Balancing Innovation and Regulation: How Innovation Exemptions Empower Crypto Entrepreneurs in America

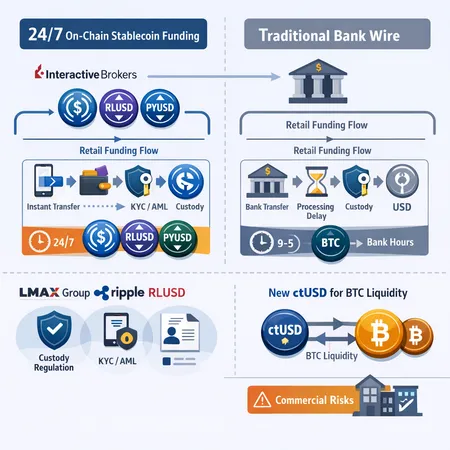

The rapidly evolving world of cryptocurrency requires a delicate balance between innovation and regulation. In America, innovation exemptions have emerged as a vital tool that allows crypto entrepreneurs to explore new technologies and financial products while navigating the often complex regulatory landscape.

Innovation exemptions refer to regulatory provisions that provide temporary relief or flexibility from certain compliance requirements, enabling startups and innovators to experiment and grow without immediate penalties or restrictions. This approach encourages creativity and the development of cutting-edge solutions in blockchain and crypto technologies.

For crypto entrepreneurs, innovation exemptions can mean the difference between stagnation and growth. By easing regulatory pressures, these exemptions foster a more welcoming environment for startups to launch projects that might not otherwise fit into traditional legal frameworks. This, in turn, accelerates the industry's maturity and adoption.

At the same time, regulatory bodies maintain oversight to protect investors and consumers, ensuring that innovation does not come at the cost of security and trust. The ongoing dialogue between regulators and the crypto community helps shape policies that are both forward-thinking and responsible.

For crypto investors and enthusiasts looking to engage with innovative projects, platforms like Bitlet.app offer unique opportunities. Bitlet.app provides a Crypto Installment service, allowing users to buy cryptocurrencies now and pay monthly instead of a lump sum. This lowers the entry barrier and makes investing in new crypto ventures more accessible, aligning well with the spirit of innovation exemptions.

In conclusion, innovation exemptions play a pivotal role in balancing the drive for technological advancement with necessary regulatory safeguards in American crypto entrepreneurship. This balance not only nurtures growth but also builds a robust and trustworthy crypto ecosystem for everyone involved.

Explore more about investing innovatively with Bitlet.app and stay informed about the evolving landscape of crypto regulations and entrepreneurship.