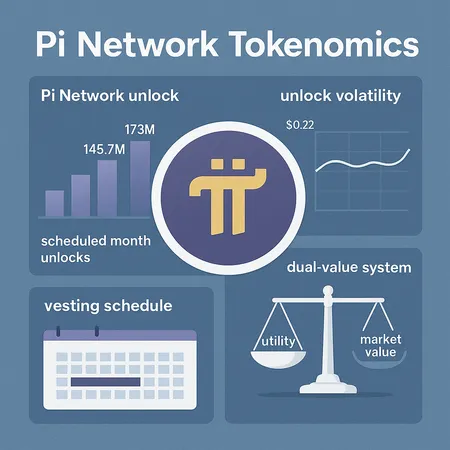

Pi Network Tokenomics: Navigating Massive Unlocks and the Dual-Value Debate

Summary

Why Pi's scheduled unlocks matter now

Pi Network’s tokenomics are entering a phase where scheduled unlocks will materially affect available supply on public markets. That doesn’t mean price will inevitably crash — but it does mean sellers will repeatedly test the market’s ability to absorb new tokens. Recent reporting highlights both the stability of PI’s trading at roughly $0.22 and the calendar of heavy unlocks stretching through late 2027, a combination that creates recurring risk for rallies and squeezes for holders.

The point is simple: an unlock is potential sell pressure. If recipients of newly unlocked tokens choose to monetise quickly, market depth and daily volume determine whether those tokens are digested with minimal slippage or whether prices gap down. For an overview of the scheduled unlock cadence and market commentary, see this report on Pi’s trading stability and the heavy unlock schedule. (See: Pi Network price is ready for a major breakout — here’s why).

The numbers that matter this month and next

Two concrete figures are already shaping near-term risk: 145.7M PI unlocking this month followed by 173M PI in December. At a market price of $0.22, those unlocks translate roughly to:

- 145.7M * $0.22 ≈ $32.054M of notional tokens entering the market this month

- 173M * $0.22 ≈ $38.06M in December

Whether that $70M+ of potential sell pressure materialises depends on holders’ behaviour and market absorption. Sellers might drip supply into markets, use OTC desks, or park tokens in liquidity pools — all of which change the dynamic.

A practical way to measure immediate dilution is to compute the unlock as a percentage of current circulating supply. If the circulating supply is 2 billion PI, 145.7M is ~7.3% of float; if circulating supply is 1 billion, it’s ~14.6%. The impact on price scales non-linearly with that ratio and the orderbook depth.

Unpacking the 'dual-value system' claim

Analysts have argued Pi implements a dual-value system — essentially a split between on-chain utility/consensus value and market-tradeable value — which can mute strong price rallies if unlocked supply is predominantly held by actors who monetise at will. This structural argument goes beyond pure supply-demand math and attempts to explain why demand pockets don’t always translate into lasting price appreciation. For an in-depth discussion, see this analysis of Pi’s dual-value dynamics (See: Pi News — Dual Value System reveals Pi Network’s true power).

The core implications:

- If a large portion of PI’s utility value is tied to internal network behavior (non-transferable or illiquid usage), it may not support the tradable price when big unlocked chunks hit the orderbook.

- Conversely, if unlocked tokens are predominantly held by participants who view PI as a speculative asset, supply increases will more directly translate to selling pressure.

Understanding which group dominates — long-term ecosystem builders vs short-term opportunists — is central to forecasting the next moves.

Vesting schedules and historical precedents

Pi’s vesting schedule — with steady monthly unlocks continuing for years — means supply shocks are not one-off events but recurring cycles. Projects with aggressive multi-year vesting have historically seen similar patterns: rallies fueled by demand can be short-lived if large, predictable unlocks are approaching, because arbitrageurs and market makers price in the future supply.

A few high-level lessons from history:

- Markets often front-run unlocks: prices can soften before the unlock date as traders sell into a known future supply increase.

- Large unlocks that hit low-liquidity orderbooks produce outsized slippage; the same notional sold in a deep market causes much less price damage.

- If a portion of unlocked tokens is retained or used productively (e.g., liquidity farming, governance commitments), the effective sell pressure is lower than the raw numbers suggest.

Given the runway of unlocks through 2027, those lessons are particularly relevant for PI holders.

