From Courtroom to Corridors of Power: How ETFs, $7B Inflows and Payments Integrations Are Rewriting XRP

Summary

Executive snapshot — what changed

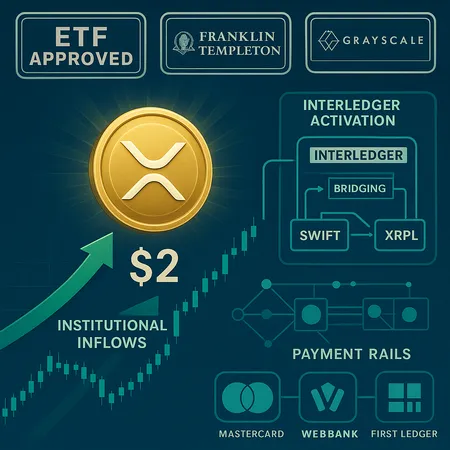

In a compressed window the market saw three distinct catalysts converge: NYSE approval momentum behind two institutional XRP-spot ETFs, a tidal spot inflow that briefly pushed XRP back above $2, and concrete signals that major payments rails and partners are preparing to use XRP and the XRPL. Put simply: the narrative is shifting from litigation and speculation to institutional allocation and payments integration.

For many market participants — and for readers who follow XRP closely — the practical question is whether this is a fleeting bid or the start of a durable re‑positioning of XRP as a payment-layer asset and institutional product. Below I map the timeline, explain the technical and market mechanics, and assess why the intersection of ETFs, inflows, Interledger and corporate strategy matters.

Timeline: approvals, inflows and partner confirmations

NYSE approvals for Franklin Templeton and Grayscale to launch XRP spot ETFs were reported as imminent, creating an immediate catalyst for institutional access and media attention. See the announcement that Franklin Templeton and Grayscale are set to launch after NYSE approval here.

Almost in lockstep, exchange flows showed a massive single‑day inflow of roughly $7 billion into XRP spot product(s), a liquidity event that helped lift the price back above $2 and signaled strong latent demand from spot buyers and likely APs/arbitrage desks. Reporting and flow data on the $7B move are summarized by Finbold here.

On the interoperability front, ISO 20022’s portal revealed a request to activate Ripple’s Interledger on SWIFT — a signal the industry is at least exploring on‑ramps that could let SWIFT-aware systems speak with XRPL rails. Read the ISO 20022 note here.

Commercial validation arrived via First Ledger, which confirmed Mastercard and WebBank will use XRP on XRPL in some capacity — a tangible partner adoption datapoint that moves this beyond press release-level noise. Coverage is available here.

Internally at Ripple, CTO David Schwartz publicly framed a shift in revenue models that reduces the company’s structural need to sell XRP, a strategic note with clear supply‑pressure implications. See his remarks summarized here.

This sequence — product approval momentum, a liquidity surge, interoperability signals and partner confirmations — is what underpins the story that follows.

Why now: the drivers behind the convergence

Several factors explain the timing and why these pieces are aligning now:

ETF approvals unlock institutional channels. Spot ETFs from big names like Franklin Templeton and Grayscale create a low-friction, custody-backed route for asset managers, pensions and family offices to gain exposure to XRP without navigating exchange custody or newer prime-broker relationships. The NYSE approval reports function as a regulatory- and distribution-credibility signal, encouraging capital to show up.

Regulatory clarity reduces execution friction. ETF green lights — and the teams standing behind them — imply a baseline level of acceptable regulatory treatment for a spot product. That reduces counterparty and compliance risk for allocators.

Strategic partnerships create real utility demand. Mastercard/WebBank confirmations via First Ledger and ISO 20022 Interledger activity suggest the flows could originate from payments use cases, not merely speculation. Utility-driven demand looks different to markets: it's repetitive, operational and tied to settlement throughput rather than pure price appreciation.

New revenue models at Ripple limit sell pressure. If Ripple relies less on programmatic XRP sales to fund operations (David Schwartz’s point), the free‑float selling tail diminishes — a direct shock absorber for price when paired with rising demand from ETFs and payments.

Combine those four ingredients and you get improved price discovery, deeper custody and higher odds of durable institutional allocation.

How ETF launch mechanics change custody and liquidity (and why that matters)

Spot ETF mechanics matter because they alter who holds an asset and how liquidity is sourced.

Custody concentration moves to regulated custodians. Rather than being distributed across many exchanges and retail wallets, large proportions of ETF‑backed XRP will sit with custodian banks and qualified custodians. That reduces exchange deposit/withdrawal-induced volatility and may increase confidence among institutional allocators.

Creation/redemption and AP arbitrage increase market depth. Authorized Participants (APs) create and redeem ETF shares against underlying XRP. That process connects ETF demand to spot markets — creating predictable liquidity when ETFs need more underlying XRP and supplying XRP back during redemptions.

Market‑maker overlays smooth spreads. Authorized market makers and APs typically provide two‑way liquidity, tightening spreads and improving execution quality on exchanges and OTC desks.

Potential for concentrated on‑chain reserve flows. ETF sponsors may use a mix of cold custody and hot operational pools. Large rebalancing events could cause temporally-discrete supply movements on the XRPL, but overall the effect should be net positive for liquidity and price discovery.

Franklin Templeton and Grayscale’s imminent launches are therefore more than symbolic: they institutionalize on‑ and off‑ramp plumbing that links CIO desks to XRPL liquidity pools and market makers in a way retail orderflow never did. The initial Coinpaper reporting on the approvals captures that immediate catalyst here.

Technical implications: Interledger on SWIFT and XRPL as payments rails

The ISO 20022 note about a request to activate Ripple’s Interledger on SWIFT is a technical and strategic handshake worth unpacking.

