XRP ETF Inflows and Ripple Escrow: How 10.8M XRP and a ~$1B Unlock Reshape Supply Dynamics into 2026

Summary

Executive summary

The past week saw a concentrated burst of institutional flows into XRP ETFs — about 10.8 million XRP added in two days — while Ripple is scheduled to unlock roughly $1 billion worth of XRP from escrow. Those two facts alone spark obvious questions for portfolio managers: who actually holds the ETF tokens, how large is the ETF sink relative to the unlock size, and what will this mean for price discovery and investor sentiment as we move into 2026?

This article examines the mechanics of XRP ETF inflows, the nature of Ripple escrow releases, historical responses to unlock schedules, possible supply shock scenarios, and practical trading posture for short‑term volatility versus longer‑term adoption narratives. Along the way we reference recent on‑chain moves and market‑share data to ground the analysis.

What happened: the inflows, the unlock, and big on‑chain moves

Two days, 10.8M XRP — the inflow data

Coin tracking reports show ETF flows into XRP funds totaling 10.8 million XRP in two days, continuing a multi‑week trend of growing ETF holdings. That kind of concentrated institutional demand is important because ETFs typically act as durable holders rather than instant market flippers. See the inflow snapshot for context in recent reporting: XRP ETF inflow hits 10.8M tokens in two days.

Ripple’s ~$1B escrow unlock and an unusual 69,999,999 XRP transfer

Separately, reporting indicates Ripple planned an unlock of about $1 billion of XRP from escrow around the same period. Escrow unlocks are scheduled and public, but the effect on circulating supply depends on how Ripple uses the unlocked tokens (sell, distribute to partners, or return to escrow). See the reporting on the planned unlock here: Ripple will unlock $1B in XRP.

On the chain, observers flagged a large 69,999,999 XRP transfer — large on its face and worth monitoring because it can signal whale activity or prelude market movements. For a description of that transfer and market speculation, see: Strange 69,999,999 XRP transfer.

Together these data points—ETF inflows, scheduled escrow unlocks, and large on‑chain transfers—create a tight feedback loop where perceived supply availability meets real institutional demand.

How ETF inflows mechanically affect circulating supply and custody

Who holds the ETF tokens?

An ETF purchase does not mean the fund mints new XRP; it means the ETF acquires tokens on the market and holds them in custody. Custodians (institutional custodial banks or qualified crypto custodians) maintain the tokens on behalf of the ETF. Authorized participants and market makers create or redeem ETF shares by delivering or receiving the underlying tokens, which transfers the economic ownership into the ETF’s custody.

Operationally this matters because:

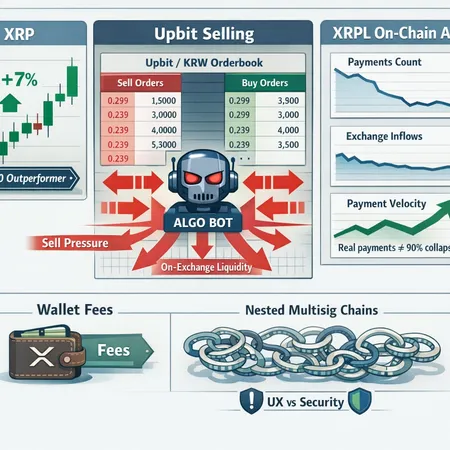

- Tokens held by ETFs are effectively removed from tradable retail float, lowering available supply for market makers and speculators.

- ETF custodians are generally long‑term holders, which reduces velocity compared with typical exchange wallets that rotate inventory to meet instant liquidity needs.

ETF demand is therefore a sink for circulating XRP. The recent 10.8M inflow is more meaningful if sustained: every incremental block of ETF‑held XRP structurally reduces available float and supports tighter price discovery.

Where ETF‑held XRP sits in the ecosystem

ETF holdings typically sit with regulated custodians or custodian pro‑viders; they are not on retail exchanges. That separation matters for price dynamics: when custody is concentrated outside exchange order books, visible exchange balances fall, and the market can move more sharply on order flow.

