Institutional BTC Accumulation: ETFs, Mining Bets, and the Liquidity Question

Summary

Why institutional accumulation matters now

Institutional adoption of Bitcoin has moved past headline-grabbing purchases to diversified allocation strategies: spot Bitcoin ETFs, private mining investments, and concentrated on-chain holdings by corporate treasuries. For allocators and wealth managers, this matters because the shape of where BTC sits — in ETFs versus mines versus cold wallets — directly changes liquidity, market depth, and how prices are discovered during stress.

For many traders, Bitcoin remains the primary market bellwether, but the plumbing behind that price is shifting. Recent reporting shows large, established players are increasing ETF exposure even amid choppy markets, while other institutions are placing big bets on mining capacity and custody structures. These are not independent stories; they interact to tighten available free float and can create asymmetric squeeze dynamics.

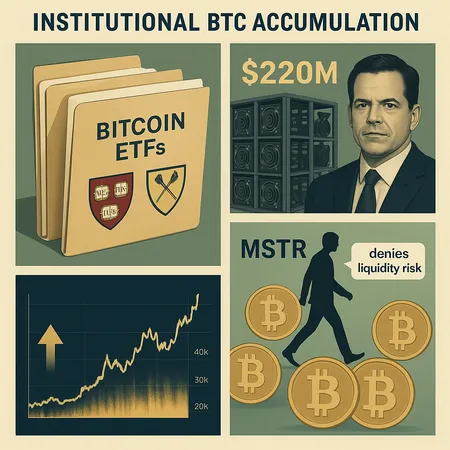

Universities piling into spot Bitcoin ETFs: scale and motive

Two stories surfaced in mid-2024 that crystalize a trend: Harvard and Emory materially increased their holdings in BlackRock’s BTC ETF. Reporting from Decrypt notes Harvard tripled its Bitcoin ETF position, while TheNewsCrypto documents that Harvard boosted its BlackRock ETF stake by roughly 257% amid market turbulence. These moves are notable for scale and timing: large endowments are buying into a nascent ETF ecosystem at prices that many retail traders would call risky.

Why would university endowments buy now? The motives are familiar to institutional allocators:

- Portfolio diversification and inflation hedging within long-duration portfolios. Universities have long horizons and can tolerate interim volatility.

- Simplified custody and operational friction reduction: an ETF reduces custody and regulatory complexity versus direct custody of BTC.

- Benchmarking and fiduciary signaling: owning a regulated ETF is easier to justify to trustees and auditors than holding direct private keys.

Those allocations are not trivial. When established endowments move at scale into ETFs, it increases demand that must be met either by ETF creation mechanisms (authorized participants shipping BTC into ETF trusts) or by secondary-market buying. That creates a new persistent buyer class that materially affects how much of the circulating supply is effectively liquid.

Mining bets as a signal: Scaramucci’s $220M commitment

Institutional conviction shows up in other forms. Anthony Scaramucci’s recent reported $220 million investment into Bitcoin mining (covered by CryptoBriefing) is the type of allocation that views BTC as an ecosystem rather than just a ticker. Mining investments indicate a belief in long-term network value, inflation-adjusted issuance economics, and the value capture from block rewards and transaction fees.

Mining commitments change the supply-side picture. Capital deployed into hashing capacity tends to lock in BTC issuance that will go to miners and often be held on balance sheets for some time. Increased institutional mining investment can therefore reduce short-term sell pressure — miners with deep pockets may be less likely to liquidate production promptly — and it also ties institutional P&L to the operational success of a vertically different business.

The practical implication for allocators: institutional mining creates an indirect form of long exposure to BTC that does not show up in ETF tallies but does remove BTC from immediate trading pools, tightening effective liquidity.

Michael Saylor / Strategy’s on-chain movements: liquidity risk or accumulation?

On-chain telemetry picked up a substantial movement of 43,415 BTC associated with Strategy/Michael Saylor, examined by ZyCrypto. Public-facing commentary from Strategy has denied that the transfers represent sales — framing them instead as redistribution across cold addresses or custodial housekeeping. But to markets, such large transfers raise questions.

There are two ways to read these moves:

- Liquidity risk narrative: repeated large transfers — especially if they end at exchanges or custodians with a history of liquidations — can signal potential supply coming to market. That creates caution among counterparties and can widen spreads.

- Accumulation / consolidation narrative: moving BTC between cold wallets, exchanges, and custodians can be operational (consolidation, security upgrades, tax planning). If the end goal is longer-term custody, it reduces circulating float.

