Bitcoin in Crisis: Iran’s Case and the Tug of Geopolitics vs. Institutional Flows

Summary

Introduction: why Bitcoin matters in political and humanitarian crises

When a currency collapses and protests spread, lives and livelihoods pivot fast. Bitcoin has increasingly shown up in those pivot points — not simply as a speculative bet but as a tool people use to move value, preserve purchasing power, and, at times, coordinate resistance. The case of Iran over the past months offers a clear, recent example: with the rial plunging and widespread unrest, multiple reports describe Iranians withdrawing BTC to escape capital controls and the collapse of local purchasing power.

Understanding these flows matters for three audiences: policy analysts assessing sanctions and humanitarian access, macro traders sizing liquidity and price drivers, and NGOs trying to determine whether crypto channels can safely deliver aid. Below I document the Iran case, unpack the dual role of Bitcoin as element of resistance and asset, describe how OTC and P2P mechanics operate under duress, and outline a practical monitoring framework to estimate how geopolitical flows influence global BTC liquidity.

Iran as a case study: protests, a collapsing rial, and Bitcoin withdrawals

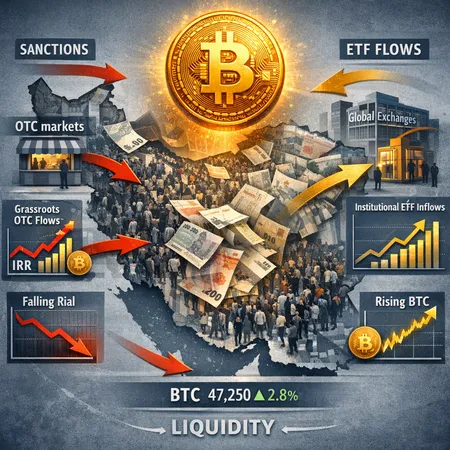

Recent reporting from Cryptonews documents Iranians increasingly turning to Bitcoin as the rial tanks amid protests and economic crisis. The headline details people exchanging local cash for BTC and shifting value offshore as domestic purchasing power evaporates (see the report here). This is not a single actor phenomenon: it spans retail sellers, small business owners, and remittance corridors.

On the price front, the broader market has simultaneously shown divergent signals. Institutional interest via spot Bitcoin ETFs has driven meaningful inflows in many jurisdictions, as daily ETF reports show large sums moving into BTC products (for one breakdown of ETF inflows see this ETF inflow report). Yet, when ETF inflows slow the market can retrace — coverage noted a retreat toward the $95k zone as ETF appetite cooled, illustrating that institutional demand and crisis-driven flows operate on different timescales and with different economic incentives.

This juxtaposition is important: grassroots demand in Iran or elsewhere is often liquidity-seeking and immediate, while ETF flows reflect portfolio allocation, custody plumbing, and macro positioning. Both affect price and liquidity, but they leave different fingerprints.

Bitcoin as an element of resistance — not just a financial asset

In crisis settings, Bitcoin plays at least three roles simultaneously:

- Store of value and capital flight conduit. When local currency collapses, BTC can be a way to escape depreciation. Converting rial to BTC, then to a hard currency or stablecoin, is a primitive hedge against inflation and capital controls.

- Censorship resistance and payments rail. Because Bitcoin is borderless and permissionless, it can facilitate cross-border transfers even when formal banking channels are restricted or surveilled.

- Symbolic and organizational tool. Crypto can signal defiance and provide channels for fundraising and information-sharing; it’s not only about money but also about autonomy.

That said, calling Bitcoin purely an instrument of political resistance flattens reality. Most participants are motivated by immediate economic calculus: preserve savings, pay for essentials, or remit funds to relatives abroad. Political motives and financial motives often overlap, but analysts should avoid romanticizing crypto’s role as purely ideological.

How value moves on the ground: OTC, P2P, and informal rails

When formal exchanges are restricted or monitored, people turn to over‑the‑counter (OTC) markets and peer‑to‑peer (P2P) channels. In Iran’s environment this typically looks like:

- Local P2P platforms and Telegram/WhatsApp networks where buyers and sellers agree rates and settle via domestic bank transfers or cash. Escrow services or reputational accounts reduce counterparty risk.

- OTC desks — sometimes informal — that can match larger trades without creating public on‑chain traces immediately, using internal ledger adjustments then settling on-chain in batches.

- Cross-border intermediaries and hawala‑style operators who convert Bitcoin into foreign fiat at either end of the chain.

Practically, many of these trades begin with a local transfer into a seller’s bank account, followed by BTC release from escrow. Liquidity providers often hedge their local exposure by simultaneously sourcing foreign currency through their own networks.

These flows can be fast and localized, but they incur legal risks: sanctions exposure for intermediaries, AML breaches, and the possibility of seizure or account closures. For humanitarian NGOs considering crypto channels, OTC routes can be effective but require strict compliance, clear provenance checks, and local legal advice.

