Inside XRPC's Blowout Debut: Why Canary Capital's XRP ETF Traded Like a Volcano While XRP Price Slid

Summary

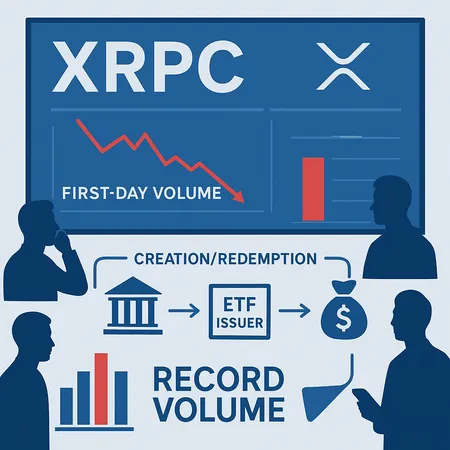

The paradox at XRPC’s debut: record volumes, falling spot

Canary Capital’s XRPC — a spot XRP ETF — opened with headline-grabbing first-day volumes that eclipsed most analysts’ models. Exchanges reported unusually large notional traded and rapid turnover in the ETF itself, yet XRP’s spot price drifted lower. At first glance the situation looks contradictory: how can an instrument designed to channel demand into an underlying asset coincide with that asset weakening? The short answer is market microstructure — creation/redemption mechanics, AP hedging behavior, and where demand is met matter as much as the headline inflows.

This piece unpacks the raw flows, the investor mix, the plumbing behind ETF transactions, and what on-chain and off-chain indicators tell us about whether XRPC’s debut was genuinely bullish or deceptively neutral.

What happened on day one: volumes and investor mix (institutional vs retail)

Multiple venue-level feeds and broker reports indicated that XRPC’s first-day turnover was record-setting for a spot-XRP vehicle: very large share creation activity alongside heavy secondary-market trading. The mix looked like this:

- Heavy creation activity from authorized participants (APs) and market-makers that supplied large creation units to match demand in the secondary market.

- Significant secondary-market trading by ETF investors — both institutional desks that needed a compliant XRP exposure and retail traders reacting to headlines.

- A notable amount of immediate distribution: large APs and market-makers distributing shares into programmatic liquidity pools and selling underlying XRP to hedge or de-risk positions.

Institutional demand was apparent from large lot trades and allocation chatter — allocations consistent with compliance-driven flows (pension, family offices, and crypto-native hedge funds preferring a regulated wrapper). Retail engagement was visible in the retail-driven spikes in intraday volume and odd-lot patterns in the ETF order book.

Why ETF flows can coincide with price weakness

Three plumbing points explain the divergence between high ETF volumes and a weak spot price: creation/redemption mechanics, secondary-market selling, and AP hedging strategies.

Creation/redemption mechanics

An ETF is created or redeemed in creation units via APs. Those APs either deliver XRP to the fund (in-kind) or deliver cash that the fund uses to buy XRP. The choice matters:

- If APs use in-kind creations by delivering XRP they already hold, the ETF receives that inventory and no immediate secondary-market buy is needed — minimal upward spot pressure.

- If APs use cash creations, the fund must buy XRP on the open market (or OTC), which can create buying pressure and push the price up.

In practice, many APs arrive with inventory or borrow XRP to deliver in-kind. That reduces direct upward price impact even when ETF creations are large.

Secondary-market selling and distribution

High ETF secondary trading volumes often mean market-makers and APs are distributing shares aggressively. To remain hedged, APs may short the ETF and hedge with spot or derivatives, or they may sell spot XRP to balance inventory. If newly created shares are sold into the market while APs sell underlying XRP to offset risk or take profits, you can see ETF volumes spike while the spot price suffers.

Additionally, ETF shares trade on an exchange in U.S. dollars (or local fiat), and secondary-market buyers can be purely speculative and not supply new net demand for XRP itself.

Hedging, arbitrage, and market-making

Market-makers and APs routinely hedge their ETF exposure using spot, futures, or swaps. When APs create shares and immediately hedge by selling spot XRP (or by entering short futures), you get mechanical selling pressure. Conversely, redemptions can force APs to buy spot XRP to deliver to the fund — that would be bullish — but redemptions were not dominant on day one.

Complex supply chains — borrowed XRP, repo-like arrangements, and OTC inventory channels — allow large APs to meet ETF creations without exerting the same upward pressure as a simple buy on the open book.

On-chain signals analysts should track

For on-chain analysts evaluating whether ETF flows are translating into spot demand, watch these indicators:

- Exchange reserves for XRP: declining exchange balances with sustained ETF creations suggest actual spot buying. If reserves are flat or rising, APs may be delivering inventory from other custody vehicles.

- Large wallet-to-exchange flows: big transfers from custody addresses to exchanges often signal selling; transfers into deep custody or cold wallets suggest genuine accumulation.

- OTC desks and off-book liquidity: sniffing out large OTC prints and block trades (via broker reports) can show whether APs sourced XRP off-exchange to avoid slippage.

