BlackRock's Ethereum ETF Launch: Impact on Institutional Investors and the Future of Crypto

BlackRock, one of the world's largest asset managers, has officially launched its Ethereum Exchange-Traded Fund (ETF), a groundbreaking step that underscores the increasing maturity and acceptance of cryptocurrencies in traditional finance. This launch is especially significant for institutional investors who have long awaited clear, regulated pathways to gain exposure to crypto assets.

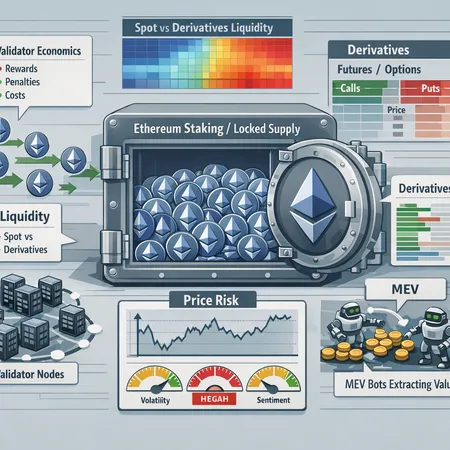

An Ethereum ETF simplifies the investment process by allowing investors to gain exposure to ETH price movements without directly purchasing or managing the underlying cryptocurrency. For institutional players, this reduces regulatory uncertainties and operational complexities.

This development is poised to increase liquidity and market stability, potentially driving broader adoption of crypto assets across diversified portfolios.

Additionally, platforms like Bitlet.app are enhancing crypto accessibility with innovative features such as the Crypto Installment service. Bitlet.app’s Crypto Installments allow investors to buy cryptocurrencies now and pay monthly, making crypto investments more approachable for retail and institutional investors alike.

In summary, BlackRock’s Ethereum ETF can be seen as a pivotal move that bridges traditional finance and the evolving crypto ecosystem, paving the way for more inclusive and mainstream participation in digital assets.