With MSTR (Strategy) a major public proxy for BTC exposure, any ambiguity around on-chain activity matters for price discovery. Markets are quick to price in possible forced selling, and even if the transfers are benign, the perception can cause short-term liquidity compression.

ETF mechanics, market depth, and the crowding of float

Spot Bitcoin ETFs were designed to offer a regulated, liquid channel for allocation. But at scale, ETF mechanics interact with on-chain and mining flows in ways allocators must understand.

- Creation/redemption mechanics: Authorized participants can create ETF shares by delivering BTC into the fund. If large institutions continue to push capital into ETFs, APs must source BTC — driving upward pressure or requiring miners and long-term holders to sell into APs.

- Secondary market liquidity vs. underlying liquidity: ETF shares may trade with tight spreads, but that liquidity can be superficial if the underlying BTC is illiquid or held by entities unwilling to sell. ETF market depth can therefore diverge from spot order book depth during stress.

- Concentration risk: as more BTC sits in ETFs, mining treasuries, or large corporate vaults, the free float available to market-makers shrinks. That elevates the chance of rapid price moves on relatively small order flows.

Taken together, these dynamics increase the probability of price discovery episodes that are more violent than historical averages. In thin moments — e.g., low liquidity windows, macro shocks, or concentrated rebalancing by large allocators — even modest sell or buy pressure can cascade into squeezes.

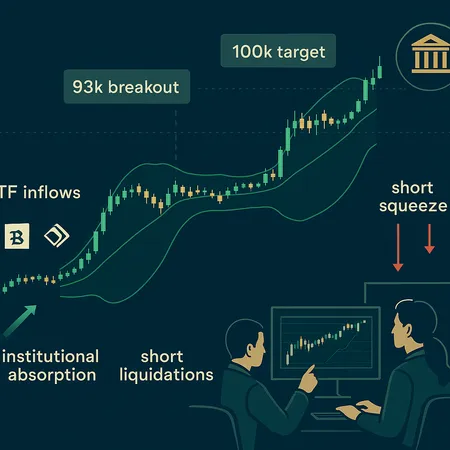

Squeeze mechanics and real-world precedents

A squeeze occurs when available liquidity cannot absorb an order flow, producing sharp price moves that trigger stop-losses and algorithmic liquidations. With BTC, the risk is amplified because much of the supply is now held by long-duration or operational actors (ETF trusts, miners, corporate treasuries) who do not act as market-makers.

Historical intraday crashes and rallies have often been tied to liquidity gaps rather than fundamental news. Today’s added layer — concentrated ETF holdings and on-chain transfers flagged as potential sell signals — makes such gaps more likely and potentially deeper.

Practical guidance for allocators and wealth managers

If you’re sizing BTC exposure at scale, treat the asset as both a liquid exchange-traded instrument and a networked commodity whose effective liquidity depends on custody and concentration.

- Stress-test liquidity assumptions: model scenarios where a fraction of ETF-held BTC is suddenly unavailable or where custodial transfers create temporary sell pressure.

- Demand transparency on ETF creation paths: understand how your ETF provider sources BTC and who the authorized participants are.

- Consider split allocations: a mix of ETFs for operational simplicity and direct custody (with audited cold storage) for control can balance convenience and liquidity visibility.

- Price in premium for execution risk: large allocations will move markets; use algos, limit fills, and negotiated block trades rather than market orders.

- Monitor on-chain signals and mining capex: mining investments like Scaramucci’s can reduce short-term sell pressure, while large on-chain transfers from major holders warrant closer scrutiny.

Bitlet.app and similar custodial platforms can simplify operational aspects, but they don’t eliminate market-impact risks; a fiduciary approach must combine operational hygiene with market microstructure awareness.

Conclusion: conviction with caveats

Institutional accumulation across ETFs, mining, and concentrated on-chain holdings signals a maturing appetite for BTC among allocators — and that is bullish in a structural sense. Reporting that Harvard and Emory increased their ETF bets (see Decrypt and TheNewsCrypto) and high-profile mining allocations (CryptoBriefing on Scaramucci) underscore broadening conviction. Yet large internal transfers by entities linked to Strategy/Michael Saylor (reported by ZyCrypto) highlight a persistent ambiguity: is supply being locked up or quietly readied for sale?

For institutional allocators, the takeaway is nuanced. Higher institutional demand reduces the free float and can be a tailwind for long-term price appreciation, but it also raises short-term liquidity risk and makes price discovery more brittle. Effective allocation requires treating BTC not just as an asset class but as a market ecosystem where custody decisions, ETF flows, and mining economics interact to shape real-world liquidity and squeeze risk.