Legal, policy, and ethical risks to consider

The use of BTC in sanctioned or fragile states raises acute policy questions:

- Sanctions and secondary liability. Facilitating value transfers to sanctioned actors or jurisdictions can expose intermediaries and donors to penalties. Even non‑state humanitarian flows can be scrutinized.

- AML/KYC and beneficiary protection. Rapid, anonymous transfers can increase fraud and diversion risk. NGOs and donors must balance speed and traceability.

- Domestic enforcement and reprisal risk. Individuals converting cash to BTC in authoritarian settings may be targeted; legal protection and operational security matter.

Policy actors should differentiate between personal capital flight aimed at survival and organized sanctions evasion. The former often poses humanitarian concerns; the latter is a policy priority for enforcement. Guidance and licensing frameworks can help—allowing vetted humanitarian crypto flows while targeting illicit networks.

How ETF flows and institutional demand interact with grassroots drivers

Institutional flows — notably spot ETF purchases — change the macro liquidity landscape by aggregating large, often longer‑term buys into regulated vehicles. ETF reporting shows that even as local crisis demand grows, ETFs can pull price in the opposite direction depending on flows and market expectations. Recent reporting describes both heavy daily ETF inflows and periods where price retreated as ETF momentum faded.

The key differences are:

- Time horizon. ETFs represent allocation decisions that can persist; crisis flows are often fleeting and liquidity‑hungry.

- Liquidity sourcing. ETFs and institutional buyers are integrated with custodians and large OTC desks; grassroots flows rely on local OTC and P2P rails.

- Price impact profile. Large institutional buys can tighten global order books and reduce available liquidity on exchanges; fragmented retail flows can create localized spreads and premium pricing (e.g., higher BTC/fiat rates on local markets).

For traders watching price, these channels can produce conflicting signals: on‑chain indicators might suggest outflows to custody while regional OTC shows heavy retail buying. Reconciling these signals is vital for correct sizing and risk management.

What analysts should monitor to estimate geopolitical flows and their liquidity impact

To translate noisy data into actionable insight, focus on a blend of on‑chain and off‑chain indicators:

- Exchange net flows and regional exchange order books. Sharp, sustained withdrawals from global exchanges can tighten liquidity; localized premiums on regional platforms indicate demand pressure.

- P2P marketplace volumes and spreads. Platforms that publish peer‑to‑peer volume (or third‑party trackers) can reveal retail appetite and ephemeral capital flight.

- Stablecoin mint/redemption activity. Surge in stablecoin issuance in certain corridors can imply conversion intent from BTC to USD‑linked instruments.

- On‑chain clustering and UTXO age. Rapid movement of older coins or large UTXO sweeps to new addresses/custodians suggests longer‑term repositioning.

- OTC desk reports and ETF inflow data. Daily ETF inflows provide a direct read on institutional demand; OTC desk anecdotes and formal reports help bridge the institutional‑retail gap (see ETF inflow summaries here and price coverage here).

- Payment processor and remittance proxies. Volume changes in regional PSPs or evidence of hawala operators adapting to crypto rails can be early signs of capital flight.

Combining these indicators helps attribute liquidity changes: are coins moving into custody (institutional), or is retail converting local cash to BTC and offloading to foreign fiat (geopolitical)? Each leaves a different trail.

Practical watchlist for NGOs, policymakers and macro traders

- Daily ETF flows and custody announcements.

- P2P spreads in local fiat pairs and Telegram/market chatter.

- Exchange inflows/outflows by region.

- Stablecoin minting patterns tied to on‑ramps.

- Anecdotal OTC desk intelligence.

- Legal and policy shifts: sanctions notices, bank account closures, or licensing changes.

Conclusions and operational takeaways

Bitcoin’s presence in crises like Iran’s is neither wholly heroic nor purely speculative. It is a pragmatic tool for people seeking to preserve value and, simultaneously, an asset class being reshaped by large institutional players. For policy analysts and NGOs, the imperative is to distinguish humanitarian use from illicit evasion, to monitor a broad set of signals, and to design frameworks that allow safe, compliant assistance when appropriate.

For macro traders, recognizing the different liquidity profiles and temporal signatures of grassroots flows versus ETF-driven demand is essential for sizing risk and interpreting price moves. Platforms and services — from local OTC operators to regulated solutions — will continue to mediate these tensions, and services like Bitlet.app are part of the broader ecosystem where P2P and regulated flows intersect.

Sources

- Report: Iranians withdrawing Bitcoin amid protests and economic crisis — https://cryptonews.com/news/iranians-withdraw-bitcoin-amid-protests-and-economic-crisis-rial-tanks-to-record-low/

- Coverage: Bitcoin price retreating to $95K as ETF inflows slow — https://crypto.news/bitcoin-price-retreats-to-95k-support-zone-as-etf-inflows-slow-and-market-hype-cools/

- ETF inflow data summary — https://blockonomi.com/bitcoin-etfs-see-100-18-million-net-inflow-as-ibit-leads-with-315-79-million/

For further context on how on‑chain indicators and P2P volumes interplay with geopolitical events, see discussions on Bitcoin and evolving rails like DeFi which sometimes absorb collateral flows in adjacent markets.