Estimating market absorption capacity

Rather than guessing, use measurable heuristics to estimate how much newly unlocked supply the market can absorb without dramatic price moves.

Key metrics to track:

- Average daily traded volume (ADV) across major exchanges — compare monthly unlock notional to ADV. If an unlock equals 50%+ of ADV, expect outsized volatility.

- Orderbook depth at key price bands (e.g., how much volume sits within ±5% and ±10% of mid-price).

- 7-day and 30-day VWAP — reveal recent demand intensity and help size staged exits.

Example heuristic: if your unlocked tranche equals 10% of 30-day ADV, a fully market sell will likely push the price materially; consider staging sales over multiple days or using limit/iceberg orders to reduce slippage.

Orderbook and flow monitoring

Monitor on-chain distribution and hot-wallet movements that precede exchange inflows. If a cluster of large wallets starts moving PI to exchange addresses ahead of a monthly unlock, that’s a high-alert signal. Combine on-chain monitoring with orderbook snapshots to anticipate execution risk.

Strategies for traders and token holders

When heavy unlocks are on the calendar, adopt a rules-based approach rather than ad-hoc reactions. Below are practical tactics sorted by objective.

Risk-limited liquidity exit (for holders who want partial exposure off the table):

- Staggered selling: break intended sales into tranches over days/weeks to avoid being the marginal seller on a single day.

- Limit orders and iceberg execution: use non-market fills to hide intent or to systematically take liquidity without sweeping the book.

- OTC channels: for large sizes, OTC desks and P2P platforms reduce market impact — they may charge a small spread but prevent slippage.

Hedging and downside protection (for traders looking to preserve exposure but limit risk):

- Perps/futures: short a correlated perpetual contract to hedge spot exposure (if PI derivatives liquidity exists). Size hedge to expected sell risk, not full position.

- Options: buy puts or structured floors where available, though options on small tokens may be illiquid.

Liquidity provision and yield strategies (for holders wanting yield while waiting out unlock cycles):

- LP participation: provide liquidity in stable/PI pools but be conscious of impermanent loss during big price moves.

- Staking-like arrangements: where ecosystem tools exist that lock or reduce immediate sell incentives, these can decrease effective circulating supply.

Operational best practices:

- Keep a portion of holdings in stablecoins for re-entry on dips.

- Avoid emotional on-chain panic sells; have pre-defined thresholds and execution plans.

- Watch announcements and on-chain wallet flows in the 48–72 hours before scheduled unlocks.

Playbook by risk profile

Conservative holder:

- Take profits on a rolling schedule ahead of unlocks. Keep 20–30% in spot, hedge remainder or OTC sell.

Moderate holder:

- Stagger sales, use limit orders, maintain a small hedge via futures; participate selectively in liquidity pools.

Aggressive trader:

- Speculate on volatility: short into unlocks, buy the dip post-unlock if on-chain data shows accumulation rather than distribution.

Checklist before heavy unlock windows

- Confirm exact unlock dates and recipients (team, treasury, ecosystem grants).

- Calculate unlock as % of circulating supply and as days’ worth of ADV.

- Set execution rules (size per day, limit vs market, OTC thresholds).

- Prepare hedges and ensure you can execute them quickly.

- Monitor on-chain flows and orderbook depth 72 hours prior.

Final thoughts

Pi’s roadmap of monthly unlocks through 2027 introduces a structural tailwind for unlock volatility: predictable supply shocks that markets will price into PI’s tradeable value. The dual-value system framing helps explain why on-chain utility alone may not prevent short-term price pressure when unlocked supply is monetised. Traders and holders should focus on measurable metrics — circulating supply, orderbook depth, ADV — and adopt concrete execution plans (staggered sells, OTC, hedges) rather than ad-hoc reactions.

This is not an argument to abandon long-term conviction or to panic-sell; it’s a reminder that tokenomics — especially vesting schedules — matter. For investors tracking projects with aggressive unlocks, building playbooks and discipline pays off. Keep monitoring trusted reporting and analysis, and use platforms responsibly: tools like Bitlet.app and other P2P/earn services will likely see flows shift during heavy unlock periods as participants seek alternative liquidity channels.

For further reading on Pi’s unlock schedule and the dual-value analysis, consult the reporting and analysis linked above.