How RLUSD’s FSRA Approval in Abu Dhabi and XRP ETF Inflows Rewire Onshore Liquidity

Summary

Executive snapshot

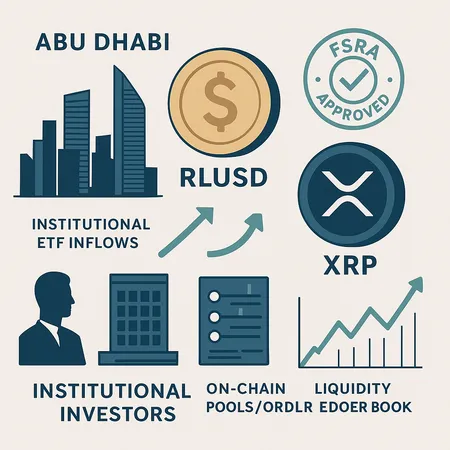

The FSRA’s approval of Ripple’s RLUSD inside ADGM and the parallel surge in spot XRP ETFs (GXRP, XRPZ) are not isolated headlines — they are a liquidity plumbing story. One is regulatory permissioning for a regulated stablecoin to operate inside a major Gulf hub; the other is real-money demand for on‑chain XRP deployed via institutional ETF mechanics. Together they change how assets flow between custodians, exchanges and regulated markets.

What FSRA authorization permits RLUSD to do inside ADGM

Permitted uses and market scope

FSRA authorization effectively places RLUSD on a regulatory whitelist for use by licensed entities within Abu Dhabi Global Market (ADGM). That permission typically includes: settlement and payment services among regulated firms, custody and safekeeping by licensed custodians, and integration into regulated trading and settlement systems. For reporting and market participants this means RLUSD can be used as a recognized, on‑shore settlement rail rather than a purely over‑the‑counter instrument (CoinPaper announcement).

Operational constraints and compliance signals

Authorization is not a free pass — FSRA’s greenlighting comes with compliance obligations around KYC/AML, transaction monitoring, reserve attestations and limits on which entities can use RLUSD inside ADGM. The Coindesk coverage emphasizes that permitted uses are circumscribed to regulated participants and venues, which reduces counterparty uncertainty but raises operational thresholds for on‑ramp/off‑ramp providers (Coindesk).

Why Abu Dhabi’s posture matters for global stablecoin adoption

ADGM is aiming to be a Gulf anchor for regulated digital assets. A few structural reasons why this matters:

- Regulatory clarity: ADGM’s rule‑making and FSRA signaling reduce legal ambiguity for banks, custodians and exchanges contemplating onshore stablecoin use. That lowers onboarding friction.

- Regional distribution: Gulf sovereign and institutional treasuries are active; a regulated onshore stablecoin can be used for cross‑border treasury operations and for trading in local regulated venues.

- Precedent effect: When ADGM authorizes a major token, other regional regulators (and international counterparties) take notice; it can accelerate bilateral licensing discussions.

In short, the FSRA greenlist for RLUSD is less about a single token and more about demonstrating that a dollar‑pegged stablecoin can be operated under Gulf regulatory guardrails — an important credibility boost for regulated stablecoins everywhere.

How spot XRP ETFs work — mechanics and early performance

ETF mechanics in practice (GXRP, XRPZ)

Spot ETFs such as GXRP and XRPZ operate by having authorized participants (APs) create and redeem ETF shares in exchange for the underlying XRP. APs source XRP on the open market, deliver it to a custodian, and receive ETF shares to place with investors. Redemptions work in reverse. This creation/redemption conveyor is the primary channel through which ETF demand becomes on‑chain demand for XRP.

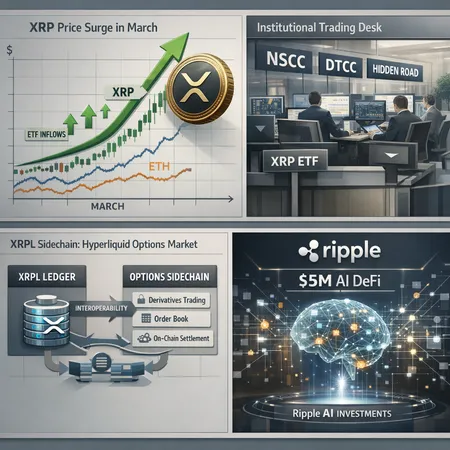

Early flows and sizing the demand shock

Launch‑day figures matter: reports show spot XRP ETFs pulled roughly $130M in inflows at launch, a clear institutional signal of appetite for XRP exposure via regulated wrappers (TheNewsCrypto). Analysts are already projecting much larger structural demand — some estimates suggest ETFs could pull in billions annually under favorable conditions (one analysis projects a $7–10B annualized range if demand accelerates) (CoinPedia).

