Stablecoins as Native Brokerage Rails: USDC, RLUSD, PYUSD and the 24/7 Funding Shift

Summary

Executive overview

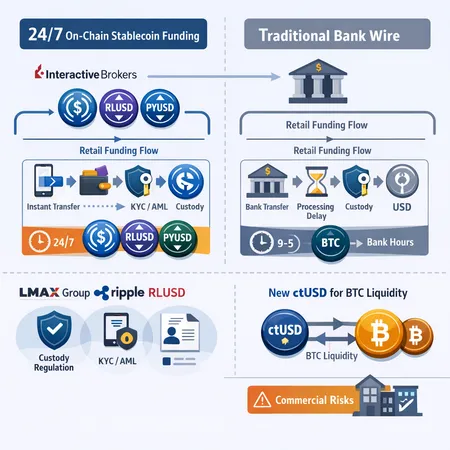

Stablecoins are no longer just a crypto niche; they are being architected as native brokerage rails. Firms such as Interactive Brokers have started to accept USDC for 24/7 funding and plan to add RLUSD and PYUSD, while exchanges and infrastructure providers (LMAX Group, Ripple) are deepening stablecoin integrations. New stablecoins like Citrea USD (ctUSD) are being designed specifically to channel liquidity into Bitcoin flows, blurring lines between payments, custody and market infrastructure.

This feature unpacks the business case for brokers adopting on‑chain funding, explains custody and settlement mechanics, walks through a step‑by‑step retail funding flow for USDC versus a traditional bank wire, and flags the commercial and regulatory questions product and compliance teams should watch.

Why brokers are adopting stablecoin rails

Three business drivers dominate the shift.

- Speed and availability: on‑chain settlement runs 24/7. When funding windows no longer depend on bank hours, brokers can onboard funds and credit client accounts almost instantly, which is a material UX improvement for active traders.

- Cost and operational simplicity: stablecoin rails can reduce friction in cross‑border funding and cut bank transfer fees and reconciliation overhead—especially for brokers operating global client books.

- Liquidity innovation: stablecoins such as RLUSD and ctUSD are being positioned as purpose‑built liquidity vehicles (for payments or BTC liquidity), creating new corridor and inventory management strategies for market‑making desks.

Interactive Brokers’ decision to add USDC 24/7 funding—with plans to use ZeroHash conversions to bring RLUSD and PYUSD online—illustrates a hybrid approach where broker platforms leverage existing fiat rails alongside tokenized USD options (source: https://crypto.news/stablecoin-rails-give-interactive-brokers-24-7-funding-edge-with-usdc-rlusd-pyusd/). Meanwhile LMAX Group’s partnership with Ripple and a significant investment to integrate RLUSD reflects demand at the institutional exchange level for native stablecoin rails that marry payments infrastructure with matching engines (source: https://bitcoinist.com/lmax-group-ripples-rlusd-stablecoin-global-exchange/).

Product teams should note that this is not just about taking crypto deposits; it’s a strategic reshaping of how funding, settlement and liquidity interact across the trade lifecycle.

Case studies: Interactive Brokers, LMAX Group and ctUSD

Interactive Brokers

Interactive Brokers announced 24/7 funding with USDC and plans to add RLUSD and PYUSD via third‑party conversion paths. That move is significant because it demonstrates a large, regulated broker treating tokenized USD as a mainstream inbound funding mechanism rather than an exotic option (details: https://crypto.news/stablecoin-rails-give-interactive-brokers-24-7-funding-edge-with-usdc-rlusd-pyusd/).

LMAX Group and RLUSD

LMAX Group has publicly partnered with Ripple and committed investment to integrate RLUSD into payments and exchange infrastructure—an indication that exchanges see benefit in embedding stablecoins directly into settlement and cross‑border rails rather than only relying on bank correspondent networks (analysis: https://bitcoinist.com/lmax-group-ripples-rlusd-stablecoin-global-exchange/).

Citrea USD (ctUSD)

New entrants like Citrea USD (ctUSD) are purpose‑built to provide USD liquidity specifically for Bitcoin flows—an explicit productization of stablecoins as asset‑pairing liquidity vehicles. ctUSD’s issuer story highlights how market participants design stablecoins not just for general payments but for verticalized liquidity use cases that speak directly to BTC trading desks (announcement: https://news.bitcoin.com/citrea-launches-usd-stablecoin-for-bitcoin-liquidity-issued-by-moonpay-powered-by-m0/).

