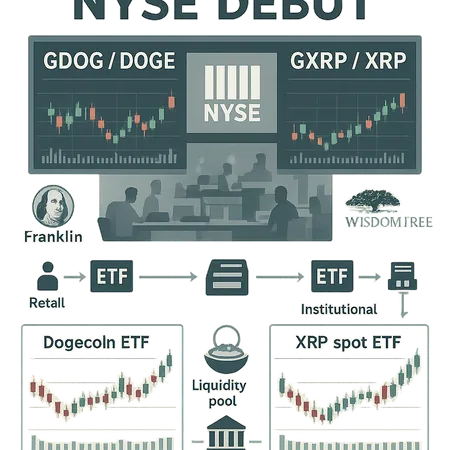

GDOG & GXRP: How Grayscale’s Spot Dogecoin and XRP ETFs Reshape Flows, Liquidity and Price Discovery

Summary

Executive snapshot

Grayscale’s green light to list spot Dogecoin and XRP ETFs — trading as GDOG and GXRP on NYSE Arca — is more than a headline; it’s a structural event. These products formalize on‑ramp rails that funnel retail and institutional capital through regulated wrappers, changing how price discovery and liquidity are sourced across exchanges, OTC desks and custodians. Short term, expect heavy curiosity and front‑loaded volume. Medium term, the ETFs will compress spreads and alter arbitrage patterns, but they won’t magically cure weak base liquidity for underlier spot markets.

Timing and market backdrop: why now matters

The launches arrive at an awkward juncture for the two tokens. DOGE entered the listing period after a weak quarter: retail interest has cooled compared with meme cycles, and transaction activity has not shown a decisive recovery. By contrast, XRP’s on‑chain picture is mixed — pockets of active flows amid uncertainty about sustained institutional demand.

Market reaction in the hours around listing largely followed a familiar script: anticipation bid prices, some pre‑positioning by traders and then a volume spike on day one. Coverage of Grayscale’s approval highlighted the regulatory milestone and immediate trading implications, noting how the ETFs clear a path for mainstream access to these non‑Ethereum assets (The News Crypto). Reporting ahead of the debut emphasized investor positioning and jumps in DOGE price as the market priced expectations (Crypto Economy).

For many traders, Dogecoin remains a behaviorally driven asset — sentiment and retail flows matter. That makes GDOG particularly prone to fast, headline‑driven turnover rather than steady institutional accumulation at first.

How Grayscale alters ETF competition and liquidity dynamics

Grayscale’s entries shift the competitive landscape. Franklin and WisdomTree were already building spot offerings; Grayscale brings deep brand recognition and an existing ETF pipeline that can attract incremental allocations quickly. The immediate effects are:

- Compressed ETF fee dynamics and narrower spreads as providers vie for AUM. Grayscale can trade on distribution muscle and market‑making relationships to capture early inflows.

- Greater fragmentation of natural liquidity: multiple ETFs mean multiple NAVs, multiple AP (authorized participant) corridors and potentially divergent premiums/discounts during stressed periods.

- A larger pool of regulated custodians and custody models, which changes how spot liquidity is aggregated across venues.

Blockonomi’s take on the DOGE listing suggested meaningful initial volume expectations and flagged how ETF launches can front‑load trading activity (Blockonomi). That front‑loaded volume will test market‑making capacity on both the ETF and spot sides.

Custody matters more than most allocators expect. ETFs require reliable, auditable custody for the underlying tokens and efficient mechanisms for creation/redemption. Any hiccup — slow custody transfers, deposit limits, or constrained AP liquidity — can widen ETF spreads and produce dislocations between GDOG/GXRP and underlying DOGE/XRP prices.

Market‑making and AP behavior

Authorized participants and professional market‑makers will be the plumbing. Their appetite to create or redeem shares defines where ETF prices settle relative to NAV and, by extension, how much net buying pressure lands in spot markets. Expect market‑makers to:

- Provide liquidity in early sessions to reduce ETF price volatility.

- Hedge exposure via spot, futures and options; the balance between these hedges influences realized directional flow to spot exchanges.

- Adjust quoted spreads dynamically as they assess custody throughput and settlement latency.

If APs initially prefer synthetic or derivative hedges over physical creation (because of custody friction or settlement risk), then ETF flows may route into futures and derivatives rather than immediate spot buys — muting the direct upward pressure on DOGE or XRP.

Short‑term price scenarios and volume expectations

No outcome is guaranteed; consider three near‑term scenarios for each token.

