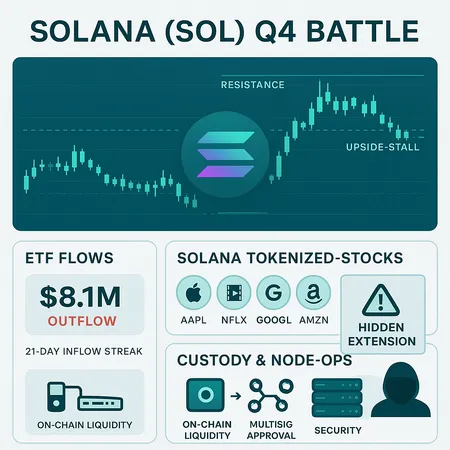

Solana's Q4 Battle: Resistance, ETF Outflows and Tokenized-Stock Security Risk

Summary

Solana’s Q4: resistance, ETF flows, and tokenized-stock danger

Q4 is often where narratives harden into performance: tokens either graduate to a new structural trend or retrace to earlier regimes. For SOL, that choice is happening against three simultaneous forces — price testing technical resistance, a sudden flip in ETF flows, and a security incident tied to tokenized stocks that exposed UX gaps. Together they create a compound risk that matters to funds, node operators, and security leads deciding whether to redeploy capital or wait for clearer signals.

The rest of this piece dissects each vector, ties them together with liquidity and custody advice, and ends with a risk-adjusted playbook for traders and builders. For many readers, on-chain lessons will echo across other ecosystems — and if you’re tracking cross-market cues, remember that DeFi and liquid derivatives often amplify these moves.

1) Technical picture: Solana reclaims resistance — how far can it go?

In recent sessions SOL reclaimed a meaningful resistance band that had capped rallies earlier this year. The price action looks bullish in the short term: higher highs and renewed demand near prior consolidation zones. That recovery was noted in market coverage highlighting Solana reclaiming crucial resistance amid the broader rebound, a technical backdrop that invites more buyers.

But a reclaimed level is not the same as an unchallenged breakout. Typical places where upside can stall include:

- Prior distribution zones where traders who bought earlier are still underwater and use rallies to exit. These create thin, repeatable supply walls.

- Liquidity gaps on centralized exchanges and concentrated orderbooks that make the asset vulnerable to sweeps and stop-hunts.

- Macro cross-currents: if BTC stalls or risk appetite contracts, SOL’s positive structure can compress quickly.

From a market microstructure perspective, the quality of the breakout matters more than the breakout itself. Look for increasing on-chain inflows to exchanges, rising derivative open interest without a simultaneous rise in spot buys, and persistent ETF demand — all of which resolve whether a reclaimed resistance becomes a new support or a failed test.

For directional context, many funds still view Solana as a liquidity-rich layer with distinct narrative drivers (NFT activity, high-throughput DeFi) but also with tighter windows for order execution than some other L1s. That nuance is crucial when sizing entries.

2) ETF flows — the $8.1M outflow and what redemptions imply

ETF flows act as a real-time barometer of institutional sentiment and liquidity pressure. After a 21-day inflow streak into Solana-linked ETF products, the market recorded an $8.1M outflow — the first meaningful reversal in that run. Blockonomi covered this flow reversal, which is important because even modest ETF redemptions can create outsized price pressure in thin on-chain liquidity windows.

Why does a relatively small outflow matter? There are a few mechanics to understand:

- ETF redemptions force product managers to sell underlying assets into the market or to use authorized participants to meet redemptions, which transmits selling pressure to spot orderbooks.

- ETFs concentrate exposure; flows are sticky during inflow streaks and can flip quickly when narratives change, converting a steady bid into a sharp offer.

- Redemptions also alter the depth across venues; a single large AP or market-maker reacting to an ETF outflow can compress liquidity across both CEX orderbooks and on-chain DEX pools.

The Blockonomi report about the outflow highlighted the fragility of multi-week inflow momentum. Issuers and market-makers — including large ETF issuers like 21Shares and other tokenized-sol exposure providers — must be ready to arbitrate between ETF mechanics and on-chain liquidity. The practical implication: funds should monitor intraday ETF flow windows and on-chain liquidity metrics (DEX depth, concentrated liquidity positions, and exchange reserve changes) to anticipate when redemptions might materialize as price moves.

Redemptions also accelerate price discovery. When flows reverse, prices can gap lower and reprice expectations for capital allocation. For allocators deciding whether to redeploy on Solana, the presence of ETF outflows increases the probability that short-term rallies are liquidity-driven rather than structural.

3) Tokenized stocks on Solana — adoption, incentives, and the hidden-extension scam

Solana has become a popular rails choice for tokenized stocks: fast settlement and low fees make it attractive for projects minting securities-like tokens. That adoption improves on-chain liquidity and brings non-crypto capital into the ecosystem, but it also introduces off-ramp and custodial complexity.

