The Ripple Labs SEC Settlement: Implications for Crypto Regulation and Institutional XRP Sales

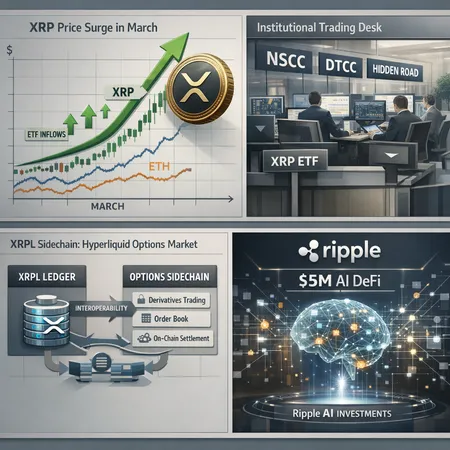

The Ripple Labs SEC Settlement represents a watershed moment for the cryptocurrency industry, particularly regarding regulatory clarity and the treatment of XRP as an asset. The U.S. Securities and Exchange Commission (SEC) had previously accused Ripple Labs of conducting an unregistered securities offering, leading to years of legal battles that caused uncertainty around XRP's status.

With the recent settlement, Ripple Labs has reached an agreement with the SEC, which could potentially pave the way for clearer regulatory frameworks dealing with cryptocurrencies. This development is crucial for institutional investors who have been hesitant to engage with XRP due to regulatory risks.

One of the key outcomes of this settlement is the renewed confidence it brings to institutional XRP sales and trading. It signals that regulatory bodies and crypto firms can come to mutually acceptable arrangements, minimizing legal risk and fostering market growth.

Platforms like Bitlet.app stand to benefit greatly from such regulatory progress. Bitlet.app not only offers a reliable platform for buying and trading cryptocurrencies but also provides a Crypto Installment service. This service allows users to acquire cryptocurrencies like XRP now and pay monthly over time, making institutional and retail investment more accessible.

Overall, the Ripple Labs SEC Settlement serves as a promising indicator that the crypto regulatory environment is evolving toward clearer guidelines and broader acceptance, which will encourage institutional participation and innovation in the space.