How ETF inflows interact with on‑chain liquidity and price formation for XRP

Direct liquidity channel: AP buying pressure

When ETFs accumulate shares, APs must buy real XRP. This creates direct buy pressure on spot venues, widening the demand base beyond retail and OTC desks. If APs source XRP from major exchanges, orderbooks thin, spreads tighten or widen temporarily, and market‑makers adjust quotes. That translates into visible on‑chain transfers to custodial wallets.

Interaction with regulated stablecoins like RLUSD

Here’s where RLUSD’s ADGM authorization becomes strategically relevant: APs, custodians and exchanges operating in or routing through ADGM can settle creation/redemption flows using a regulated on‑shore stablecoin instead of relying exclusively on offshore USD‑stablecoins. That matters because:

- Settlement finality improves when using a regulator‑approved token inside ADGM.

- Counterparty credit and reserve transparency reduce operational risk for institutional participants.

- Exchanges with ADGM footprints can net settlements in RLUSD, reducing the need to move USD‑pegged reserves off‑chain.

Consequently, creation/redemption flows for GXRP/XRPZ could increasingly draw on RLUSD liquidity in ADGM venues — particularly for APs that want a compliant Gulf settlement rail.

Secondary effects: lending markets, margin and inventory

ETF inflows reduce available exchange inventory as token holdings shift to custodial accounts. That tightens supplies for spot lenders and derivatives markets, pushing up borrowing costs for short sellers and amplifying asymmetric price moves. In stressed moments this can cascade: thin orderbooks + concentrated ETF AP activity = sharper price swings.

Modeling scenarios: short, medium and structural impacts

- Short term (days–weeks): ETF launches create immediate buy pressure; exchanges see elevated outflows to custodial wallets; spreads and volatility tick up. RLUSD availability in ADGM can accelerate settlements for APs operating in the region, slightly reducing settlement friction.

- Medium term (months): Continuous institutional flows can create a structural baseline demand for XRP — orderbook depth improves at higher price levels but funding and lending tightness remain elevated. Regulated stablecoins like RLUSD start appearing in settlement mosaics for regional APs and exchanges.

- Structural (12+ months): If ETFs scale toward the billion‑dollar annual figures some analysts project, and if other Gulf regulators echo ADGM’s framework, onshore stablecoin rails could become a dominant settlement layer for regional flows — changing FX and custody economics for asset managers.

Strategic takeaways for asset managers and exchanges

For asset managers and allocators

- Reassess settlement rails: Model trade lifecycle costs using both offshore stablecoins and ADGM‑authorized RLUSD to determine best execution and custody choices.

- Factor in liquidity externalities: ETF creation/redemption creates concentrated spot buys; stress‑test portfolios for inventory drains and lending squeezes.

- Engage APs and custodians early: Ensure your chosen APs have access to both global liquidity pools and ADGM‑registered settlement rails.

For exchanges, custodians and market‑makers

- Onshore rails matter operationally: Exchanges with ADGM presence or correspondent relationships will have a competitive edge offering RLUSD settlement to regional institutional clients.

- Liquidity provisioning must be dynamic: Anticipate ETF‑driven flows and set inventory targets, borrowing lines, and market‑making spreads accordingly.

- Compliance is part of liquidity: FSRA authorization raises the bar for AML/KYC and attestations — integrating these controls is non‑negotiable for working with RLUSD flows.

For infrastructure providers

- Build connectivity: Settlement and custody providers (including platforms like Bitlet.app) should prioritize plumbing between off‑shore stablecoins and ADGM‑authorized tokens to offer seamless rails.

- Monitor concentration risk: If ETF flows and on‑shore stablecoins concentrate liquidity in a few custodians, counterparty exposure can become the next systemic risk to model.

Practical checklist before allocating or listing

- Confirm AP and custodian access to ADGM settlement rails and whether they can transact in RLUSD.

- Stress‑test trading algorithms for sudden drops in exchange inventory and higher borrow rates.

- Ensure legal counsel has validated that ETF creation/redemption activity and RLUSD settlement comply with cross‑border FX and tax rules.

Conclusion

RLUSD’s FSRA greenlist in ADGM and the early wave of XRP ETF inflows are complementary forces. One reduces settlement and counterparty uncertainty within a major Gulf jurisdiction; the other brings persistent institutional demand that must be satisfied with real on‑chain XRP. Together they push the market toward a multi‑rail, compliance‑first plumbing model where regulated stablecoins and ETF mechanics co‑determine price formation and liquidity. For institutional strategists and exchanges, the message is actionable: adapt custody, strengthen AP relationships, and design liquidity systems that span both global and ADGM‑authorized rails.

Sources

- Ripple's RLUSD approved in Abu Dhabi — CoinPaper

- Ripple’s RLUSD stablecoin wins key regulatory green light in UAE — Coindesk

- XRP ETFs drive $130M inflows on launch day — TheNewsCrypto

- XRP ETFs could pull in $7–10B annually as demand accelerates — CoinPedia

(Internal links in context: for readers tracking cross‑market dynamics see XRP and broader DeFi implications.)