Uniswap's Cross-Chain Interoperability Breakthrough: A New Era for DeFi on Solana and Ethereum

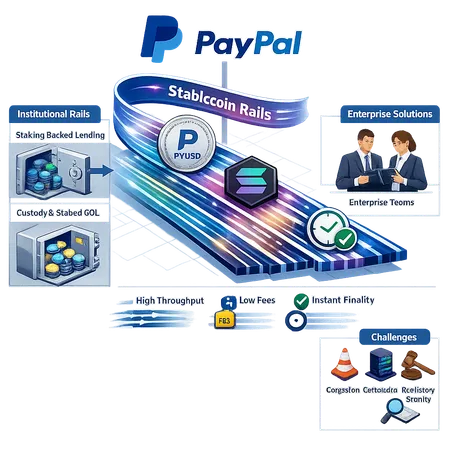

Uniswap, the pioneering decentralized exchange protocol on Ethereum, has reached a new milestone by implementing cross-chain interoperability with Solana. This breakthrough empowers users to seamlessly swap assets and access liquidity pools across the two leading blockchain ecosystems.

Cross-chain interoperability is a major advancement toward creating a more unified and efficient DeFi landscape. With Uniswap’s integration, the advantages of Ethereum’s vast DeFi ecosystem meet Solana’s high-speed, low-cost transactions. This means users can enjoy faster trading with lower fees while still leveraging the deep liquidity and smart contract capabilities of Ethereum.

For users looking to dive into this enhanced ecosystem, platforms like Bitlet.app provide complementary services that simplify crypto investments. Bitlet.app offers a unique Crypto Installment service, which allows investors to buy cryptocurrencies now and pay over time with monthly installments instead of paying in a lump sum. This service makes crypto investing more accessible, especially in a dynamic environment fueled by innovations such as Uniswap’s cross-chain solutions.

In summary, Uniswap’s cross-chain interoperability with Solana marks a significant step toward a more interconnected DeFi experience. With tools like Bitlet.app's installment plans, users can navigate this evolving market flexibly and efficiently, making the most of the next generation of decentralized finance.