Related posts

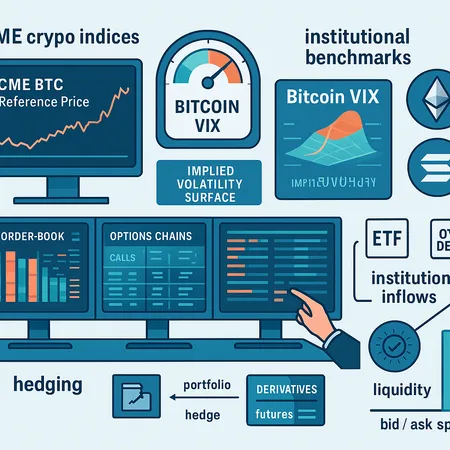

CME’s new pricing indices and a VIX‑style Bitcoin volatility measure are creating standardized reference points that change hedging, derivatives pricing and liquidity provision for BTC, ETH, SOL and XRP. Institutional benchmarks reduce fragmentation, force re‑calibration of models, and reshape how ETF, OTC and market‑making desks operate.

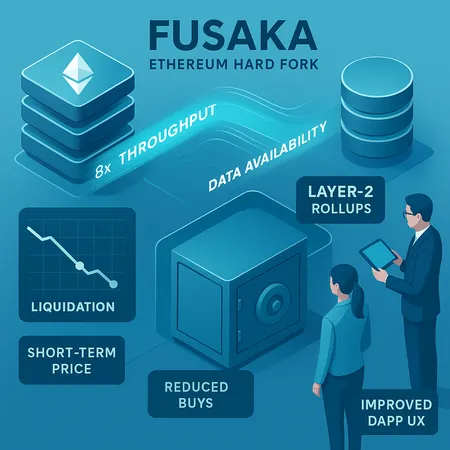

Fusaka delivers material data availability and throughput gains for Ethereum, but protocol upgrades alone rarely stop short‑term selling. Traders and protocol analysts need to separate technical improvements from real token demand.

21Shares’ updated Dogecoin ETF filing — with fee disclosures and custodian details — reignited DOGE price action and debate over whether spot Dogecoin products can attract sustainable institutional capital.