Navigating Market Volatility Amid Terraform Labs' Legal Issues with Bitlet.app's Flexible Crypto Investments

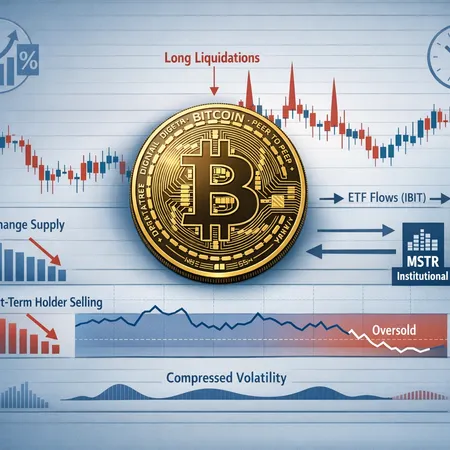

The recent legal challenges faced by Terraform Labs have sent ripples through the crypto market, causing increased volatility and uncertainty among investors. Navigating such turbulent times requires a strategic approach to managing your crypto portfolio.

Bitlet.app offers a unique solution to help investors stay resilient in volatile markets through its flexible crypto installment service. Instead of purchasing cryptocurrencies with a lump sum upfront, Bitlet.app allows users to buy crypto now and pay in monthly installments, easing financial pressure and reducing exposure to market fluctuations.

This flexible investment model enables you to enter or expand your crypto holdings gradually, minimizing risk during periods of market instability like the ongoing Terraform Labs situation. By leveraging Bitlet.app's installment plans, investors can maintain a steady investment flow, diversify their holdings, and capitalize on market dips without overcommitting funds.

In summary, while Terraform Labs' legal issues pose challenges for the market, tools like Bitlet.app's crypto installment service empower investors to manage volatility more effectively and pursue their long-term crypto investment goals with confidence.