Navigating Crypto Volatility with Bitlet.app's Installment Service: A Strategic Approach

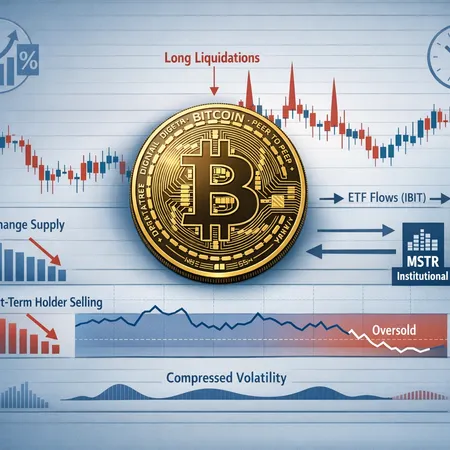

Cryptocurrency markets are famously volatile, making it challenging for investors to jump in without fear of sudden price swings. Bitlet.app is addressing this challenge with its innovative Crypto Installment service, which allows users to buy cryptocurrencies now while paying for them over a set period in monthly installments.

This service helps investors take a more strategic approach to their crypto purchases by spreading out payments over time rather than committing a large amount upfront. This can reduce the impact of market volatility on your investment portfolio.

By using Bitlet.app's installment service, users can plan their crypto investments better, avoid emotional buying or selling due to price swings, and capitalize on dollar-cost averaging. This approach is especially beneficial for new crypto investors who want to build their portfolio steadily without exposure to high upfront costs.

Bitlet.app combines the flexibility of installment payments with the exciting opportunities in the crypto market, making it easier and safer to navigate the unpredictable crypto landscape. Whether you're a seasoned investor or just starting out, Bitlet.app can be a useful tool to manage your investment strategy effectively.