Impact of SEC and CFTC’s 2025 Regulatory Plans on Cryptocurrency Markets and How to Stay Ahead

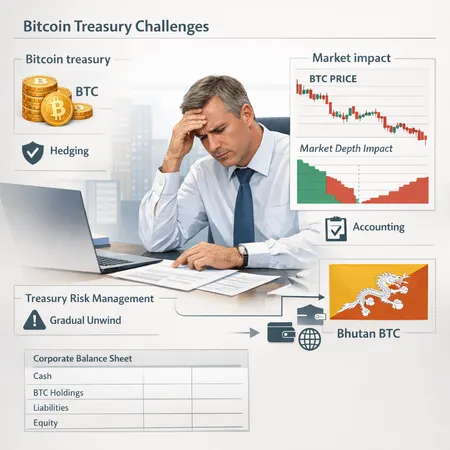

In 2025, major regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are set to implement new regulations aimed at increasing oversight within cryptocurrency markets. These changes are likely to reshape the industry, affecting trading, compliance, and investment strategies.

The SEC plans to focus heavily on consumer protection and transparency, while the CFTC is expected to enhance its regulatory framework particularly around crypto derivatives and futures. These adjustments seek to foster a more mature market environment but may also introduce challenges for casual investors and businesses alike.

For investors looking to stay ahead, it's critical to monitor these regulatory developments closely and adapt strategies accordingly. One way to remain flexible is by leveraging innovative platforms that cater to evolving market conditions. Bitlet.app, for example, offers a unique Crypto Installment service allowing users to purchase cryptocurrencies immediately while paying in monthly installments. This feature can help mitigate risks associated with market volatility and regulatory uncertainty by reducing upfront capital requirements.

To succeed in this changing landscape, stay informed, use adaptive investment tools like Bitlet.app, and consider regulatory compliance part of your investment toolkit. Embracing such strategies will help investors not only comply with upcoming regulations but also capitalize on new opportunities in the cryptocurrency market.