Tokenized ETFs and Real‑World Primitives: What Archax/Hedera and CyberCharge–Aster Reveal About On‑Chain Execution

Summary

Introduction: why these two experiments matter

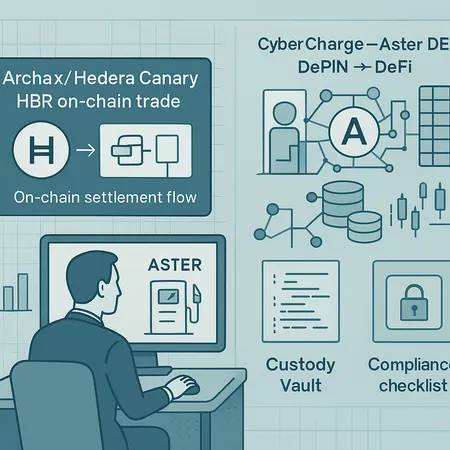

Tokenized financial products are no longer thought experiments. Two concrete developments from 2024 — Archax executing the first on‑chain trade of a tokenised Canary HBR ETF on Hedera, and the CyberCharge–Aster DEX alliance to merge DePIN rewards with decentralized trading — signal an important shift. These are not just tech demos: they show how tokenized ETF mechanics and real‑world asset primitives like DePIN (decentralized physical infrastructure networks) are being bridged into tradable, on‑chain markets.

For institutional product builders and Web3 asset managers, these cases highlight practical design choices: ledger selection, custody, regulatory posture, liquidity provisioning, and how to model off‑chain economic rights on‑chain. Platforms like Bitlet.app are already watching these developments as they reshape how on‑chain exposure maps to real world value.

1) Mechanics of tokenised ETF execution on Hedera

How an on‑chain ETF trade was executed

Archax’s trade — the first on‑chain trade of the tokenised Canary HBR ETF on Hedera — illustrates a clean path from ETF economic exposure to on‑chain tradability. In practice, tokenized ETF execution requires three coordinated pillars: the token representation of fund shares, a settlement rail that supports atomic or near‑atomic transfers, and trusted post‑trade processes for custody and reconciliation.

On Hedera, the technical stack used Hedera’s consensus service and native token standard to represent ETF shares tied to the Canary HBR product. Archax acted as an institutional marketplace, matching buy and sell orders and facilitating the on‑chain transfer of tokenized shares. The trade demonstrated that a regulated marketplace could use a fast, low‑fee ledger like Hedera (and its native HBAR token for gas/settlement primitives) to move ETF exposure on chain while preserving market integrity. The trade is discussed in detail in the reporting on Archax and Hedera’s execution here.

Why the Archax on‑chain trade matters

There are a few practical takeaways for builders:

- Settlement finality and speed: Hedera’s consensus algorithm reduces settlement latency and lowers counterparty risk versus multi‑step off‑chain settlements. Faster finality lets issuers rethink netting and intraday liquidity requirements.

- Institutional rails can coexist with on‑chain execution: A regulated broker‑dealer (Archax) handled matching and pre‑trade controls while the ledger recorded final ownership — a hybrid model that appeals to compliance teams.

- Token standards and provenance: Tokenized ETF shares must embed claim logic (entitlement to NAV, redemption mechanics) and audit trails, which smart contract patterns on Hedera can provide.

Taken together, the trade is a concrete proof point: on‑chain ETF execution is operationally feasible when traditional market infrastructure and blockchain rails are integrated carefully. For more context on Hedera as a ledger choice, see discussions of Hedera in ecosystem writeups.

2) Merging DePIN rewards with decentralized trading: CyberCharge and Aster DEX

The DePIN→DeFi bridge: mechanics and incentives

DePIN projects tokenize rights and rewards tied to physical infrastructure — for example, EV‑charging credits, bandwidth, or sensor data. CyberCharge’s partnership with Aster DEX aims to convert charging rewards (a real‑world incentive stream) into tradable tokens that plug directly into decentralized order books and liquidity pools. The alliance was announced and summarized in the press note about CyberCharge and Aster DEX forming an alliance to merge DePIN and DeFi here.

Mechanically, the flow looks like this: physical infrastructure operators earn reward tokens from DePIN protocols when users interact with hardware (e.g., charge an EV). Those reward tokens are minted to represent a claim on future rewards or immediate utility. Aster DEX lists these tokens, allowing market makers and traders to provide liquidity, hedge exposure, or create derivative products. Critical pieces include oracles that validate physical events, tokenized vesting and reward schedules, and mechanisms to prevent double‑counting of on‑chain claims.

Why tokenizing DePIN rewards matters for markets

Two immediate benefits for institutional builders:

- New primitive for yield and hedging: DePIN tokens transform infrastructure usage into predictable cash‑flow‑like streams that can be securitized or bundled into index‑style tokenized ETFs.