As inflows grow, ETFs can create a new backbone of institutional demand similar to what we've seen in other markets (the same mechanism that lifted Bitcoin flows in previous cycles). For XRP specifically, the growing prominence on retail venues (for example, being among top‑traded assets on platforms such as Uphold) complements institutional appetite by ensuring liquidity exists across channels; see reporting on XRP’s trading prevalence in 2025 for context.

Putting escrow unlocks into perspective: not all unlocked XRP is new supply

Escrow mechanics and historical behavior

Ripple’s escrow system was designed to programmatically release set amounts of XRP each month to prevent sudden, uncontrolled supply unlocks. But a crucial nuance: unlock ≠ sale ≠ circulating supply increase. Historically Ripple has:

- Sell some unlocked XRP into the market for operational and business purposes,

- Use unlocked XRP for liquidity programs, partnerships, and customer distribution,

- And, importantly, return unused unlocked XRP back into escrow.

This discretionary behavior means the mechanical headline number for an unlock (dollars or tokens) overstates the immediate supply available to markets unless Ripple explicitly sells or transfers the tokens to exchanges or third parties.

Compare scale: ETF holdings versus a ~$1B unlock

A single-day or multi‑day ETF inflow of 10.8M XRP is not negligible, but must be compared to the unlock size in token terms and to the rate at which ETFs accumulate tokens. If the ~$1B figure refers to hundreds of millions of XRP at certain prices, that looks large in nominal supply terms. But two key offsets shrink the immediate market impact:

- ETF absorption: ETFs may continue to buy and absorb some or all of that unlocked supply, especially if inflows continue.

- Operational non‑sell volume: a portion of unlocked XRP may be allotted to partners or returned to escrow rather than dumped on exchanges.

So the arithmetic matters: a large unlock can be neutralized if ETF demand keeps pace. Conversely, if unlock tokens move quickly to exchanges and ETF demand cools, there is clear downside pressure.

Historical price effects of escrow unlocks and large transfers

The market’s response to previous unlocks and big transfers has been mixed: sometimes muted, sometimes accentuating volatility. Two patterns emerge from history:

- When demand momentum (retail + institutional) is strong, unlocks are absorbed and price impact is muted or even bullish because market participants price-in larger future utility.

- When demand is weak, unlocks can create short‑term selling pressure that accelerates corrections as market makers offload inventory.

Large on‑chain transfers (the 69,999,999 XRP example) often act as immediate volatility triggers because they change perceived available supply or reveal potential intent (e.g., movement to exchanges or to OTC counterparties). But transfers alone don't prove intent to sell — they may be internal rebalancing, custody consolidations, or movement to OTC desks for matched trades.

Potential supply shock scenarios and probability framing

No single path is certain; frame risk scenarios probabilistically:

Base case (highest probability): Partial absorption. ETFs continue to buy, Ripple uses a mix of sales and returns to escrow, and net new float is modest. Outcome: elevated liquidity, smoother price discovery, moderate upward bias.

Upside case (plausible): Demand outpaces supply. Strong institutional flows plus retail interest (high trading volumes on platforms) absorb both recent inflows and the unlocked XRP, tightening float and pushing price higher as ETF demand compounds.

Downside case (tail risk but real): Sudden sell pressure. A material portion of unlocked XRP moves to exchanges or to OTC counterparties that sell into thin order books, while ETF inflows slow. Outcome: sharp price decline and increased volatility.

Wildcard case: Whale-driven re‑distribution. Large transfers (like the 69,999,999 XRP) could represent a coordinated move that reallocates liquidity across venues, causing momentary dislocations that savvy traders can exploit.

Price discovery under ETF demand: why institutional appetite matters

Institutional ETF demand does more than soak up tokens. It also influences how prices are discovered:

- ETFs create a persistent marginal buyer, reducing likelihood that sell orders will permanently depress prices.

- They improve market depth off‑exchange; as ETF holdings grow, the tradable float on exchanges can shrink, increasing short‑term volatility but strengthening long‑term support levels.

