Solana’s Split Narrative: ETF Inflows vs Inflation Debate — What DeFi Investors Should Know

Summary

Executive snapshot

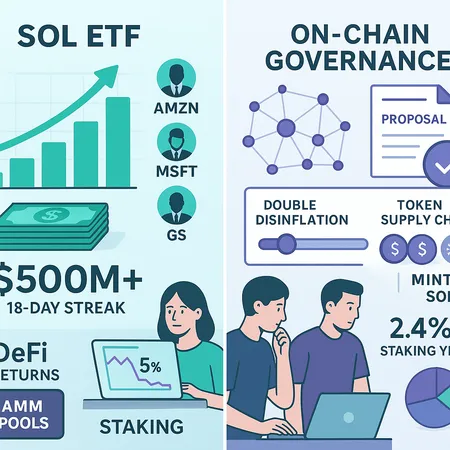

Solana is running two parallel stories: strong, almost institutional interest through SOL ETFs versus a heated governance conversation about inflation and token supply. The former is driving near-term inflows and price momentum; the latter could change the economics that underpin staking and DeFi yields. For DeFi investors and portfolio managers, the key question is whether ETF‑driven price action or protocol‑level tokenomics will be the dominant force over your investment horizon.

What’s happening now: ETF inflows meet governance heat

Over the past weeks, multiple SOL ETF products recorded sustained net inflows, with an 18‑day streak that attracted north of $500 million in fresh capital — a clear signal institutional vehicles are rotating into SOL exposure (Cointribune report). At the same time, Solana governance has renewed debates over inflation mechanics: proposals including a second disinflation plan and large supply adjustments (market notes referenced a ~2.9 billion token cut scenario and bullish price targets as a result) are on the table and being dissected by the community and analysts (AmbCrypto analysis on the double‑disinflation plan and Coincu market note).

This is not just noise. ETF demand and governance choices pull on the same lever — token supply and perceived scarcity — but they act through different channels and on different timelines.

Why ETF inflows matter (mechanics and significance)

SOL ETFs function as a demand conduit: authorized participants buy SOL in the spot market to create ETF shares, or ETF managers aggregate capital to obtain SOL exposure on behalf of investors. When inflows are persistent — like an 18‑day streak — they represent ongoing, predictable demand that can:

- Remove available float from the spot market, tightening liquidity.

- Amplify short‑term price momentum as managers accumulate systematically.

- Signal institutional conviction, which can attract secondary flows from allocators who follow perceived smart money.

From a DeFi perspective, ETFs matter because they can raise asset prices quickly, altering impermanent loss dynamics for LPs, changing borrowing collateral values, and re‑pricing yields denominated in SOL. The Cointribune piece frames the inflows as evidence of persistent institutional appetite that could sustain rallies beyond retail cycles.

The inflation proposal: what ‘double disinflation’ and supply tweaks mean

The governance discussion centers on reducing long‑run inflation and/or cutting circulating supply. Broadly, two levers are in play:

Disinflation — lowering the yearly issuance rate (reducing new SOL minted per year). A “double disinflation” plan would step down issuance faster than the existing schedule. AmbCrypto highlights concerns that such a plan could squeeze DeFi returns by reducing native staking and protocol reward flows.

Supply adjustments/cuts — proposals discussed in market notes include aggressive supply reductions (the Coincu coverage referenced a hypothetical ~2.9B cut scenario). A meaningful supply cut is an immediate change to circulating tokens that can materially lift scarcity narratives.

Mechanically, if issuance falls or tokens are removed from circulation, the immediate effect is reduced inflationary pressure on price — everything else equal, fewer new tokens chasing liquidity supports higher price per token. But for validators, stakers, and DeFi protocols that earn rewards in newly issued SOL, lower issuance means lower nominal staking yields and protocol subsidies unless those rewards are reallocated from elsewhere.

Staking, tokenomics and the math of returns

Staking yields on Solana come from two sources: block rewards (issuance) and transaction/fee distributions. If the protocol reduces issuance:

- Nominal staking yields fall because there are fewer new tokens to distribute to stakers/validators. A 30–50% cut in issuance will translate into a proportional reduction in annualized staking yield unless the network increases fees or changes distribution policies.

- Real yields may compress further if price appreciation from ETF demand lags or fails to offset the drop in token yield. That is, a staker who relied on 6–8% nominal yields may see that nominal number halve, and if SOL price doesn’t climb commensurately, their USD returns decline.

For DeFi users, many protocols subsidize LPs and borrowing markets with native issuance. Disinflation therefore risks reducing incentive budgets or forcing protocols to transition to fee‑only incentives — a painful process that can create temporary liquidity gaps.

Short‑term market effects vs long‑term composability

Short term, ETF inflows can be powerfully bullish: they bid up price, attract liquidity, and increase on‑chain activity as token holders chase yields or rebalance. That dynamic can temporarily mask the impact of inflation changes.