- Native liquidity for physical infrastructure: By listing DePIN rewards on decentralized venues like Aster, projects gain continuous price discovery and open the path for structured products, lending against tokenized future flows, and on‑chain derivatives.

Mentioning ASTER as the protocol token for Aster DEX helps market participants align incentives (liquidity mining, governance) and create deeper pools. Critics will note oracle and operational risk — more on that below — but the core innovation is converting real‑world activity into portfolioable on‑chain instruments.

3) Regulatory and custody considerations for tokenised institutional products

Legal classification and securities risk

Tokenized ETFs and DePIN reward tokens sit at a regulatory crossroad. An ETF token that represents an interest in a regulated fund may be treated under securities laws, requiring registered issuers, prospectus obligations, and KYC/AML at distribution points. That’s why Archax’s hybrid model — regulated matching with on‑chain settlement — is instructive: it preserves regulated intermediaries’ controls while leveraging blockchain benefits.

For DePIN tokens, classification is nuanced. A utility token for paying charging fees differs legally from a tokenized claim on revenue. Product designers must map economic rights to regulatory regimes and design primary issuance to comply with jurisdictional rules.

Custody, segregation, and insured safekeeping

Institutional buyers expect custody models that mirror traditional holdings: segregated accounts, insured cold storage, and clear auditing. Tokenized ETFs increase the need for custody providers that can:

- Hold tokenized shares and underlying cash/securities when redemption mechanics require off‑chain settlement.

- Provide proof of reserve and on‑chain reconciliation between token supply and off‑chain assets.

- Support governance actions, redemptions, and corporate events tied to the underlying fund.

Specialized custodians — or licensed trust banks building token custody — will be preferred over retail custodians for institutional flows. Custody design must also address smart contract risk: can the custodian pause transfers to comply with court orders or sanctions? These operational controls are non‑negotiable for many institutional counterparties.

Oracles, auditability, and operational integrity

The bridge between physical events and token issuance runs through oracles. For both tokenized ETFs (NAV feeds, corporate actions) and DePIN rewards (charging event verification), oracle integrity is essential. Institutions will demand multi‑party attestations, attestation services, and redundancy to avoid single points of failure. Regular audits and transparent attestations of token backing will be required to build trust.

4) What these moves reveal about the future of tradable, on‑chain real‑world exposure

Gradual institutionalization, not overnight replacement

The Archax/Hedera trade and CyberCharge–Aster alliance show a pragmatic path: hybrid systems where regulated entities manage pre‑trade controls and compliance while blockchain rails handle settlement, transparency, and composability. Expect tokenized ETFs and DePIN tokens to be adopted first in regulated corridors with clear custodian and legal frameworks.

Composition of future portfolios

In five years we’re likely to see hybrid portfolios that mix native crypto tokens, tokenized ETFs representing baskets of traditional assets, and DePIN‑derived income streams. These instruments will be composable: tokenized ETFs could include tranches of DePIN revenue tokens, while DeFi primitives can underwrite short‑term liquidity for institutional market makers.

Key technical and market enablers

Several enablers will determine velocity of adoption:

- Reliable, low‑cost ledgers (e.g., Hedera’s low fees and finality) for institutional settlement legs.

- Interoperable token standards that encode entitlement logic and legal metadata.

- Custodians and broker‑dealers willing to integrate on‑chain flows into existing post‑trade chains.

- Robust oracles and attestation networks to connect physical events to token minting and redemption.

Practical checklist for product builders

If you’re evaluating on‑chain execution for tokenized financial products, start with this checklist:

- Define the economic claim clearly: dividend, NAV entitlement, revenue stream, or utility.

- Choose ledger and token standard that support finality, governance, and audit trails (Hedera is one option to evaluate for low‑latency settlement).

- Design custody and segregation upfront; involve licensed custodians early.

- Build or integrate redundant oracles and attestation services for real‑world events.

- Model regulatory pathways — prospectus requirements, exemptions, and KYC/AML workflows.

- Pilot with a regulated broker/matching engine to balance compliance and on‑chain benefits (Archax’s trade is a good blueprint).

Conclusion

Archax’s on‑chain Canary HBR ETF trade on Hedera and the CyberCharge–Aster DePIN‑to‑DeFi alliance are complementary demonstrations: one shows how institutional products can be executed on a high‑throughput ledger; the other shows how real‑world infrastructure rewards can become financial primitives. For institutional product builders and asset managers, the opportunity is clear — but it requires careful engineering, legal design, and trusted counterparties. Those who crack custody, oracle integrity, and compliant issuance will unlock new asset classes that are tradable, programmable, and composable on‑chain.

Sources

- Archax executes first on‑chain trade of the tokenised Canary HBR ETF on Hedera: https://blockonomi.com/tokenised-canary-hbr-etf-executes-first-onchain-trade-on-hedera/

- CyberCharge and Aster DEX form new alliance to merge DePIN and DeFi: https://blockonomi.com/cybercharge-and-aster-dex-form-new-alliance-to-merge-depin-and-defi/