Ripple’s Regulatory and Market Momentum: What MAS License, ETP Inflows, and European Listings Mean for XRP

Summary

Executive summary

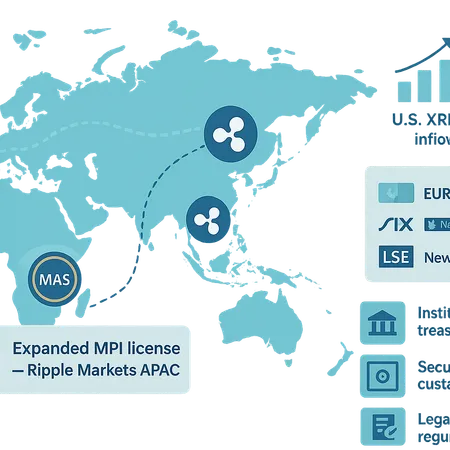

Global crypto market signals are converging around Ripple and XRP: Singapore’s expanded MPI approval for Ripple Markets APAC, record ETP inflows for XRP tied to U.S. product launches, and new European exchange listings all point to improving regulatory and market access. For institutional treasury teams and regulators considering crypto payment rails, this combination matters not as a price story but as an operational one — improved licenses and distribution expand legal envelopes, liquidity, and custody choices needed to deploy real-world cross-border settlement.

This brief assesses what those developments mean for payments use cases, the legal and custody posture institutions must adopt, and a practical thesis for XRP over the next 6–12 months.

Regulatory milestone: MAS expands Ripple’s MPI license — why it matters

In July 2024 Singapore’s Monetary Authority granted an expanded market payment institution (MPI) scope that allows Ripple Markets APAC broader payment activity under MAS oversight. Reporting on this regulatory step highlights two immediate effects: formalized supervision in a major APAC payments hub and a clearer compliance perimeter for Ripple’s Asia-facing operations (Bitcoinist report).

Why this is significant for institutions:

- Supervision matters: MAS oversight gives counterparties and banks a familiar supervisory anchor — a material reduction in regulatory counterparty uncertainty versus jurisdictions without explicit licensing.

- Corridor credibility: Singapore’s status as a regional payments hub increases the probability that institutional partners will pilot or onboard Ripple-powered rails in APAC corridors.

- Playbook for other regulators: MAS decisions often shape regional regulatory thinking; a stable, supervised operating model offers a reference for other APAC authorities.

For treasury teams evaluating rails, the MAS license shifts the conversation from “Is Ripple legal here?” to “How do we integrate it compliantly?” That’s a practical upgrade.

Market signals: ETP inflows and European listings boost liquidity and distribution

Legal clarity only scales if markets provide liquidity and access. Two contemporaneous market signals are worth highlighting.

First, U.S. exchange-traded product inflows have returned and XRP saw record weekly gains tied to new ETF/E TP dynamics, signaling renewed institutional demand and pipeline flows into spot-like products (Cointelegraph coverage). Even when regulatory uncertainty remains in the U.S., ETP inflows functionally improve on- and off-ramps by concentrating custody, compliance, and market access through regulated product wrappers.

Second, European retail and OTC channels have broadened XRP distribution: exchanges like Safello expanded listings across the region, lowering onboarding friction for euro-denominated flows and non-U.S. corridors (Safello announcement via Bitcoin.com). More listings equal deeper order books, smaller spreads, and faster settlement windows — all helpful for treasury deployment.

Together, these signals improve the preconditions for using XRP in payments rails: regulatory clarity + liquid access points + product wrappers that institutions trust.

Payments rails and real-world settlement: operational implications

If you run a corporate treasury or sit in a central bank payments unit, the relevant question is not “Will XRP pump?” but “Can XRP reduce settlement time, cost, and counterparty risk?” Consider three operational implications:

- Liquidity depth and corridor choice

- Use XRP where liquidity is demonstrably available. Europe–APAC lanes and certain USD/euro pairs look more feasible given recent listings and ETP-driven demand.

- Treasuries should maintain dynamic liquidity matrices (on-chain order books, exchange book depths, and OTC counterparties) to select appropriate rails.

- Latency and reconciliation

- XRP’s short settlement times can materially reduce intraday liquidity needs compared with traditional correspondent banking. That said, integrating on-chain settlement into existing ERP and treasury systems requires robust reconciliation tooling, monitoring, and fallback rails.

- Counterparty and operational risk

- Liquidity providers, custodians, and fiat on-/off-ramps remain the primary counterparty exposures. Having multiple regulated custodians and exchange partners reduces single-point-of-failure risk.

Practical note: teams piloting XRP rails should run parallel settlement tests for discrete corridors, measuring end-to-end timing, FX slippage, and the behavior of on-ramps under stressed conditions.

Legal, on-ramp, and custody assessment

Regulatory clarity at the license level does not eliminate legal complexity. Institutions must map a set of legal and operational controls before routing treasury flows through XRP.