- Institutional presence can attract derivatives desks, options markets, and market makers to provide better two‑way liquidity, enabling more professional price discovery.

Think of ETF demand as shifting the marginal supply curve: the same sell volume will have a larger price effect if fewer tokens are available on exchanges. Conversely, the existence of patient institutional custody can shorten the duration of sell‑offs if buying returns.

How portfolio managers and traders should position

For portfolio managers (medium‑ to long‑term lens)

- Treat ETFs as a structural source of demand: allocate exposure with the view that ETF adoption generally reduces float and raises the probability of higher long‑run valuations.

- Monitor cumulative ETF holdings relative to exchange supply and escrow schedules as a dynamic signal for rebalancing.

- Use hedges (options, futures) around known escrow unlock dates to limit downside tail risk, but avoid overreacting to every monthly unlock—context matters.

For active traders (short‑term lens)

- Expect spikes in volatility around unlock announcements and large transfers. Keep position sizing conservative and avoid excessive leverage into unlock windows.

- Watch on‑chain movements, exchange inflows, and order book depth as immediate cues — a large transfer to an exchange is materially different from a transfer to a custody wallet.

- Use limit entries and tiered exits; liquidity can evaporate quickly if whales press the sell side.

Tactical monitoring checklist

- Daily ETF flow reports and cumulative ETF holdings (to measure the demand sink).

- Public escrow schedule and Ripple’s announcements.

- Exchange balances and large on‑chain transfers (watch for movement to known exchange addresses).

- Options open interest and futures basis (for signs of positioning and leverage).

The narrative into 2026: adoption, ETFs, and market structure

Institutional flows into XRP ETFs and elevated trading on retail platforms suggest that XRP is being re‑priced as more than a speculative token: it is becoming an instrument with institutional wrappers, liquidity, and clearer custody. This structural shift underpins a longer‑term adoption narrative that may survive short‑term noise.

That said, the combination of scheduled escrow unlocks and unpredictable large transfers means volatility will remain higher than for fully matured markets. For investors, the correct mental model is not “unlock equals crash” but rather a conditional model: price impact depends on contemporaneous demand. If ETF demand (and broader crypto market health) remains strong, surface‑level unlocks will be absorbed; if demand wanes, they will accentuate downturns.

Remember that XRP sits inside a broader crypto market that also includes layers like NFTs, memecoins, and DeFi — structural liquidity changes in one segment can migrate and affect others. Bitlet.app users and institutional desks should therefore combine on‑chain monitoring with macro liquidity signals.

Final takeaways

- The 10.8M XRP ETF inflow over two days is a meaningful institutional demand signal; ETFs act as a structural sink and can improve price discovery over time.

- A ~$1B Ripple escrow unlock is significant nominally, but unlock ≠ automatic sell; Ripple’s historical behavior often blunts immediate supply shocks.

- Large on‑chain transfers are volatility catalysts and should be monitored for destination (custody vs exchange) to infer selling intent.

- Portfolio managers should view ETFs as a positive in the medium term but manage risk around unlock dates with hedges and sizing discipline; traders should brace for short‑term volatility and use tactical tools.

For further background reading on ETFs and institutional custody mechanics, and to track ongoing flows, check daily flow reports and exchange data; also see comparative coverage on XRP’s trading prominence in 2025 which supports the thesis of rising institutional and retail interest.

Sources

- https://coinpedia.org/news/xrp-etf-inflow-hits-10-8m-tokens-in-two-days-extending-29-day-streak/

- https://finbold.com/ripple-will-unlock-1-billion-xrp-tomorrow-2/?utm_source=snapi

- https://u.today/strange-69999999-xrp-transfer-just-hit-chain-is-it-ripple-selling-again?utm_source=snapi

- https://coinpedia.org/news/xrp-news-today-xrp-emerges-as-upholds-top-traded-crypto-in-2025/

(Also referenced general market mechanics and custody practices; mention of XRP and Bitcoin for comparative context.)