Long term, however, DeFi composability depends on predictable incentives. Protocols design incentive schedules assuming certain issuance and reward levels. If governance reduces issuance suddenly or redirects rewards, then:

- Liquidity providers could face lower APYs or be outcompeted by pools subsidized differently.

- Borrowing markets relying on SOL collateral may see shifts in loan‑to‑value economics and margin call behavior.

- Cross‑protocol strategies (e.g., vaults, yield farms, composable LPs) may need redesigns to remain viable.

AmbCrypto’s analysis flags this tension: short‑term scarcity narratives driven by ETFs can coexist uneasily with longer‑term yield compression from disinflation, creating a bifurcated market where price and utility incentives diverge.

Risks to liquidity providers and yield strategies

If inflation and incentive flows compress while price remains elevated or volatile, several specific risks surface for DeFi participants:

- Impermanent loss risk increases when price rallies quickly (ETF bids) and then reverts, especially for concentrated LPs on AMMs.

- Protocol incentive uncertainty can lead to withdrawal cascades: if rewards are cut, LPs exit, reducing depth and increasing slippage.

- Yield strategies that rely on staking rewards as a key return component may see sharply reduced APRs, forcing re‑optimization into riskier assets or leverage.

- Collateral volatility risk for lending platforms — rapid price moves driven by external flows can tighten margins and trigger liquidations.

The market mover roundup also shows SOL among resilient contenders during market fluctuations, suggesting that some investors view these risks as manageable or priced in, but that's not universal (The Currency Analytics roundup).

Building an investor checklist: balancing ETF momentum with governance risk

For portfolio managers and DeFi allocators, a pragmatic checklist helps translate the narrative split into risk‑adjusted positions:

- Define your timeframe. ETF flows can dominate intraday-to-quarter horizons; tokenomics shifts dominate multi‑quarter to multi‑year outcomes.

- Monitor staking economics weekly. Track nominal staking rates, effective yields after fees, and any governance proposals that alter issuance schedules.

- Size LP exposure relative to expected subsidy runway. If a pool depends on issuance for 60–80% of its APR, assume 50% of that subsidy evaporates in stress scenarios.

- Use volatility‑aware position sizing. When ETF inflows increase the chance of rapid repricing, reduce single‑asset exposure or increase hedges.

- Stress‑test lending positions. Model collateral value swings under both a sustained ETF‑driven rise and a sharp reversion event tied to governance disputes.

- Follow governance signals and on‑chain votes. A proposal’s likelihood of passing is the single biggest driver of tokenomics outcomes; early voting trends and validator statements matter.

Practical hedges include: short protection via options if liquid, diversifying into fee‑heavy protocols less dependent on issuance, and staggered entry into staking or LP positions rather than lump sums.

Decision scenarios: a simple framework

Consider three scenarios to guide allocation sizing:

- ETF‑led bull with benign governance: Increase tactical exposure, but keep LP and staking exposure moderate and hedged.

- ETF inflows + aggressive disinflation passed: Favor price appreciation plays and reduce reliance on staking/issuance yields; migrate to fee‑earning strategies.

- Governance chaos (uncertain proposals, voting deadlock): Keep defensive posture, avoid long‑dated leverage, and preserve optionality until clarity returns.

Final takeaways for DeFi investors

- ETF inflows can be powerful and immediate: sustained SOL ETF inflows have already moved capital and attention into SOL markets.

- Protocol tokenomics still matter more for yields: changes in issuance or supply directly affect staking yields and incentive budgets that underpin DeFi composability.

- Don’t confuse price momentum with sustainable yield: a rising SOL price helps total returns in nominal terms, but if staking and subsidy flows compress, the recurring yield profile shifts materially.

For portfolio managers assessing exposure to SOL, the right answer may be a balanced one: participate in ETF‑driven upside with controlled sizing and hedges, while maintaining a close read on governance developments. Track votes, monitor staking economics, and prefer strategies that can survive a meaningful reduction in native issuance.

Bitlet.app users and DeFi allocators building strategies should fold these considerations into position sizing and risk limits rather than reacting purely to headline inflow numbers.

Sources

- https://www.cointribune.com/en/solana-etf-hit-18-day-inflow-streak/?utm_source=snapi

- https://ambcrypto.com/will-solanas-double-disinflation-plan-squeeze-defi-returns-analysts-weigh-in/

- https://coincu.com/news/2-9b-cutsolana-eyes-faster-path-to-1-5/?utm_source=snapi

- https://thecurrencyanalytics.com/marketmovers/investors-seek-high-growth-crypto-opportunities-as-sol-ltc-and-moonbull-gain-momentum-217116

For further reading on ecosystem trends, see Solana market updates and the latest on DeFi.