How Bitlet.app’s Crypto Installment Service Helps Investors Manage Volatility

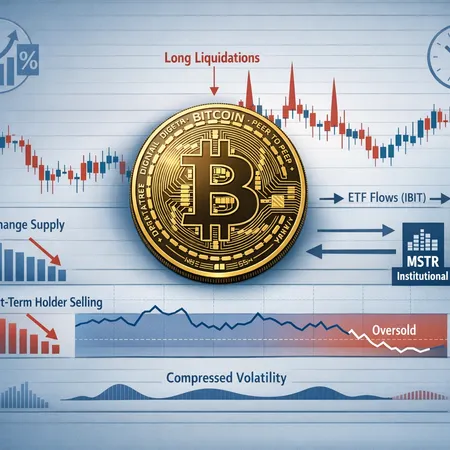

In today’s fast-changing and often volatile cryptocurrency market, managing investment risk and cash flow is crucial for any investor. Bitlet.app has introduced an innovative Crypto Installment service that allows investors to purchase cryptocurrencies now and pay for them in monthly installments. This feature is particularly beneficial during tumultuous market conditions where sudden price swings can be intimidating. Instead of committing a large sum all at once, investors can spread out their payments, reducing financial strain and exposure to volatility.

By using Bitlet.app’s Crypto Installment service, investors can strategically manage their portfolios, maintain liquidity, and avoid the pressure of timing the market perfectly. This approach enhances accessibility for new and seasoned crypto buyers alike, ensuring they have more control and flexibility in how they invest.

For anyone looking to navigate the unpredictability of the crypto world with greater ease, Bitlet.app offers a practical solution that combines convenience with financial prudence. Explore their platform to leverage the benefits of crypto installment buying today.