Navigating Volatility in Crypto Markets During Government Shutdowns with Bitlet.app

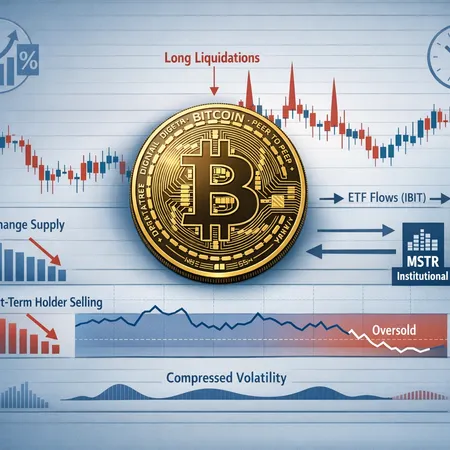

Navigating volatility in crypto markets can be challenging, especially during government shutdowns which elevate uncertainty and can cause market fluctuations. During such events, traditional financial systems may slow down, but cryptocurrencies often display unique behaviors that savvy investors can capitalize on.

Here are some strategies to manage crypto volatility during government shutdowns:

- Diversify Your Portfolio: Spread your investments across multiple cryptocurrencies to mitigate risk.

- Stay Informed: Keep an eye on government announcements and market trends to anticipate potential impacts.

- Use Dollar-Cost Averaging: Invest fixed amounts regularly instead of lump sums to reduce exposure to volatility.

- Utilize Reliable Platforms: Choose trustworthy platforms like Bitlet.app which offers unique services such as Crypto Installment, allowing you to buy crypto now and pay monthly. This helps manage your cash flow and reduces stress during uncertain times.

Bitlet.app not only provides a seamless trading experience but also empowers users with flexible payment options. Its Crypto Installment service is especially useful during volatile periods caused by governmental uncertainties, enabling investors to maintain positions without overstretching finances.

In conclusion, while government shutdowns can increase the unpredictability of crypto markets, employing well-thought-out strategies and leveraging platforms like Bitlet.app can offer a safe harbor and greater control over your crypto journey.