Uniswap's Cross-Chain Breakthrough Between Solana and Ethereum and How Bitlet.app Enhances the DeFi Investment Experience

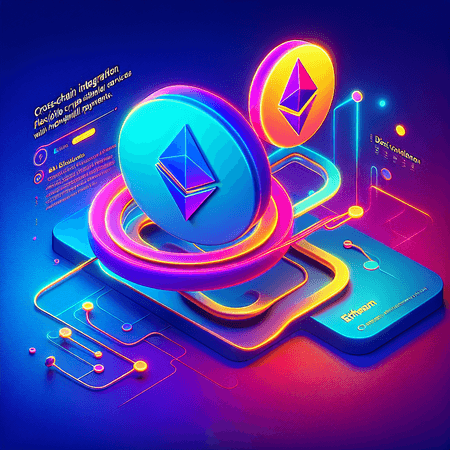

Uniswap, one of the leading decentralized exchanges, has achieved a major breakthrough by enabling cross-chain functionality between Solana and Ethereum. This integration allows users to swap tokens seamlessly across both blockchains, breaking down the barriers that previously limited liquidity and interoperability in the DeFi ecosystem.

The cross-chain capability unlocks access to Solana's high-speed transactions and low fees alongside Ethereum's vast DeFi landscape, creating new opportunities for traders and investors to diversify their portfolios effectively.

In tandem with this technological advancement, Bitlet.app is enhancing the DeFi investment experience by introducing its unique Crypto Installment service. This feature empowers investors to buy cryptocurrencies now and pay over time through manageable monthly payments, reducing the entry barriers commonly associated with large upfront costs.

By combining Uniswap's cross-chain tools with Bitlet.app's flexible payment solutions, investors can access a powerful and user-friendly DeFi ecosystem. This synergy promotes wider adoption, financial inclusion, and smarter asset management.

To explore more about how Bitlet.app can support your DeFi investments and take advantage of the latest cross-chain innovations, visit Bitlet.app today and start investing with ease and flexibility.