Legal and compliance considerations

- Jurisdictional testing: MAS approval in Singapore reduces APAC uncertainty but does not immunize counterparties in other legal regimes. Confirm licensing, AML/KYC, and tax treatments in all corridor jurisdictions.

- Contractual clarity: custody agreements, settlement netting, and force majeure clauses should explicitly cover crypto-specific events (hard forks, chain reorgs, sanctions delistings).

On-ramp/off-ramp and banking relationships

- Banking corridors remain the gating factor. Exchanges and custodians can provide settlement, but fiat rails still require bank partners willing to accept crypto-originated flows. Expect the fastest wins in corridors with crypto-friendly banking.

- ETPs improve institutional rails by centralizing custody and compliance; they are a useful bridge while bespoke treasury integrations mature.

Custody models and operational best practices

- Segregated custody with institutional-grade auditors and insurance is table stakes. Multi-custodian strategies lower concentration risk.

- Hot-cold key management: for settlement use, hot wallets (with strong MPC or HSM controls) are necessary for speed, but need compensating controls: X-of-Y signing, real-time monitoring, and automated anomaly detection.

- Regulatory reporting and traceability: choose custodians with chain-analytics partnerships and experience responding to regulator information requests.

Bitlet.app and similar platforms illustrate how fintech offerings can simplify rails by combining on-ramp, custody, and compliance under a single interface — but institutions must still validate the underlying custody and banking relationships.

Thesis for XRP over the next 6–12 months (practical scenarios)

Thesis overview: With improving regulatory footprints (notably MAS), renewed institutional demand via ETPs, and broader European listings, XRP is positioned to see practical adoption in corridors where liquidity, custody, and banking converge. That does not guarantee universal use; adoption will be corridor-specific and measured.

Scenario A — Selective adoption (Base case, most likely)

- What happens: Pilots and live rails expand in APAC–Europe corridors and select USD lanes. ETP flows sustain liquidity and attract institutional counterparties.

- Implication: Measured increases in on-chain settlement volumes for commercial payments; improved spreads in major trading pairs; incremental treasury use-cases.

Scenario B — Accelerated adoption (Bull case)

- What happens: Additional regulated approvals or constructive guidance in other APAC/EU jurisdictions plus more banking partnerships. Institutional treasuries begin to use XRP for daily FX netting and intercompany settlements.

- Implication: Meaningful uptick in real-world payment volumes; larger OTC counterparties and custodians compete to support on-demand treasury integrations.

Scenario C — Headwinds persist (Bear case)

- What happens: Banking counterparties remain cautious, legal disputes or adverse rulings increase friction, or liquidity concentrates in ETP wrappers rather than usable exchange/OTC depth.

- Implication: XRP price may rally on demand but usable settlement rails remain niche and constrained.

Recommended risk-managed actions for treasury teams and regulators

- Start small, prove processes: run sandboxed corridor pilots with capped volumes and clear SLAs for timing and reversibility.

- Build multi-layered custody and banking relationships: use more than one regulated custodian and at least two fiat on-/off-ramps.

- Require auditability: insist on traceability, proof-of-reserves where available, and regular compliance reporting.

- Monitor regulatory developments: use MAS’s model as a reference but don’t assume reciprocity; do jurisdictional legal reviews for each corridor.

Strategic takeaways for institutional evaluators and regulators

- Regulatory licensing (like MAS’s) is a turning point because it converts abstract compliance risks into concrete operating agreements. That’s a necessary precondition for treasury adoption.

- Liquidity signals from ETP inflows and European listings materially improve on/off-ramps; however, distribution via ETP wrappers is not the same as deep exchange/OTC depth needed for active settlement.

- Treasury teams should treat XRP as a potential payments tool in selected corridors — not a wholesale replacement for correspondent banking — and design pilots to measure time-to-settlement, FX slippage, and operational resilience.

Conclusion

The confluence of MAS licensing, U.S. ETP interest, and broader European listings creates a favorable environment for XRP to mature into a practical payments rail in specific corridors. Regulatory clarity reduces counterparty uncertainty; market distribution widens access; custody and compliance frameworks remain the operational fulcrums. For institutional treasury teams and regulators, the sensible path is cautious experimentation: sandboxed pilots, multi-party custody, and clear legal frameworks that allow the benefits of faster settlement to be measured without taking on unmanaged risk.

Sources

- Reports on MAS approval and Ripple’s expanded activities in Singapore: https://bitcoinist.com/ripple-major-win-singapore-license/

- Data and reporting on crypto ETP inflows and XRP’s record weekly gains: https://cointelegraph.com/news/crypto-etps-inflows-return-xrp-record-bitcoin-ether?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Coverage of European exchange listings and distribution expansions (Safello): https://news.bitcoin.com/safello-expands-cryptocurrency-offering-with-xrp-bnb-mana-and-five-more-digital-assets/