Payments‑first strategies and company roadmaps

Broadly, firms are reorienting product roadmaps toward payments‑first outcomes. That trend was visible in recent industry restructurings, where companies prioritized payments and stablecoin use cases as core business lines—an important context when evaluating why brokers would scale stablecoin rails (context: https://cointelegraph.com/news/polygon-labs-layoffs-payments-first-stablecoin-strategy?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound).

Custody models and settlement mechanics

There are a few custody patterns brokers can choose when accepting stablecoins:

- Broker‑controlled hot wallet: the broker controls private keys and custody in‑house for rapid operational control and instant margining, but this increases operational and security burden.

- Third‑party crypto custodian: use regulated custodians (institutional custodians, qualified custodial services) to outsource key management and insurance, trading off some speed for governance controls.

- Custodial split/hybrid: an operational hot wallet for intraday liquidity and a cold, third‑party custodian for long‑term holdings.

Settlement and finality

On‑chain transfers offer probabilistic finality quickly (minutes to an hour depending on chain and confirmations) versus ACH or wire transfers which have multi‑hour to multi‑day latency and business‑day dependence. That speed translates into faster crediting of client accounts and enables brokers to reduce settlement margin exposure windows. However, on‑chain finality is contingent on the underlying network and the token standard—ERC‑20 token transfers on Ethereum have different characteristics from L2 or alternative EVM chains used by some stablecoins.

Trusted conversion rails (for example, using a custodian or a fiat/crypto conversion partner like ZeroHash) let brokers accept a stablecoin on‑chain and immediately convert it to internal fiat ledger balances, which is how Interactive Brokers plans to expand beyond USDC (source: https://crypto.news/stablecoin-rails-give-interactive-brokers-24-7-funding-edge-with-usdc-rlusd-pyusd/).

Step‑by‑step: funding a brokerage account with USDC vs a bank wire

Below are representative flows from a retail client perspective. Exact steps vary by broker implementation, custodial partner and KYC.

Funding with USDC (on‑chain)

- Client completes KYC/AML on the broker platform and links crypto wallet or purchases USDC in‑platform.

- Broker provides an on‑chain deposit address (or an integration with a widget/custodial partner). Client initiates a USDC transfer from their wallet or third‑party exchange.

- The broker’s deposit monitoring system watches for confirmations on the relevant chain. After the required number of confirmations, the broker credits the client’s cash ledger denominated in USD (or token balance) in near‑real time—often within minutes.

- If broker policy mandates conversion, an automated on‑chain or off‑chain conversion (via an API to a liquidity provider) converts USDC to fiat and updates the client’s fiat balance.

- Client uses credited balance to trade immediately; withdrawals can be initiated back to a wallet or converted to fiat and wired out.

Time to usable funds: minutes to an hour depending on chain confirmations and conversion steps.

Funding with a bank wire

- Client completes KYC/AML and adds a bank account to the broker platform.

- Client initiates a wire via their bank. Interbank messaging, correspondent banking and cutoffs affect timing.

- Receiving broker checks incoming wire, performs reconciliation and posts the credit to the client’s fiat ledger once funds settle.

- Client can trade once funds are available; withdrawal back to the bank requires additional settlement and processing.

Time to usable funds: same business day to multiple business days depending on timezones, correspondent banks and cutoffs.

Operational notes

- Reconciliation: bank wires require manual/Clearing reconciliation. On‑chain deposits need address tagging and monitoring to avoid attribution errors.

- Fail modes: on‑chain transfers can be sent to wrong addresses (irreversible) while wires can be returned or routed incorrectly but are reversible via banks.

Commercial and operational risks for broker‑dealers

Adopting stablecoin rails shifts several risk vectors that broker‑dealers must manage:

- Counterparty and issuer risk: stablecoins rely on issuer reserves, redemption mechanisms and legal structures. A partial or full loss of peg (or issuer insolvency) creates balance sheet exposure.

- Smart contract risk: bridge, contract or token vulnerabilities can lead to loss of funds—sophisticated audits and insurance are necessary.

- Liquidity and redemption risk: converting large on‑chain stablecoin inflows to fiat on demand can stress liquidity providers and create slippage.

- AML/KYC complexity: on‑chain activity requires robust transaction monitoring, chain analysis and sanctions screening; brokers may need new tooling or partners.

- Operational security: private key management, hot wallet protections and secure signing workflows are critical.

