XRP at a Crossroads: Institutional Momentum vs. Mounting Technical Risk

Summary

Executive snapshot

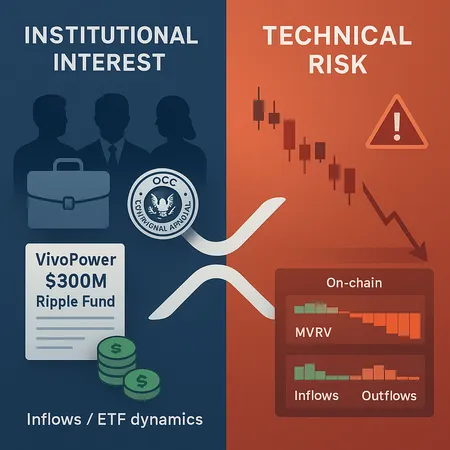

XRP finds itself in a classic fundamental-versus-technical tug-of-war. On one side: regulatory progress and institutional endorsement — notable examples include VivoPower’s newly announced $300 million institutional Ripple equity fund and conditional approvals from the U.S. Office of the Comptroller of the Currency (OCC) permitting firms including Ripple to operate national crypto bank-like entities. On the other side: price action that is underperforming, meaningful outflows and on-chain metrics showing faded realized gains. For allocators using platforms like Bitlet.app, the question is not just whether Ripple’s narrative improves, but whether the market structure for XRP supports fresh risk allocation.

Institutional and regulatory catalysts — why they matter

Two developments have shifted investor perception lately. First, the private-sector vote of confidence represented by VivoPower’s $300M institutional Ripple equity fund signals growing appetite for regulated, large-scale exposure to Ripple-related assets and equity exposure tied to the ecosystem — read the announcement for details. Second, the OCC’s conditional approvals for firms including Ripple and Circle mark a milestone that could materially lower regulatory uncertainty and improve on-ramps for institutional capital; the approval is not unconditional, but it is meaningful progress in U.S. regulatory acceptance.

Why these matter: institutional funds and regulated entities can create sticky inflows, derivative product formation, and broader market participation — dynamics that historically compress volatility and lift market caps over multi‑quarter timeframes. That said, institutional intent does not instantly translate to price, especially in a market where retail leverage and sentiment still amplify short-term moves. For broader market context, many traders still watch Bitcoin flows and ETF activity as barometers for correlation and liquidity.

Recent inflows and ETF-related dynamics — a mixed picture

On-chain and exchange data paint a nuanced story. AmbCrypto reported roughly $16.4M in inflows into XRP-related vehicles, but price largely stalled near the $2 area. This suggests that while capital is arriving, it's either being absorbed by sellers or used to rebalance positions rather than push price materially higher. ETF narratives continue to matter: spot-Bitcoin ETF flows have altered liquidity patterns across crypto, and ETF-engaged capital often rotates between large-cap altcoins like XRP when traders seek yield or relative value.

Importantly, inflows tied to institutional products can be front-loaded (announcement-driven) and then slow if execution or secondary-market liquidity is constrained. That’s why inflow figures alone are insufficient; one must read them alongside exchange withdrawals, concentration metrics, and realized profit-taking.

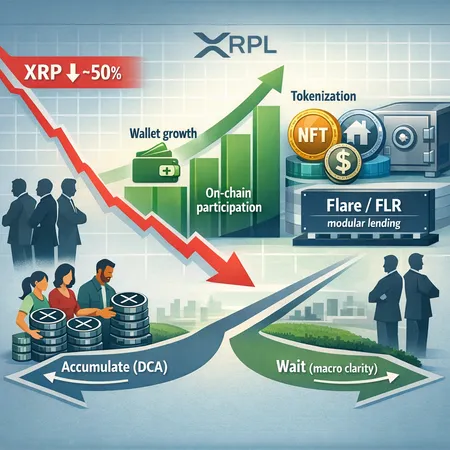

The technical warning: can XRP revisit $1?

Several technicians and commentators point to a deteriorating chart structure. A recent analysis warned of a path toward $1 if selling pressure accelerates and key support zones fail. The argument is straightforward: repeated failures to reclaim prior ranges increase the likelihood of deeper mean reversion, especially if order book depth is thin and macro liquidity tightens.

From a trading perspective, watch these technical cues:

- Failures to hold the $1.80–$2.10 zone on meaningful volume — a sign of distribution.

- Moving average crossovers (e.g., 50-day under 200-day) that confirm medium-term bearish bias.