These signals help distinguish creation-driven price support from superficial ETF distribution.

Institutional demand vs retail reaction: different time horizons

Institutionals buy ETFs for compliance, custody convenience, and portfolio allocation. They tend to be patient and may not mechanically move spot prices if allocation is routed through block trades or over-the-counter channels. Retail traders, by contrast, react quickly to headlines, moving in and out of the ETF (or selling underlying XRP) in ways that increase intraday variance.

On day one, the clinic was clear: institutions created lots of XRPC exposure for their books, while retail participants and some trading desks supplied liquidity and absorbed inflows — often by selling XRP on spot venues. The result: strong ETF volumes but weak spot price.

Regulatory and narrative implications for payments-focused tokens

XRP is primarily positioned as a payments-focused token, and an institutionally adopted ETF adds a different narrative: a compliance-friendly, regulated chassis for exposure. That has two competing implications:

- Positive narrative: an ETF legitimizes XRP as a tradable, custody-ready asset, lowering barriers for conservative allocators. Long-term, that could expand deep-pocketed demand for payments-focused tokens.

- Cautionary note: ETF adoption does not resolve regulatory questions about token utility or legal classification. If regulators tighten rules around payment tokens or cross-border settlement use cases, flows into ETFs may become more of a defensive positioning than a growth signal.

The net effect depends on policy clarity. An ETF can accelerate institutionalization, but it also concentrates regulatory scrutiny on the token — and that matters for payments-focused protocols.

Is XRPC’s debut bullish, neutral, or deceptive for spot price discovery?

Short answer: it’s all three, depending on the timeframe and which flows dominate.

- Bullish case: sustained net creations funded by market buys or rising on-chain accumulation (falling exchange reserves) will tighten spot liquidity and push price higher over weeks to months. If institutions use ETFs as permanent allocations, structural demand grows.

- Neutral case: APs deliver in-kind from inventories, and ETF shares simply repackage existing supply for compliant investors. Volumes will be large, but the net spot demand is minimal; price discovery stays largely governed by existing order books.

- Deceptive (bearish) case: heavy secondary-market selling, AP hedges that result in spot selling, or redemptions after an initial euphoria can create surprising downside pressure despite large ETF notional.

Which scenario unfolds depends on three variables: how APs source XRP (in-kind vs cash), whether inflows persist, and whether on-chain signals show true accumulation.

Near-term scenarios and tradeable signals

Here are practical near-term scenarios investors should monitor and trigger levels or signals to watch for:

Scenario A — Structural bull: persistent net creations and falling exchange supply

Trigger: multiple consecutive days of net creations > distributions; exchange reserves decline; institutional block buys reported. Actionable signal: tighter ETF secondary spreads, narrowing premium to NAV, and rising basis between futures and spot becoming more positive.

Scenario B — Neutral: high ETF volumes, flat on-chain balances

Trigger: heavy creation/redemption churn with exchange reserves flat and stable OTC desk quotes. Actionable signal: ETF price tracks NAV closely but spot remains range-bound; trade volatility around headlines without clear trend.

Scenario C — Deceptive or bearish: selling pressure from hedging or redemptions

Trigger: large wallet-to-exchange transfers, AP liquidation reports, or increasing redemptions; ETF premium widens then reverses. Actionable signal: widening ETF-NAV discount, spike in futures basis selling, and rising open interest on short positions.

Practical takeaways for on-chain analysts and ETF investors

- Don’t equate headline ETF volume with unconditional net demand for XRP. Inspect creation types and on-chain flows.

- Track exchange reserves and large custody transfers as immediate indicators of whether ETF-created demand is reaching the spot market.

- Watch market-maker behavior: hedging and distribution strategies can flip inflows into selling pressure quickly.

- Institutional adoption via ETF is structurally positive over time, but the short-term price path is governed by microstructure and sourcing choices.

For traders and allocators, that means combining traditional ETF metrics (creations/redemptions, NAV premiums) with on-chain analytics (exchange flows, whale transfers) to determine whether XRPC activity is a real bid under XRP or mostly a wrappers-and-distribution story.

Final read: context matters more than headlines

XRPC’s debut showed there is sizable appetite to access XRP through a regulated product. But the debut also underscored a simple, often-missed truth: ETF demand and spot price discovery operate through different gears. A surge of ETF volume can be bullish — or neutral — or even deceptive depending on how the plumbing is filled.

For analysts, the work is continuing: stitch together creation/redemption reports, AP behavior, and on-chain flows to get a clear signal. The arrival of XRPC enlarges the institutional market for XRP, but whether that translates to lasting price appreciation will be decided by the operational details of how demand is met.

Platforms facilitating fiat-crypto rails and custodial flows, including Bitlet.app, will likely watch these dynamics closely as ETF wrappers reshape institutional access to payments-focused tokens.

ETF and XRP investors should use the checklist above: creation type, exchange reserves, and AP hedging activity — these tell you whether the XRPC story is genuinely bullish or mainly a high-volume episode in market plumbing.