How CME’s Crypto Indices and a Bitcoin VIX Are Reshaping Hedging, Liquidity and Market Structure

Summary

Executive overview

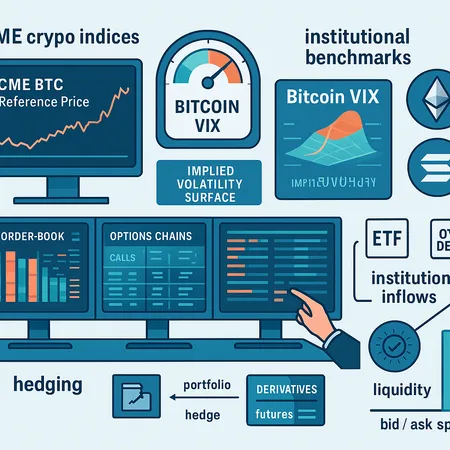

CME’s recent rollout of regulated pricing indices and volatility benchmarks for BTC, ETH, SOL and XRP marks a turning point: markets that once lived on fragmented OTC quotes and exchange‑specific marks now have standardized institutional reference points. For participants who price derivatives, run hedges or run liquidity desks, these indices will become key inputs. The shift matters for hedging cost formation, risk transfer, and the architecture of liquidity across venues.

For many desks, the first practical step is to treat the CME indices as a primary pricing and volatility input — alongside, not beneath, top exchange feeds. That means re‑calibrating models, re‑estimating basis risk, and rethinking execution strategies when hedges reference a regulated index rather than spot exchange prints. For example, Bitcoin quoting anchored to a recognized benchmark reduces disputes over settlement and simplifies OTC compression.

What the CME crypto indices measure and why that matters

CME’s announcement lays out two complementary sets of benchmarks: pricing indices and volatility indices. The pricing indices collate cross‑venue data into a regulated, time‑stamped price for each asset (BTC, ETH, SOL, XRP). The volatility indices offer an implied/observed measure of market turbulence akin to a VIX for each asset, with particular attention paid to Bitcoin volatility measures. See the official release for details on methodology and governance.

How these indices differ from what traders used before:

- Previously: spot levels came from exchange books (Coinbase, Binance, Kraken, Binance US etc.) or bespoke OTC mid‑markets, which meant fragmentation, inconsistent timestamps and disputes for settlement.

- Now: a consolidated, auditable price and volatility series reduces settlement ambiguity and gives clearing houses, custodians and prime brokers a common reference.

CME’s design choices—venue weighting, outlier filters, and time windows—matter because they determine how representative the index is during stress. Traders need to read the methodology and run scenario tests that map exchange microstructure to index behavior under spikes and outages. The launch announcement and methodology overview are summarized in industry reporting, which is useful background when implementing the indices in pricing stacks.

Why a standardized Bitcoin volatility index changes hedging and derivatives pricing

A regulated, VIX‑style Bitcoin volatility index acts as a lingua franca for implied risk. Right now, implied vol and realized vol for crypto are derived from a mix of exchange option markets, bespoke OTC quotes and historical returns. That heterogeneity creates model dispersion: two desks pricing the same option can quote wildly different prices because they use different vol surfaces and stress assumptions.

With a Bitcoin VIX (and analogous indices for ETH, SOL, XRP):

- Pricing convergence: Quants can anchor implied vol surfaces to a benchmark level and calibrate local volatility or stochastic vol models to that reference, reducing pricing disagreements across counterparties.

- Hedging efficiency: Delta‑ and vega‑hedges that reference the same volatility measure reduce mark‑to‑market friction when moving exposures between counterparties or clearing houses.

- Product innovation: ETFs, structured products and volatility swaps become easier to design when there is a transparent spot and volatility index.

But standardization also exposes model risk. A single benchmark can mask microstructure nuances—for example, under extreme flows the Index might gap differently than the local exchange you use for execution. That difference creates basis risk between the instrument priced off the index and the liquidity you can access in practice.

Practical modeling implications:

- Re‑calibrate implied vol surfaces to the CME volatility index instead of relying solely on exchange options; use indices as a prior for Bayesian calibration.

- Backtest historical hedges against the index to quantify realized vs implied divergence and set dynamic hedge ratios.

- Introduce basis‑risk terms in P&L attribution: track index execution slippage and funding differences when porting hedges between CME‑referenced products and spot liquidity pools.

Implications for ETFs, OTC desks and institutional flow

Standardized institutional benchmarks lower transaction frictions that previously discouraged large balance‑sheet players. When custodians, asset managers and banks can reference a regulated index for NAV calculations and settlement, the compliance and operational burden of entering crypto markets falls.

This development dovetails with documented institutional inflows. Recent reporting highlights significant fresh institutional capital rotating into Bitcoin and crypto products, changing the liquidity profile and market depth. Coverage on institutional capital formation and the way large players are allocating to crypto provides concrete examples of this trend. Broker‑dealer coverage expansions and formalized “crypto allocation” offerings at major financial firms further underline demand.

