Meme‑Coin Resurgence 2026: PEPE, BONK, DOGE, SHIB — Catalysts, Signals, Risk

Summary

Quick read: what’s happening and why it matters

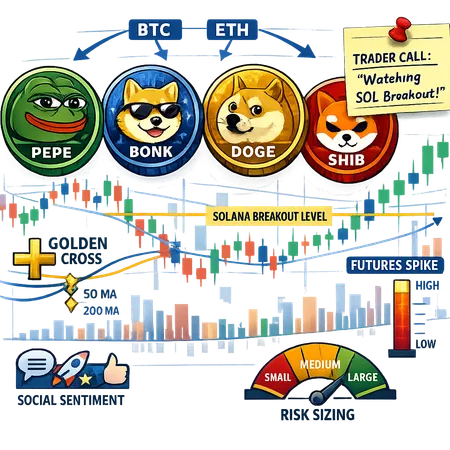

Meme coins are back in focus. In the first days of 2026, flows into PEPE, BONK, DOGE and SHIB created violent intraday moves and fresh headlines. Some rallies are clearly social‑fuelled — lightning-fast buys after an influencer or trader call — while others are more technical, driven by cleared resistances, moving‑average crossovers and rising futures activity. For active retail traders the question isn’t whether memecoins will pump; it’s how to distinguish signal from noise and size positions so a winning trade doesn’t turn into a catastrophic one.

Parsing the four catalysts: social vs technical

PEPE — social catalyst with classic crowd dynamics

PEPE’s jump in early 2026 followed a widely followed trader's bullish call, sparking rapid repricing as retail and bots chased price and liquidity thinned. Coverage explains how a single influential call can concentrate buy pressure and create short‑term squeezes (crypto.news). That structure — heavy social amplification, low on‑chain fundamental backing — tends to create sharp, headline‑driven spikes that can reverse as quickly as they formed.

Practical take: label PEPE rallies as primarily social unless you also see accompanying higher‑timeframe accumulation, rising exchange withdrawals, or meaningful on‑chain holder diversification.

BONK — technical breakout on Solana

BONK’s recent move looked more technical: prices cleared a notable resistance band on Solana and momentum attracted follow‑through, according to market coverage of the technical level it cleared (CoinDesk). When a low‑float token breaks a structural level on improving volume, follow‑on liquidity can come from both retail and systematic traders chasing breakouts.

Practical take: technical breakouts like BONK’s are tradable if volume and order‑book depth support size. But breakouts on thin order books can still fail — confirm with multi‑exchange volume and a clean retest if you plan to scale in.

DOGE — classic momentum: golden cross + futures spike

DOGE’s rebound in early 2026 shows textbook momentum signals: a rising moving‑average configuration (a golden cross on higher timeframes) and increased futures activity, which pushed both price and leverage higher (U.Today). Those signals often attract momentum funds and options/futures flows, which can sustain a move beyond pure social hype.

Practical take: DOGE is a hybrid case. Momentum signals improve the trading edge, but they also increase crowdedness — watch open interest and funding rates for signs of fragile extension.

SHIB — retest of long‑term demand with a potential golden cross

SHIB’s setup early in 2026 featured a retest of a long‑term demand zone with an approaching golden‑cross formation on longer moving averages, indicating a possible structural turn if buyers defend the area (CoinPedia). When long‑term support holds and short‑term momentum aligns, the risk/reward profile improves — though not immune to social spikes.

Practical take: treat SHIB as a swing‑trade candidate when it respects multi‑month demand and shows rising accumulation metrics; otherwise, expect chop.

Liquidity and volume patterns: the true tell

Volume behavior separates reliable breakouts from one‑off squeezes. Social‑driven pumps (PEPE‑style) tend to show sudden volume spikes concentrated on a few exchanges, thin order books, and rapid deltas in on‑chain balances. Technical rallies (BONK, DOGE’s momentum leg) often show broader exchange participation, sustained increases in traded volume across multiple timeframes, and cleaner retests.

Key checks before committing size:

- Exchange spread and depth: small caps can have wide spreads that eat your entry.

- Volume consistency: is volume high for one session only, or sustained across sessions and venues?

- Exchange flows: rising withdrawals to private wallets suggest accumulation; inflows signal liquidity sellers are waiting.

- Futures/open interest: rising OI alongside tightening funding often precedes sharper moves and liquidations.

On Solana tokens like BONK, measure on‑chain Dex liquidity and Serum/AMM depth; Solana’s high throughput can mask thin concentrated liquidity if most liquidity pools are small.