A recent example of the downside is the 'hidden extension' scam that targeted Solana users, a security episode covered by Blockonomi that demonstrates how UX design and extension permissions can be weaponized. Attackers tricked users into approving malicious browser-wallet extensions or permissions that allowed unauthorized asset moves or approval of malicious programs. The scam is not unique to Solana, but the high-throughput UX and the proliferation of tokenized-stock providers created a surface ripe for social-engineering attacks.

Why now? Several factors converged:

- Higher tokenized-stock volumes created more onboarding funnels, increasing the chance of users clicking unfamiliar prompts.

- New custodial flows and wrapping/unwrapping machinery require users to interact with multiple contracts and UI prompts, raising cognitive load.

- The rapid adoption cycle means many users are inexperienced with permission hygiene — they accept broad approvals to access tokenized equities quickly.

Why it matters: tokenized stocks often represent real-world value and regulatory sensitivity. A successful scam that drains tokenized-stock exposure not only causes direct loss but can chill institutional counterparties and custodians. That reputational damage can throttle liquidity providers and market-makers, tightening spreads and increasing slippage for SOL traders.

4) Custody and UX: how funds and node operators should think about Solana as liquidity rotates

When liquidity is rotating — ETFs outflowing, DEX pools rebalancing, tokenized-stock flows spiking — custody and UX transform from compliance checkboxes into active risk-management levers. Here is a set of operational considerations:

- Segregate custody by product: isolate tokenized-stock vaults from native SOL and DeFi staking balances. This prevents a single exploit from cascading across exposures.

- Prefer threshold or multisig schemes for large wallets, and use hardware-backed signing for node operators and treasury managers.

- Harden wallet UX: reduce the number of approval prompts, minimize approval scopes (use ERC-20-like allowance minimization patterns where possible), and implement explicit consent for extensions and plugins. Educate front-line traders and PMs on checking program IDs and signatures before approving transactions.

- Monitor on-chain permission grants and approvals with automated alerting. A mature ops stack watches for large approval events, sudden allowance increases, or unknown program interactions.

- Node operators should rate-limit RPC endpoints and enforce whitelists for contract interactions where feasible. Consider running private relays or middlewares that sanitize or require an internal approval for high-value calls.

Bitlet.app and other custody providers emphasize UX that balances convenience and safety — but institutional teams must build the guardrails into their operational runbooks, not rely solely on third-party UX defaults.

5) A risk-adjusted playbook for traders and builders

For funds, security leads, and protocol teams, the question is not binary: “deploy” or “pause.” It’s which tranche of capital, under what conditions, and with which protections. Here’s a practical, risk-tiered playbook.

Conservative tranche (capital you can’t afford to lose)

- Keep funds in segregated cold custody. No direct exposure to tokenized-stock rails.

- Use limit orders and reduce exposure around known ETF settlement windows or scheduled redemptions.

- Maintain higher margin buffers for leveraged positions.

Opportunistic tranche (short-term alpha seeking)

- Size positions small relative to local on-chain liquidity; prefer venues with deep orderbooks or OTC desks.

- Hedge with inverse derivatives or cross-venue arbitrage strategies.

- Continuously monitor ETF flow dashboards and on-chain metrics — pause add-ons on the first credible outflow signal.

Builder tranche (protocols, node operators)

- Delay aggressive product launches that require broad user approvals until post-incident hardening and user education is complete.

- Integrate metadata and program ID verification into UIs; default to conservative approval scopes.

- Run red-team exercises simulating social-engineering and extension-based attacks.

Trade sizing and exit rules

- Use dynamic sizing: reduce notional exposure by a factor tied to a liquidity metric (e.g., available DEX depth at +/-1% slippage).

- Predefine exit triggers tied to ETF net flow thresholds or a set percentage of exchange inflows over 24 hours.

Communication and contingency

- Maintain direct lines with major market-makers and custodians; when ETF redemptions occur, coordinated liquidity provision can reduce disorderly moves.

- Publicly document response plans for tokenized-stock incidents to restore counterparty confidence faster.

Final thoughts: calibrate, don’t panic

Solana’s Q4 is a reminder that price action, institutional product flows, and UX-security incidents are tightly coupled. A reclaimed resistance band is a bullish technical signal, but ETF outflows and tokenized-stock scams are liquidity and trust tests that can invert market psychology quickly. Funds and node operators should therefore calibrate deployment in tranches, harden custody and UX, and monitor ETF and on-chain liquidity metrics in real time.

If you manage institutional capital, the right posture right now is neither blind retrenchment nor reckless redeployment — it’s conditional engagement: small, monitored exposures with operational guardrails that can be tightened the moment flows or fraud vectors accelerate.