Interledger is a protocol bridge, not a replacement. Interledger’s design is to route value across heterogeneous ledgers and rails. If SWIFT (or SWIFT participants) adopt Interledger hooks, it doesn’t mean SWIFT disappears — it means SWIFT could route value to on‑chain settlement layers like XRPL when that makes operational or cost sense.

Faster settlement and reduced Nostro/Vostro friction. XRPL’s native settlement speed and deterministic finality lower counterparty credit exposure and reduce the need for pre-funded Nostro/Vostro balances in certain corridors. That’s a potential material cost saver for banks.

On‑chain liquidity management becomes a critical competency. Using XRP for bridging requires prudent liquidity provisioning: market makers, custodians and payments hubs will need to manage on‑ledger pools to guarantee immediate conversion into local currency. That creates a new category of revenue capture (spread capture, settlement fees) directly tied to on‑ledger activity.

Interoperability raises compliance and monitoring questions. Real‑world bank integrations will layer AML/KYC and reconciliation processes. That creates middleware opportunities and, importantly, reasons for treasury teams to prefer regulated custody setups (again reinforcing ETF/custody channels).

The ISO 20022 portal write‑up that highlighted the Interledger activation request gives a useful primer on how this radar ping could translate into real rails work here.

Ripple’s revenue shift, partners and supply dynamics

David Schwartz’s public remarks that other revenue reduces the need to sell XRP are significant because they change the supply-side assumptions that have weighed on price since the litigation era. Less programmatic selling equals a smaller continuous supply overhang.

At the same time, partner confirmations matter. First Ledger’s reporting that Mastercard and WebBank will use XRP on XRPL — if execution matches the announcement — demonstrates enterprise‑grade adoption and use cases beyond pure speculation. You can read the First Ledger confirmations here: https://thecurrencyanalytics.com/altcoins/first-ledger-confirms-mastercard-and-webbank-will-use-xrp-on-xrpl-217142.

Operationally, these partnerships create recurring settlement demand. That demand is different from ETF or trading demand: it is transactional and tied to payment volume, FX corridors and reconciliation cycles. If settlement volumes grow, so does the economic case for on‑chain liquidity providers and for XRPL as a rails option.

Short‑term risks to watch

Volatility and chasing flows. Large single‑day inflows (like the reported ~$7B) can reverse quickly. Short-term traders and APs can exacerbate intraday volatility.

Operational kinks at launch. ETF launches often experience initial arbitrage inefficiencies, custody edge cases or settlement mismatches that can create temporary divergence between spot and ETF prices.

Regulatory second‑order effects. Approval of ETFs doesn’t immunize all jurisdictional or counterparty risks. Changes in policy, AML enforcement, or banking relationships could create new frictions.

Execution risk for payments integrations. Pilot projects and partner announcements do not always translate into volume at scale. Integration timelines, regulatory approvals and legacy banking inertia can slow enterprise adoption.

The longer‑term value‑capture thesis

When you stitch together ETF-driven institutional allocation, payments-led recurrent demand, and reduced corporate selling, a plausible long-term thesis emerges: XRP could capture durable value through on‑ledger settlement economics rather than purely speculative capital appreciation.

Key elements of that thesis:

- Improved price discovery from institutional participation. Spot ETFs and allocators provide a reference price and a deeper pool of liquidity.

- Recurring transaction-based demand. Payments use cases generate repeatable demand that’s less correlated to macro liquidity cycles.

- Fee and spread capture by liquidity providers. On‑ledger market makers and custodians can earn steady returns from settlement flows, creating an ecosystem that monetizes transaction volume.

Asset managers and analysts (including Bitwise and others in the ETF conversation) have argued that ETFs can materially change how institutional portfolios treat digital assets: from optional speculative allocations to line‑item exposure. If that shift happens for XRP, the combination of allocation flows plus payments utility is a powerful double tailwind.

Practical takeaways for investors and payments executives

For allocators: monitor ETF flows, AP behavior and custody announcements closely. ETF inflows can seed deeper liquidity but also increase correlation to broader risk assets during market stress.

For payments teams and banks: proof‑of‑concepts with Interledger and XRPL can materially reduce settlement friction in specific corridors. Start with low‑latency FX corridors where liquidity is available and regulatory alignment is achievable.

For market makers and custodians: expect a new operational regime. Managing on‑chain liquidity and cold/hot custody for institutional ETFs and payments clients will be a core competency.

Platforms facilitating crypto payments and earnings (including Bitlet.app) will monitor these developments because they change custody, settlement and product design assumptions across the industry.

Bottom line

The recent cluster of ETF approvals, a record inflow day, Interledger activation signals and partner confirmations is not a single definitive pivot but it is a structural inflection point. Together they increase the probability that XRP evolves from a litigation-era headline asset to a genuinely useful piece of payments infrastructure with institutional markets built around it. Short-term noise and execution risk remain — but the plumbing for a new lifecycle of XRP utility is being assembled in public.

Sources

- https://coinpaper.com/12555/xrp-etf-approval-set-to-drop-tomorrow-franklin-templeton-and-grayscale-ready-to-launch?utm_source=snapi

- https://finbold.com/xrp-reclaims-2-after-massive-7-billion-inflow-in-24-hours/?utm_source=snapi

- https://coinpaper.com/12553/iso-20022-s-nod-puts-ripple-s-interledger-on-swift-radar-a-new-era-set-to-begin?utm_source=snapi

- https://thecurrencyanalytics.com/altcoins/first-ledger-confirms-mastercard-and-webbank-will-use-xrp-on-xrpl-217142

- https://u.today/schwartz-claims-other-revenue-reduces-ripples-need-to-sell-xrp?utm_source=snapi