Meme Coin Pullback Playbook: DOGE Weakness, SHIB Targets, and Conservative Rules

Summary

Why this pullback merits attention

Meme coins are reflexive: social narratives and liquidity conditions amplify each other, so what looks like a small decline can cascade into fast, deep drawdowns. For traders focused on Dogecoin (DOGE) and Shiba Inu (SHIB), today's pullback is a reminder that technicals and macro liquidity signals matter as much as social sentiment. The goal below is practical: compare DOGE’s recent technical weakness vs. SHIB’s multi-target forecasts, explain how BTC dominance and liquidity drains increase volatility, and lay out a conservative trading framework with concrete entry/exit rules and risk controls.

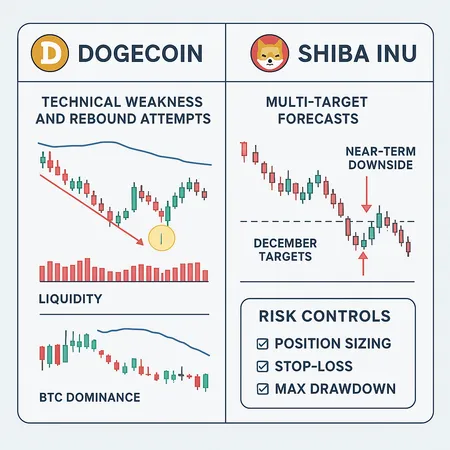

DOGE: technical weakness and rebound attempts

Dogecoin has struggled to turn rebounds into sustainable rallies. Recent technical commentary highlights shallow bounces and clear resistance levels that cap upside attempts. NewsBTC’s technical note on a recent bounce argues DOGE’s recovery looked limited in scope after a deeper decline versus Bitcoin, and cautioned about the sustainability of short-term rallies (see the NewsBTC technical note on the bounce).

A follow-up NewsBTC analysis described the rebound as weak, pointing to hurdles near the ~0.1650 area and suggesting that upside attempts may fail unless broader market liquidity returns. Those pieces underline two practical observations for traders: first, relief rallies in DOGE often fail to reclaim trend-defining levels; second, relative weakness versus Bitcoin (i.e., DOGE/BTC underperformance) signals that even if USD-price bounces occur, risk-on follow-through is not guaranteed. See the NewsBTC analysis showing the weak rebound and likely hurdles near $0.1650 for details.

What traders should watch in DOGE

- Overhead supply bands and the last multi-week swing high (use 4H and daily).

- DOGE/BTC relative performance as a filter: if DOGE lags BTC, prioritize defensive sizing.

- Volume on the bounce: low-volume recoveries are dangerous because they reverse quickly.

SHIB: multi-target forecasts and the near-term divergence

Shiba Inu’s narrative is more fragmented. Some price models project a meaningful year-end upside (one projection has a December target around $0.00000193), while shorter-term indicators show vulnerability to another leg down amid the current pullback. The SHIB forecast that combines a mixed near-term outlook with a later upside target is illustrative of the two-way risk traders face; it’s possible to have both a near-term drawdown and a calendar-year target if liquidity returns later (see the SHIB price prediction and analysis).

That split — short-term downside vs. longer-dated upside target — is common in meme coins. It creates a trading environment where speculators who want to chase the December narrative must either accept larger stops or scale in opportunistically after proof of liquidity recovery.

How SHIB’s forecast affects trading choices

- Treat long-term price targets as scenario probabilities, not guaranteed outcomes.

- If your view is the December target, define a staggered build plan rather than a single-size entry.

- Be explicit about the time horizon: near-term technical failure should trigger stop rules irrespective of year-end forecasts.

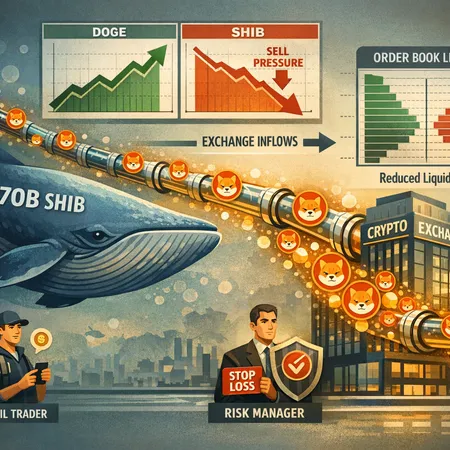

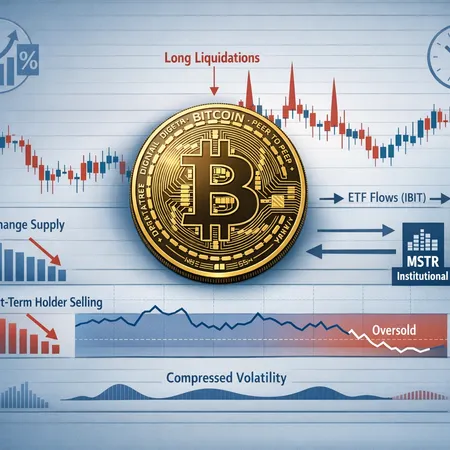

How BTC dominance and liquidity drains amplify meme-coin volatility

The mechanics are straightforward but powerful. When Bitcoin reclaims dominance or institutional flows concentrate there, capital rotates out of small caps and memecoins. Conversely, when BTC dominance falls and alt-season narratives return, meme coins can spike violently, often with extreme intraday moves.

Liquidity drains — large withdrawals from exchanges, reduced stablecoin supply, or concentrated order-book thinning — make memecoins especially fragile. Thin order books mean the same market sell triggers a much larger price move. During these episodes:

- Slippage increases dramatically, making market orders costly.

- Stops cluster and cascade, causing outsized volatility and flash crashes.