- Settlement mismatch: if a broker credits accounts faster than it can legally or practically convert stablecoins to fiat (or off‑ramp), it assumes funding and settlement risk.

These commercial risks have measurable P&L and regulatory implications—brokers must quantify capital, liquidity and operational controls before fully embracing token rails.

Regulatory touchpoints and policy questions to watch

Stablecoin adoption by regulated brokers raises overlapping regulatory issues across jurisdictions. Key touchpoints:

- Money transmission and licensing: accepting stablecoins as a funding mechanism may trigger money transmission laws, depending on whether firms custody, convert or transmit value.

- Custody law: holding tokenized USD on behalf of clients raises custody, trust account and segregation questions. Which legal framework applies—fiduciary trust rules or custodial crypto laws—depends on the jurisdiction.

- Stablecoin issuer regulation: issuers such as those behind USDC and PYUSD operate under differing regulatory regimes and disclosure requirements. Broker reliance on an issuer shifts some compliance load onto issuer transparency.

- AML/CFT and sanctions: regulators expect robust chain analytics and transaction monitoring. On‑chain transparency helps analysis but also requires the deployment of forensic tooling and processes.

- Payments regulation: integration into payments infrastructure (as with RLUSD and Ripple/LMAX) invites oversight from payments regulators and central banks; settlement finality and netting considerations may be examined.

- Consumer protection and disclosures: clients must understand redemption mechanics, peg risks and operational limits for tokenized funds.

Policy watchers should pay attention to ongoing rulemaking around stablecoin reserves, redemption rights and whether stablecoins become classified as money market instruments in some regimes. Firms should also monitor guidance from banking and securities regulators about custody, segregation and capital treatment.

Practical recommendations for product leads and compliance officers

- Start with a clear product boundary: decide if stablecoin balances are ledger equivalents of fiat, segregated client funds, or a separate tokenized bucket with distinct controls.

- Select custody and conversion partners with institutional pedigree and regulated footprints; require proof of reserves and regular audits from stablecoin issuers and custodians.

- Build robust reconciliation and monitoring: chain watchers, address labeling, and AML analytics are table stakes before enabling on‑chain deposits.

- Model liquidity and stress scenarios: quantify conversion latency, slippage and counterparty credit exposures under stressed market conditions.

- Engage regulators early: obtain interpretive guidance about money‑transmission, custody and capital implications to avoid misclassification after launch.

- Test UX flows and failure modes: simulate mistaken on‑chain deposits, partial confirmations and chain reorganizations so support teams can respond quickly.

These practical steps will help balance the product upside—faster funding, better client experience, new liquidity channels—against commercial and regulatory costs.

Conclusion

Stablecoins such as USDC, RLUSD, PYUSD and purpose‑built tokens like ctUSD are shifting from peripheral crypto utilities to core brokerage rails. For fintech product leads, compliance officers and advanced retail traders, the appeal is clear: 24/7 funding, faster on‑chain settlement and new liquidity strategies. But the move requires careful choices around custody, conversion, governance and regulatory alignment.

Brokers that treat tokenized USD as a structural part of their funding architecture—not just a marketing add‑on—can unlock operational advantages and new liquidity plays. Yet success demands investment in custody, risk modeling and compliance tooling. As firms such as Interactive Brokers and LMAX Group show, the future of brokerage rails will likely be hybrid—bank rails plus token rails—rather than an immediate one‑for‑one replacement.

For teams evaluating this change, consider the tradeoffs between speed and counterparty exposure, and plan governance accordingly; platforms like Bitlet.app and institutional custody providers are part of the ecosystem that can help operationalize these rails safely.

Sources

- https://crypto.news/stablecoin-rails-give-interactive-brokers-24-7-funding-edge-with-usdc-rlusd-pyusd/

- https://bitcoinist.com/lmax-group-ripples-rlusd-stablecoin-global-exchange/

- https://news.bitcoin.com/citrea-launches-usd-stablecoin-for-bitcoin-liquidity-issued-by-moonpay-powered-by-m0/

- https://cointelegraph.com/news/polygon-labs-layoffs-payments-first-stablecoin-strategy?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

Additionally referenced concepts: stablecoins, USDC, RLUSD, PYUSD, ctUSD, BTC and general on‑chain settlement mechanics.

For many traders, Bitcoin remains the primary market bellwether; for product teams building next‑generation rails, watching the evolving interplay between Stablecoins and traditional payment infrastructure will be essential.