepared for a longer runway to liquidity-driven growth. In a crowded L2 landscape, the ultimate determinant will be whether MegaETH can convert product quality and security credibility into sustained developer adoption once token incentives are introduced.

Sources

- MegaETH mainnet launch: what to expect — Coingape

- ENS to deploy ENSv2 exclusively on Ethereum — Bitcoin.com

For context on Layer 2 trade-offs and ongoing L2 adoption trends, see broader coverage on Ethereum and how liquidity and composability influence DeFi integrations.