Dogecoin (DOGE / GDOG)

Bull case: Strong retail FOMO + efficient AP creations. Heavy retail inflows buy GDOG on NYSE, APs respond by creating shares and purchasing DOGE spot, pushing DOGE higher for several sessions. Blockonomi and pre‑listing coverage anticipated elevated day‑one volumes, which can feed momentum if liquidity holds (Blockonomi).

Base case: Front‑loaded volume, quick profit‑taking. GDOG trades heavy day one, then NAV spreads and AP activity normalize. DOGE sees short bursts of premium but reverts as sellers on spot exchanges offset ETF buys.

Bear case: ETF premium collapses and retail unravels. If AP creation is slow due to custody bottlenecks or if speculative retail exits after initial pop, GDOG shares could trade at a discount, and spot DOGE could underperform as the net buy pressure evaporates.

Volume expectations: expect a concentrated spike in daily ADV for both GDOG and underlying DOGE in the first 3–10 trading days, then a taper. The magnitude depends on retail marketing, fee competition and listed‑product accessibility.

XRP (XRP / GXRP)

Bull case: Institutional adoption and passive allocations. XRP’s real‑world payment utility narratives and institutional wallets drive steadier flows into GXRP. APs create at scale, and spot XRP sees sustained buying.

Base case: Mixed flows, arbitrage keeps markets aligned. GXRP acts as another liquidity conduit; APs and market‑makers use derivatives to balance exposures, keeping large divergences rare.

Bear case: Regulatory or custody friction slows creations. Given XRP’s complex regulatory history, any operational snag could restrict immediate conversions into spot XRP, keeping GXRP priced with a premium/discount tail risk.

Volume expectations: XRP might show a higher proportion of institutional ticket sizes relative to DOGE, meaning steadier but potentially lower headline retail churning. Coverage around price expectations and market reaction can provide context for short‑term targets (Coinpaper).

How ETFs re‑route retail vs institutional demand — arbitrage implications

ETFs formalize a pathway for retail capital to access tokens without self‑custody complexity. That typically increases retail allocation capacity but also concentrates custody and counterparty exposure with custodians and APs. Institutions, meanwhile, may prefer ETFs for balance‑sheet access or compliance reasons — but larger allocators could also push for direct custody if scales justify it.

Arbitrage dynamics to track:

- NAV premium/discount: Large, persistent premiums incentivize AP creations and spot buying; discounts incentivize redemptions and spot selling.

- Basis between ETF and futures: If APs hedge ETF exposure using derivatives, futures markets could lead or lag spot moves.

- Cross‑venue latency: Time to move tokens between custodians and exchanges creates short windows for cross‑exchange arbitrage and opportunistic market‑making.

Effective arbitrage will narrow ETF‑spot gaps over time. But early on, frictions — custody limits, KYC bottlenecks for APs, and operational conservatism — can allow short‑lived divergences that advanced traders can exploit.

Practical implications for allocators and advanced retail traders

If you’re deciding whether to reposition ahead of listings, consider both market structure and execution risk:

- Monitor creation/redemption notices and AP flow commentary in real time. These are leading indicators of where actual spot demand is landing.

- Watch the ETF’s NAV premium/discount and exchange spreads closely in the first two weeks. Large, persistent deviations reveal operational stress or strong directional demand.

- Use derivatives to hedge or express conviction. If custody or AP friction is likely, derivatives may offer cleaner exposure while arbitrage normalizes.

- Size exposure for potential volatility. GDOG could see more retail‑driven spikes; GXRP may show steadier, institutionally driven accumulation.

- Keep an eye on custody and fee disclosures. Higher custody fees or transfer limits can change effective cost basis for ETF investors and market‑makers.

Bitlet.app users — particularly those using installment buys or P2P liquidity services — should be mindful that ETF flows can temporarily widen or tighten spreads in spot markets used for execution.

Conclusion

Grayscale’s GDOG and GXRP listings mark a new phase: ETFs are now a mainstream channel for DOGE and XRP exposure. The initial weeks will be noisy — front‑loaded volumes, ETF‑spot basis swings, and active market‑making. Over time, competition among providers (Franklin, WisdomTree and others) should improve product economics and compress spreads, but operational realities — custody throughput, AP behavior, and derivatives hedging — will determine how much of ETF demand is funneled into spot buying versus synthetic hedges.

For allocators and advanced retail traders, the edge lies in watching the plumbing: creation/redemption activity, NAV spreads, and market‑maker hedging. Those indicators tell you whether ETF flows are translating into real spot demand or simply rotating liquidity across venues.

Sources

- Announcement of Grayscale approval and trading context: The News Crypto

- Coverage of GDOG debut and initial volume expectations: Blockonomi

- Market reaction and price outlook around the launch: Coinpaper

- Reporting on investor positioning and pre‑listing flows: Crypto Economy