For ETF and OTC desks specifically:

- ETFs: Index‑referenced pricing simplifies NAV publication and arbitrage mechanisms. Authorized participants and market makers can hedge ETF exposures more predictably when the underlying reference is standardized.

- OTC desks: Standard indices reduce negotiation friction for large block trades because both parties can agree to a public, auditable reference at settlement. That reduces credit exposure and compression costs on long‑dated or bespoke trades.

- Prime brokers and custodians: Having a regulated index facilitates margining and default waterfalls because valuation disputes become less frequent.

Institutional flow examples and signaling: mainstream financial firms expanding crypto coverage and launching allocation frameworks are concrete evidence that demand is shifting from retail to institutional channels. Those flows amplify the liquidity improvements created by indexation, but they also create new systemic footprints that desks must manage.

Market‑structure evolution: liquidity, concentration and systemic considerations

Indices reduce fragmentation and encourage aggregation. Instead of liquidity splintering across dozens of venues, an index pulls price discovery toward a consolidated reference that clearing houses and institutional desks use for official pricing. That tends to deepen liquidity around the index price and tighten quoted spreads in normal markets.

However, there are tradeoffs:

- Concentration risk: liquidity focused on index‑referenced venues can create single‑point stress when those venues or the index calculation experience outages.

- Herding: large participants hedging to the same benchmark increase correlation of flows, amplifying moves during deleveraging events.

- Volatility feedback loops: if the Bitcoin VIX informs risk limits and triggers, it can accelerate margin selling in stressed conditions, similar to how equity VIX spikes affect options desks.

Regulators and risk committees should therefore watch the interplay between transparent benchmarks and centralized liquidity. The goal is to have the benefits of standardization—better price discovery, lower settlement friction—without creating brittle infrastructure.

Practical implications for market makers and portfolio allocators

For market makers, hedging desks and portfolio allocators the new indices are both opportunity and responsibility. They create cleaner inputs for quoting and risk management but require active adaptation:

Model and data changes:

- Ingest CME pricing and volatility indices as canonical inputs in pricing engines.

- Rework volatility surface construction to honor index constraints, and run sensitivity analysis for index vs exchange divergence.

- Use the index series for stress scenarios and for setting dynamic capital and margin buffers.

Execution and liquidity provision:

- Tighten quoting algorithms around the index mid when you can access efficient hedges that follow the same index.

- Pre‑position liquidity in venues that contribute meaningfully to the index; understand index weightings to avoid providing offsetting liquidity where the index price differs.

Risk and operations:

- Add basis‑risk monitoring dashboards that report index vs venue deltas across positions, especially during high volatility.

- Update legal and settlement workflows so that OTC trades can formally reference the CME index for valuation and dispute resolution.

Portfolio allocation:

- For allocators, the index simplifies benchmarking. Consider constructing passive allocations or volatility‑managed strategies that explicitly reference the CME metrics.

- But keep an eye on concentration and correlated flows—diversify execution paths and counterparties to avoid single‑point liquidity squeezes.

These changes are practical and incremental. Firms that integrate the indices early, test them against internal data, and redesign operational playbooks will gain both efficiency and client trust. Bitlet.app and similar platforms will find these indices useful when building institutional‑grade settlement and financing products.

Implementation checklist for quant and derivatives desks

- Ingest: subscribe to the CME index feed and archive a local series for backtesting.

- Calibrate: re‑fit stochastic vol/local vol models with index constraints; use the index as a prior in parameter estimation.

- Backtest: replay historical hedges using the index to measure realized vs modelled P&L and refine hedge ratios.

- Operationalize: embed index references in documentation, trade confirmations and settlement clauses for OTC transactions.

- Stress test: run tail events where index and exchange diverge to quantify potential basis shocks and liquidity drains.

Conclusion

CME’s crypto pricing and volatility indices are not just another market product—they are infrastructure. They bring transparency and standardization that materially change derivatives pricing, hedging mechanics and the behavior of liquidity providers. Institutional benchmarks reduce friction and foster growth, but they also introduce concentration and coordination risks that desks must manage.

For institutional traders, quants and derivatives desks, the mandate is clear: treat these indices as primary inputs, recalibrate models, measure basis risk explicitly, and incorporate index‑linked scenarios into stress testing. Those who do will be better positioned to price risk, manage liquidity and serve clients as crypto continues to mature as an institutional asset class.

Sources

- CME unveils crypto pricing and volatility indices: CME unveils Bitcoin, Ether, Solana, XRP pricing and vol indices

- Analysis of institutional capital transforming Bitcoin market: Bitcoin adds $732B new capital this cycle — market transforms

- Traditional finance firms expanding crypto allocation: Bank of America opens Bitcoin & crypto allocation example