- Lower highs and lower lows on daily/4H timeframes, which invite momentum selling.

A drop toward $1 would not be unprecedented if market-wide risk aversion spikes. Traders should model the move scenario with clear stop rules; longer-term holders must assess whether a lower entry point increases expected return enough to warrant adding size.

On-chain MVRV and flow dynamics — distribution signal amid headlines

On-chain measures add another layer. MVRV (Market Value to Realized Value) gauges whether holders are, on average, sitting on unrealized gains or losses. Recent MVRV dynamics for XRP show a compression from earlier realizations — meaning realized profits are down and more coins are held near break-even or small loss. That pattern can precede volatility: if holders who bought at elevated levels decide to realize losses or rotate, they add selling pressure.

Meanwhile, inflow/outflow data indicate sizable outflows from certain exchange-lists and increased transfers to custodial wallets tied to institutional products. Paradoxically, inflows into some institutional vehicles coincided with net outflows from exchanges — a neutral-to-slightly-bullish on-paper development — yet realized price gains have lagged. This points to two possibilities: institutions are accumulating but not aggressively bidding price higher, or exchanges are seeing retail-driven selling that eats through buys.

Risks to the bullish case

- Execution vs. announcement risk: Institutional funds and OCC approvals are powerful narratives but require months of deployment; headlines can be priced well before capital actually flows.

- Market structure: If liquidity providers withdraw or leverage conditions deteriorate, even modest selling can cascade into sharp declines.

- Regulatory backsliding: Conditional approvals can still be tightened or complicated by further regulatory requirements.

- Concentration and sentiment: If a large share of XRP supply is concentrated in hands that decide to distribute, MVRV and flow indicators will remain fragile.

Recognize that tangible regulatory progress reduces one dimension of risk but does not immunize the token from macro liquidity cycles or technical collapses.

Practical scenarios and positioning guidance

Scenario A — Bullish rollout (base case over 3–12 months)

- What happens: Institutional products gradually deploy capital, liquidity deepens, and price reclaims $2.50–$3.50.

- Positioning: Accumulate on lower-volume pullbacks with partial exposure — use staggered entries and set alerts for volume-confirmed breakouts. Consider reducing leverage and sizing relative to portfolio risk.

Scenario B — Rangebound / headline-driven chop

- What happens: News spikes (fund launches, approvals) lead to short-lived rallies but price fails to sustain as supply meets demand.

- Positioning: Favor shorter-term trades using defined risk (tight stops and size limits). Avoid adding large long-term positions until on-chain MVRV turns more favorable.

Scenario C — Technical break to lower support (~$1)

- What happens: Chart support fails, liquidity vacuum and stop cascades push price toward $1; sentiment sours temporarily.

- Positioning: For traders, short-term short or fade rallies with strict risk controls. For long-term allocators, consider accumulation in tranches only if thesis (adoption, regulatory traction, partnership growth) remains intact; the lower price materially improves expected return.

Practical rules for intermediate traders and allocators

- Use staggered pyramiding to avoid single-point-of-failure entries.

- Size positions so a 40–50% drawdown on XRP does not erode portfolio health.

- Monitor on-chain MVRV and exchange net flows weekly; sudden spikes in exchange inflows or rising MVRV can presage exhaustion of sellers.

- Treat regulatory headlines as catalysts, not confirmations — look for follow-through by capital deployment.

Final takeaways

XRP’s story has matured: regulatory milestones and institutional interest provide a foundation for a constructive long-term thesis. Still, the market’s present structure is fragile, with technical charts and distributionary on-chain signals warning of near-term downside should liquidity conditions deteriorate. Intermediate traders and allocators should reconcile headline-driven optimism with hard stop-loss and sizing discipline, and prefer staggered entries or shorter-duration trades until price and on-chain metrics align more clearly with the improving fundamentals.

For readers wanting to dig deeper into comparative market narratives, remember that macro moves in majors like Bitcoin and rotations into DeFi assets often set the stage for large-cap altcoin stretches. Thoughtful exposure combined with active risk management — rather than an all-or-nothing bet — is the prudent path while Ripple’s regulatory and institutional story continues to unfold.

Sources

- VivoPower launches a $300M institutional Ripple equity fund

- OCC clears Circle, Ripple and others to launch crypto national banks

- Technical bearish warning that XRP could plunge toward $1

- 16.4M flows into XRP yet price stalls near $2 — why?

- Ripple scores victories but XRP price continues to fight for survival at $2