- Bid-ask spreads widen, amplifying execution risk for retail traders.

Watch these indicators as early warnings: BTC dominance trend changes, exchange netflow (stablecoin inflows/outflows), and on-chain liquidity metrics. Also track relative strength vs. Bitcoin and whether memecoins are losing liquidity faster than larger-cap alts like ETH. For context on DOGE’s weakness relative to broader flows, also scan thematic coverage about memecoin rotations and liquidity (and the recent NewsBTC notes referenced earlier).

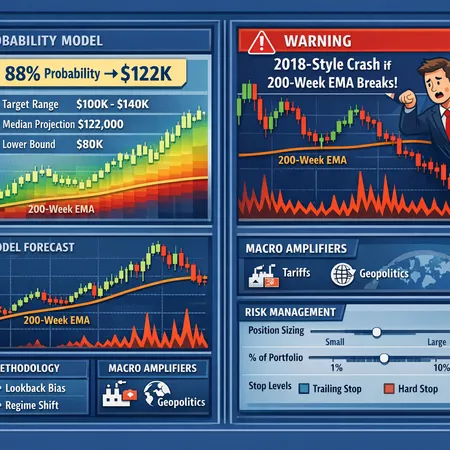

A conservative trading framework for meme-coin traders

Below is a rules-based approach you can adapt to account size and risk tolerance. This framework assumes retail traders want concrete guardrails: small per-trade risk, ATR-based stops, scaling rules, and volatility-aware execution.

1) Pre-trade filters (do not trade unless)

- BTC dominance check: avoid fresh long positions if BTC dominance is rising fast (e.g., +1%+ weekly) without a clear alt-season signal.

- Liquidity check: ensure the target token has an order-book depth that can absorb at least 0.5–1% of your intended position without moving price more than 1–2% (estimate via level 2).

- Relative strength filter: if DOGE (or SHIB) is underperforming BTC over the last 5–10 sessions, reduce position size by 25–50% or skip.

2) Position sizing and maximum risk

- Risk per trade: 0.5–1% of total account equity for conservative retail traders.

- Position size formula: Position = (Account Risk in $) / (Entry Price − Stop Price). Example: $10,000 account, 1% risk = $100. If entry = $0.08 and stop = $0.072 (0.008 difference), position = 12,500 SHIB units (or the equivalent dollar exposure).

- Max concurrent exposure to meme coins: cap at 5–10% of portfolio to limit event risk.

3) Stop placement and volatility-adjusted exits

- Use ATR-based stops: default stop = entry − (1.5–3) * ATR(14). On highly choppy days choose the higher multiple.

- Avoid fixed-percentage stops detached from volatility — memecoins often have large ranges, so ATR respects actual movement.

- Time stop: if a position doesn’t move 50% of expected distance within 2–5x the average holding time for your strategy, exit or reduce. This avoids being stuck in illiquid sideways markets.

4) Entries: patience and layered scaling

- Primary entry: limit order at technical support (daily/4H confluence) — never use market orders unless liquidity is deep.

- Scaling in: split exposure into 2–4 tranches. Buy first tranche at a tight risk-reward entry, add only if price confirms liquidity (higher lows, volume pick-up), and avoid averaging down into clear structural breaks.

- Contrarian entries (catching a falling knife): only with very small initial size (0.25–0.5% account risk) and a pre-defined add plan tied to milestones (e.g., reclaim of prior-day VWAP or specific relative-strength improvement vs BTC).

5) Profit targets and exit discipline

- Use staged profit-taking: 25–50% at 1:1 R:R, another 25–50% at 1.5–2.5 R:R, and trail the remainder with a volatility-adjusted stop.

- If a trade reaches target quickly due to a speculative squeeze, lock in gains — high intraday movement often reverses on the same day.

6) Volatility controls and hedges

- If you hold significant meme exposure and BTC shows signs of dominance re-accumulating, reduce size or hedge via inverse BTC products or short alt proxies.

- Use options (where available) to define maximum downside rather than relying solely on spot stops — buying protective puts can be an expensive but effective tail-risk control.

- Prefer limit orders and smaller order slices to minimize slippage; use iceberg or TWAP algorithms on larger fills.

7) Execution hygiene and record-keeping

- Always note entry rationale, stop, size, and time horizon before placing the trade.

- Keep a trade journal: track whether exits were rule-driven or emotion-driven. Review weekly to detect pattern errors (late exits, ignoring liquidity checks).

Practical examples (toy scenarios)

- Conservative DOGE swing: account $20k, 0.5% risk = $100. If entry = $0.10 and ATR(14)=0.015, stop = 0.10 − (2 * 0.015) = 0.07 → position = $100 / ($0.03) ≈ 3,333 DOGE-equivalent exposure.

- SHIB staged build for a December target: split planned allocation into 4 tranches over technical support bands; use 1% total account risk max, with initial tranche risking only 0.25% and subsequent adds conditional on renewed liquidity.

Final takeaways

- DOGE’s recent rebounds have been technically weak; treat rallies as needing confirmation rather than automatic buy signals (see NewsBTC analysis for specifics).

- SHIB shows mixed horizons: near-term vulnerability can coexist with later upside targets — plan entries and stops around that duality (refer to the SHIB forecast coverage).

- Always respect macro liquidity signals: rising BTC dominance and exchange outflows are real killers of meme-coin positions.

- For retail traders, discipline — small per-trade risk, ATR-based stops, staged entries, and strict liquidity checks — is the best defense against large, rapid losses.

Trade with rules, not hope. Track markets carefully and adapt position sizes when liquidity or BTC dominance shifts. For retail traders using platforms like Bitlet.app, these controls help preserve capital and keep optionality for when liquidity returns.