Navigating Crypto Market Volatility in 2025 with Bitlet.app’s Flexible Installment Plans

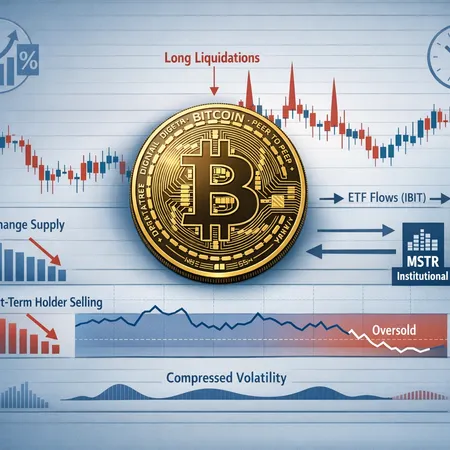

The cryptocurrency market is known for its rapid fluctuations and unpredictability, especially as we head into 2025. For many investors, navigating this volatility can be challenging and risky. However, Bitlet.app has introduced an innovative solution to help crypto enthusiasts manage their investments wisely — the Crypto Installment service.

Bitlet.app’s Crypto Installment service enables users to purchase cryptocurrencies now but pay for them in flexible monthly installments. This approach not only eases the immediate financial burden of buying crypto but also allows investors to spread out their capital over time, effectively mitigating risks associated with sudden market dips.

With Bitlet.app, investors no longer need to worry about having a large sum available upfront to enter the crypto market. Instead, the installment plans provide the financial flexibility needed to take advantage of market opportunities while maintaining control over spending.

In 2025, as crypto market volatility continues, leveraging tools like Bitlet.app’s installment plans can help both new and experienced investors build their portfolios with greater confidence and strategic planning.

Explore Bitlet.app today to discover how their flexible payment options can transform your crypto investment journey.