Correlation risk with BTC and ETH

Memecoins typically have amplified beta to the broader market. When Bitcoin or Ethereum correct, memecoins usually fall harder — leveraged positions get liquidated and volatility spikes. Even when a memecoin's rally looks idiosyncratic, a sudden BTC or ETH drop can wipe out long positions because liquidity evaporates.

Practical rules:

- Use a market‑beta filter: if BTC/ETH momentum is negative on the 4H–1D horizon, halve intended position sizes or avoid adding leverage.

- Watch funding: large positive funding on perpetuals increases tail‑risk; consider hedging via short BTC/ETH futures if your memecoin position is large relative to portfolio.

A practical trade and position‑sizing framework for meme rallies

Below is a compact framework traders can apply quickly in a live market.

Pre‑trade checklist (do this in <5 minutes):

- Catalyst type: Social / Technical / Hybrid.

- Confirm multi‑venue volume and order‑book health.

- Check BTC/ETH 4H trend: bullish / neutral / bearish.

- Funding rates and OI on major derivatives venues.

Position sizing rules (rule of thumb for retail):

- Per‑trade risk: 0.5–1.5% of total portfolio at stake (risk = distance to stop × position size).

- Maximum aggregate exposure to meme coins: 3–10% of portfolio depending on risk tolerance and experience (start lower if new).

- Use dollar‑cost averaging into breakouts or retests instead of one‑ticket entries; scale in 2–3 tranches.

Stop and target logic:

- Social pump entry: very tight initial stop (e.g., 5–10% below entry) and small size; if price confirms with a retest and volume, widen and add.

- Technical breakout: place stop below the breakout level or below the last higher‑timeframe swing low; target using measured move or next structural resistance.

- Momentum (DOGE‑style): use trailing stops tied to a moving average (e.g., 20–50 EMA on the timeframe you trade).

Risk mitigation and hedges:

- Use inverse exposure (short BTC/ETH futures) if position is >5% of portfolio to limit market beta.

- Avoid isolated leverage on social pumps; if you must use leverage, keep it minimal and time‑limited.

- Size stops to reflect liquidity — wide stops on illiquid tokens equal oversized risk.

Exit discipline:

- Take partial profits on strength (e.g., 25–50% at first major resistance) and move stops to breakeven.

- Reassess if volume and funding diverge (price up, volume/OI falling): that’s a red flag.

Signals and on‑chain checks to monitor in real time

- Whale transfers: large transfers to exchanges often precede dumps; track with alerts.

- Exchange balance changes: decreasing exchange supply suggests accumulation; sudden inflows suggest sellers are preparing.

- Derivatives skew and funding: elevated positive funding means long crowding and higher liquidation risk.

- Social sentiment momentum: measure velocity of mentions and new retail addresses interacting with the token.

For traders using platforms like Bitlet.app to move quickly, pair these checks with limit orders sized to the order book to avoid slippage.

Examples: actionable setups (concise)

PEPE (social spike): risk a small, exploratory position (≤0.5% portfolio). If PEPE retests a short‑term breakout on spot volume across exchanges and withdrawals rise, add a second tranche with a stop below the retest low.

BONK (technical breakout): enter on breakout confirmation with volume; use a stop just below the breakout zone and size larger than in pure social cases, but cap exposure given Solana liquidity quirks.

DOGE (golden cross + futures): consider a momentum swing with trailing stop based on EMA. If futures OI surges and funding flips extreme, either trim or hedge with a small BTC short.

SHIB (retest + long demand): look for accumulation signals and a clean higher‑timeframe close above the golden‑cross threshold before committing a swing‑sized position.

Final checklist before pressing buy

- What’s the dominant catalyst: social, technical or both?

- Is volume rising across exchanges and on‑chain? If no, beware.

- How correlated is the memecoin to BTC/ETH right now?

- Can I define a stop that keeps risk within 0.5–1.5% of portfolio per trade?

- Do I have a plan for profit taking and for what to do if funding rates spike?

If the answers don’t pass these practical tests, the best trade is often no trade.

Sources

- "Why PEPE Coin Price Is Going Up" — crypto.news: https://crypto.news/why-pepe-coin-price-is-going-up/

- "Bonk jumps more than 10% in 24 hours as momentum pushes price higher" — CoinDesk: https://www.coindesk.com/markets/2026/01/02/bonk-jumps-more-than-10-in-24-hours-as-momentum-pushes-price-higher

- "Dogecoin price to $0.2 — first major rebound of 2026 emerges" — U.Today: https://u.today/dogecoin-price-to-02-first-major-rebound-of-2026-emerges?utm_source=snapi

- "Shiba Inu coin price could jump 25% as golden cross formation nears" — CoinPedia: https://coinpedia.org/price-analysis/shiba-inu-coin-price-could-jump-25-as-golden-cross-formation-nears/